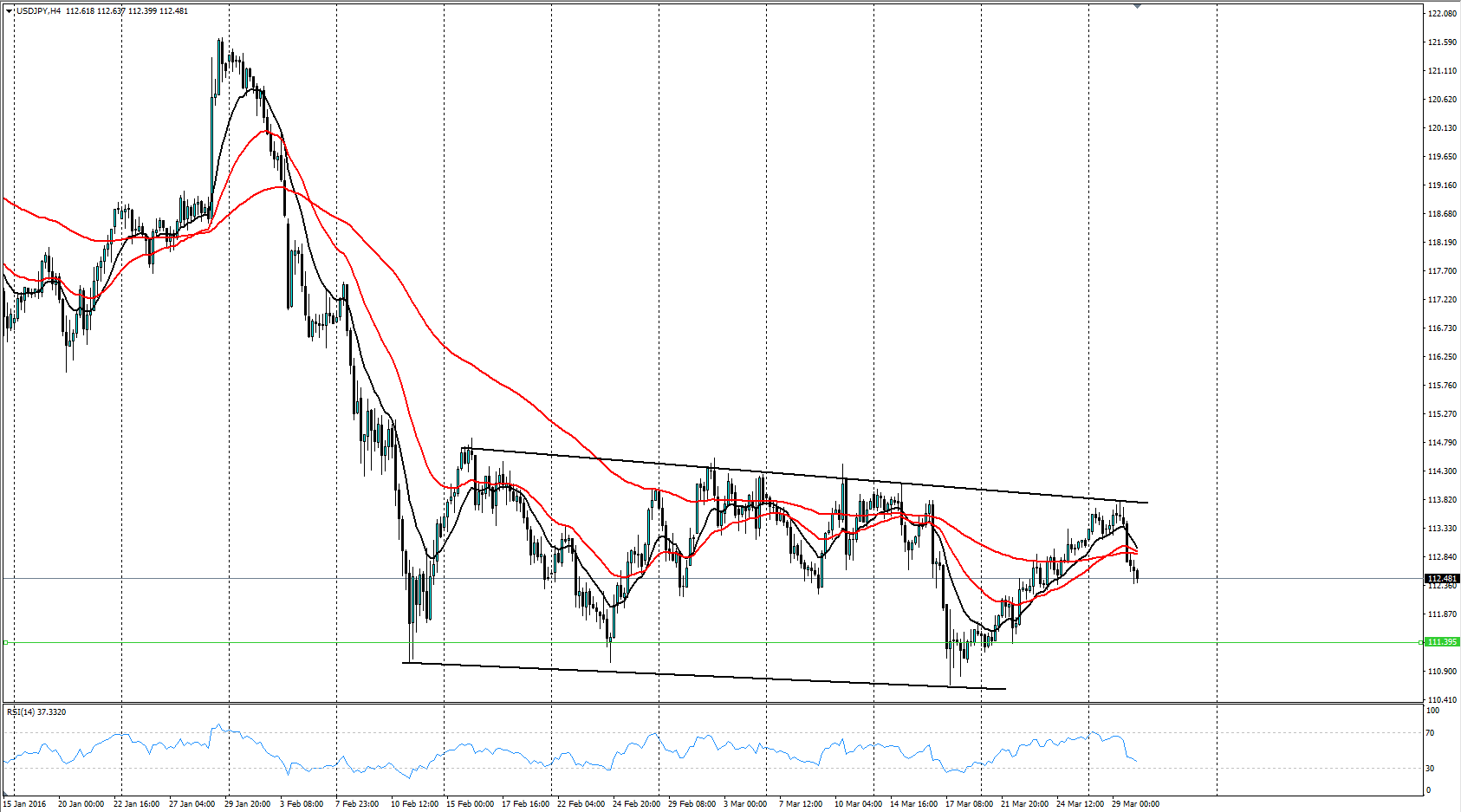

The past few weeks have been relatively positive for the USD/JPY as the currency managed to claw its way to the top of its consolidating channel. However, price action has just broken through the trend line thereby setting up the pair for a significant move back towards the bottom of the channel in the coming days.

Taking a look at the technical indicators shows a large consolidation channel and pattern that has been in play since the middle of February. In addition, it is clear that price action’s recent climb was met with some significant resistance around the top of the channel at 113.85 before failing and collapsing back through the short term trend line. Subsequently, there is some significant bearish pressure building that could see price declining sharply to the bottom of the channel.

In addition, the moving averages have also turned largely bearish and are indicating that there is plenty of scope for a downside move. In fact, price has recently just dropped back through the key 100-day moving average whilst the 12 and 30 EMA’s are declining and expected to bearishly cross in the upcoming session. The RSI oscillator is also declining sharply and although, still within neutral territory, the over-sold zone is approaching rapidly.

Subsequently, given that RSI is close to over-sold territory, the most likely scenario is that the pair will consolidate sideways over the next session before plunging to challenge support near the bottom of the channel at 111.35. However, from a fundamental point of view, keep a close watch on the US ADP non-Farm Payroll result as a surprise could invalidate the trade and see the pair rising sharply to breakout.