The new year brings a rocky start via the Economic Modern Family.

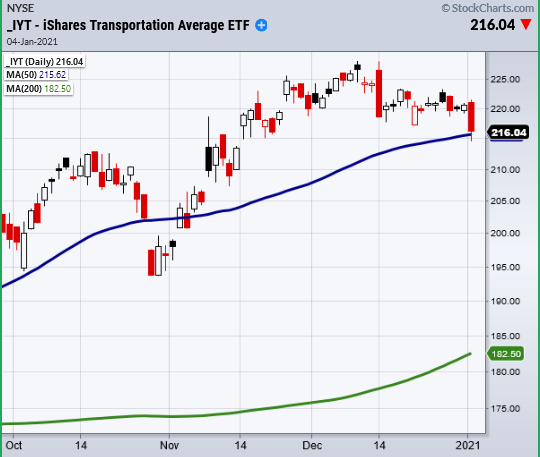

The transportation sector (IYT) of the Family made the most influential move of the day testing the 50-day moving average [DMA].

Considering how frothy the bullish run up has been, it’s not unusual to see a healthy price correction in the market.

We should expect and welcome them.

How far and how deep this correction goes will also be determined by IYT.

For Monday, we began the month with a one-day calendar range. Above today’s high in IYT will be a short-lived correction.

While a break of Monday’s low and the 50-DMA should yield more downside.

What makes these lines so valuable is that many active traders and investors watch the 50 and 200-DMA as important indicators of support or resistance.

They can also be used as a guide to understand the strength or weakness of a security relative to others, like it did in this situation.

As the Economic Modern Family stands right now, the Russell 2000 (IWM) along with Retail (XRT), Regional Banks (KRE) Biotech (IBB) and (SMH) all sit in a bullish phase.

Along with IYT, we also are watching volatility. Classically, a move in the index over 30.00 sends a stronger caution signal to the market.

Monday’s high got close. Under 25.00, will create a bit less fear.

Whenever you’re ready, here are 3 ways I can help you reach your trading goals…

- Stay one step ahead of the market with my daily market analysis, Mish’s Daily.

- Get the foundational building blocks of my trading strategies from my book, Plant Your Money Tree: A Guide to Building Your Wealth, and accompanying bonus training.

- Trade with me and take your trading the next level by following my real-time trading ideas as a member of of my premium services.

S&P (SPY) Needs to clear back over the 10 day moving average at 369.93 with 362.03 support.

Russell 2000 (IWM) 191.48 support

Dow (DIA) Needs to get back over the 10-DMA at 302.71 support 297.42

NASDAQ (QQQ) 303.60 support.

KRE (Regional Banks) Closed over the 10-DMA. Support 49.68 with 52.61 resistance to clear.

SMH (Semiconductors) 215.66 support the 10-DMA

IYT (Transportation) Closed over the 50-DMA at 215.62.

IBB (Biotechnology) Next big support the 50-DMA at 144.13

XRT (Retail) 61.91 support.