A month has gone by since the last earnings report for Hasbro, Inc. (NASDAQ:HAS) . Shares have lost about 15.4% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Hasbro Beats on Q2 Earnings, Revenues Lag Marginally

Hasbro posted mixed second-quarter 2017 results, wherein earnings surpassed the Zacks Consensus Estimate while revenues slightly lagged the same.

Earnings and Revenues Discussion

Adjusted earnings of $0.53 per share beat the Zacks Consensus Estimate of $0.46 by 15.2% and surged 29.3% year over year.

Hasbro's net revenue of $972.5 million also rose 11% over the prior-year quarter. However, revenues lagged the Zacks Consensus Estimate of $973 million by nearly 0.1%. Notably, revenues improved in three out of its four brand portfolios.

While Franchise Brands, Partner Brands and Hasbro Gaming recorded a gain, revenues declined at Emerging Brands.

Hasbro's cost of sales ratio increased 130 basis points (bps) to 37.9%. Meanwhile, selling, distribution and administration expenses declined 80 bps but royalty expense ratio rose 20 bps. Additionally, operating profit improved 17.8% year over year to $100 million.

Behind the Headline Numbers

The Franchise Brand portfolio posted revenues of $545.7 million, up 21% year over year, driven by revenue growth in Magic: The Gathering, Nerf, Transformers and Monopoly brands.

Partner Brand revenues increased 1% to $230.0 million one the back of growth in Beyblade, Dreamworks’ Trolls, Marvel and Disney Princess brands.

The Hasbro Gaming portfolio recorded a 6% year-over-year rise in revenues to $133.9 million. This uptick reflects Hasbro’s diverse gaming portfolio, including face-to-face gaming, off-the-board gaming and digital gaming. Several new games as well as traditional ones such as Dungeons & Dragons and Operation also aided the momentum.

Meanwhile, Emerging Brands revenues declined 14% to $62.9 million, due to declines in Playskool, Super Soaker and Easy-bake Oven products.

Regionally, net revenue from the U.S. and Canada segment increased 16% to $494.4 million, supported by growth in Franchise Brands, Partner Brands and Hasbro Gaming portfolios. However, the same was partly offset by a dip in Emerging Brands revenues in the region. In fact, this segment reported operating profit of $81.6 million, reflecting a jump of 41% year over year.

International revenues were $426.6 million, up 6% year over year. Revenue growth in Franchise Brands and Hasbro Gaming was offset by a decline in Emerging and Partner Brands. Notably, increased sales were registered across Latin America, Emerging markets, Europe and Asia Pacific regions. However, international operating profit was $16.9 million, down 43% from a year ago.

The Entertainment and licensing segment revenues declined 1% year over year to $51.5 million, as growth in Digital Gaming led by Backflip Studios was offset by declines in entertainment revenues. Furthermore, the segment's operating profit declined 18% to $11.3 million.

How Have Estimates Been Moving Since Then?

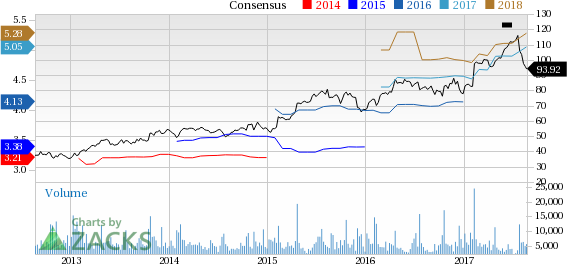

Following the release, investors have witnessed a downward trend in fresh estimates. There have been three revisions lower for the current quarter. In the past month, the consensus estimate has shifted lower by 5.2% due to these changes.

VGM Scores

At this time, Hasbro's stock has a nice Growth Score of B, a grade with the same score on the momentum front. Charting a somewhat similar path, the stock was allocated a grade of A on the value side, putting it in the top quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is more suitable for value investors than those looking for growth and momentum.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Notably, the stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

Hasbro, Inc. (HAS): Free Stock Analysis Report

Original post

Zacks Investment Research