NZD is a commodity currency and therefore risk a currency, and it is therefore subject to the ebb and flow of investor sentiment, which has taken precedence over the countries own fundamental situation on many occasions. This is not likely to change anytime soon, given the uncertainty surrounding the European debt crisis.

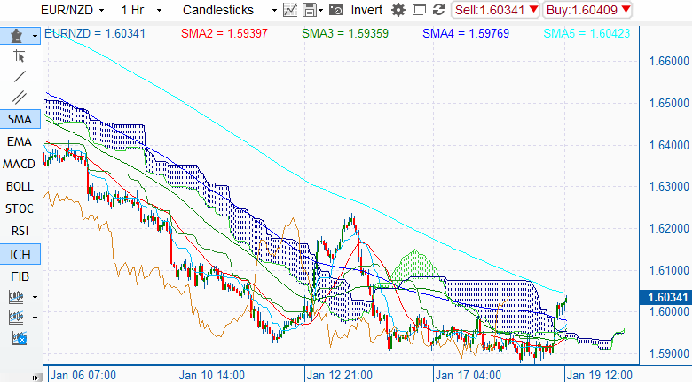

However, the nature of risk sentiment has deviated from the norm during the first part of 2012. We have seen a decoupling of sentiment surrounding Europe and the rest of the world, which was sparked by a steady flow of improving data out of the US. What does this mean for the kiwi? NZD can now move independently of EUR, which wasn’t the case for most of 2011. During most of last year risk currencies moved in tandem with the euro, but this change in sentiment has allowed the euro to break away from moving in line with the kiwi. Combine this with the positive sentiment we have seen surrounding China and the US, and NZD has fared very well.

EUR/NZD managed to break through 1.6000 and even it briefly pushed below 1.5900. Furthermore, GBP/NZD breached 1.9100 overnight, on the back of the optimism surrounding Greece and the IMF proposal. The UK has not managed to break away from sentiment surrounding Europe as much as the rest of the world has, so we think the combination of this and the positive risk sentiment has been the driving force behind the kiwi’s success against the pound.

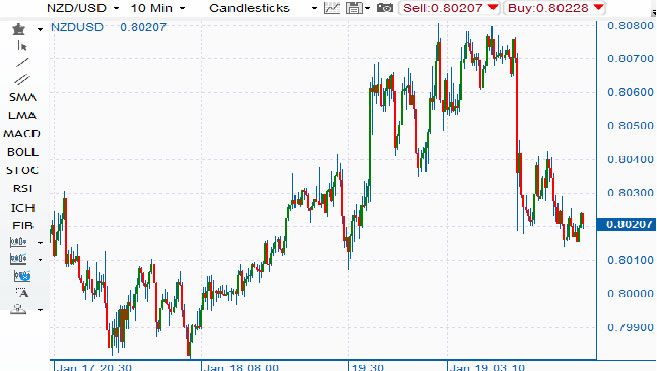

In the early hours of today’s Asia session, the kiwi was assaulted by a wave of sellers due to an abysmal domestic CPI figure, which came in at -0.3% m/m (consensus estimates were pointing towards +0.4% m/m).

This is definitely not good news for the currency. RBNZ Bollard has been hinting towards bringing the official cash off its record low of 2.5% but the CPI figures dramatically weaken the case for a rate rise, and we now expect that Bollard will not raise the cash rate until the tail-end of 2012. In our view, the dramatic slid in the kiwi this morning, which saw it approach perilously close to 0.8000 against the dollar, was the market pricing this in, yet we do not think it is fully priced in yet. Accordingly, we think above 0.8000 is too expensive and we can see some downside in the future for NZD/USD.

NZD/USD - 10min NZD/USD" title="NZD/USD" width="691" height="502">

NZD/USD" title="NZD/USD" width="691" height="502">

EUR/NZD - Hourly EUR/NZD" title="EUR/NZD" width="692" height="382">

EUR/NZD" title="EUR/NZD" width="692" height="382">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Has the Kiwi Reached its Peak?

Published 01/18/2012, 11:32 PM

Updated 05/18/2020, 08:00 AM

Has the Kiwi Reached its Peak?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.