Friday's collapse added signs of oil's reversal to a bear market. Brent losses exceeded 5% over Friday, and the pressure continued into Monday morning. Brent dropped more than 11% from the highs of Jun. 8 to around $110, which was last seen four weeks ago.

Several technical factors now favor oil being taken over by the bears. Firstly, oil has been losing in seven of the last eight trading sessions, while we have seen mixed movements in the currency and equity markets. Such a single-digit drop in oil is a sure sign of a sustained sell-off, suggesting that peak oil may be behind us.

At $111, the 50-day moving average and the upside support line of the last seven months converged. Oil closed below that critical point, and intraday trades are in the area below these one-time essential support levels.

The day's close below $110 promises to be another reminder of the start of a deep correction in the oil market.

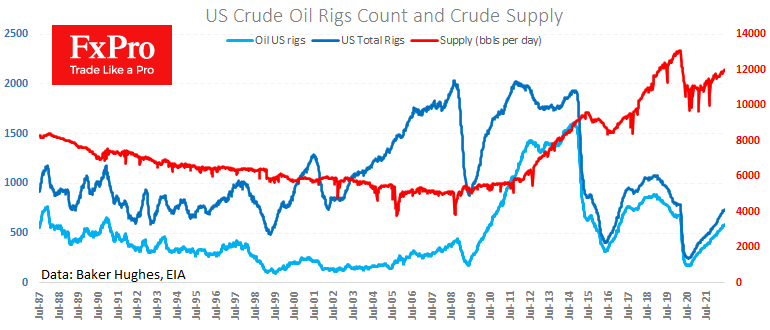

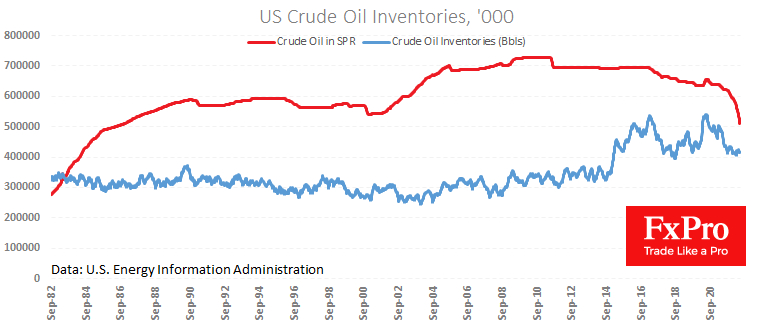

There is more and more oil in the USA. The Energy Agency has reported an increase in production of up to 12 million barrels per day. Active sales of crude stocks from the Strategic Reserve are helping to maintain the balance of commercial reserves.

At the same time, producers are ramping up drilling activity. Data last Friday showed an increase of 7 drilling rigs working to 740.

The US Presidential Administration has promised to return to filling reserves in September, which looks like good news for producers, who can get a steady buyer from the government, potentially keeping the price from an uncontrollable decline.

The balance of market forces now suggests that the market has hit its high point in the trend of the last seven months. In the coming weeks, we should be prepared for a correction to $100 or even $90 with negative surprises in the global economy and a stock market crash. However, for the rest of this year and most of the next, Brent crude may stay mainly within the $90-120 range.