Last month, the Federal Reserve raised its benchmark interest rate for the second time this year. It was the fourth quarter-point bump since interest rates were slashed to near zero in response to the Great Recession. Today, the federal funds rate stands at 1% to 1.25%.

The move reflected the central bank’s confidence in the U.S. economy. And higher interest rates should be good for savers. But after years of earning nothing in their savings accounts, the interest rates they receive on deposits have barely budged.

And in one case, savers are actually getting a lower rate of return.

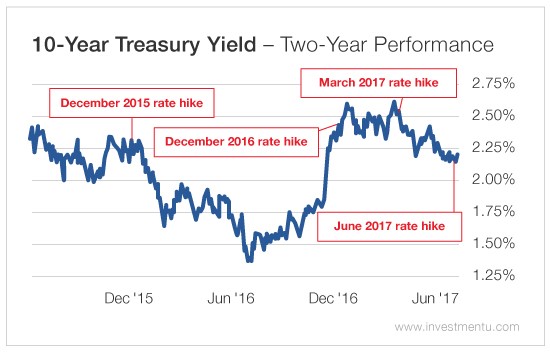

As today’s chart shows, the yield on the 10-Year Treasury actually dropped after the last month’s hike. And it fell after the Fed raised rates the last three times, too. The yield on the 10-year Treasury is actually less than it was six months ago.

Below, I’ll show you why the 10-year Treasury rate is falling. And, more importantly, I’ll tell you how to make money in spite of it.

Let the 10-Year Be Your Guide

The 10-year Treasury note is a loan investors make to the U.S. government. Since investors agree to lock up their money for a decade, the yield on the 10-year Treasury reflects a medium- to long-term view of the world’s economy.

The yield is the rate you get for investing in the note. It’s viewed as a guide for other nonadjustable interest rates.

The note is backed by the U.S. economy. And the 10-year Treasury is the most popular debt instrument in the world. That’s because the U.S. risk of default is very small relative to other countries’ sovereign debt.

The U.S. Treasury Department sells 10-year Treasury notes through an auction. The market decides the price. When demand for the world’s safest debt instrument is high, investors bid up the price and yields fall. Investors are willing to pay up to protect the safety of their principle.

Conversely, when demand is low, the price falls and yields rise. Treasury yields always move in the opposite direction of prices.

Investors from across the globe buy Treasurys. Therefore, 10-year Treasury yields tell us what investors think about many of the world’s economies... not just that of the U.S.

While the Fed’s move in June signaled a strengthening U.S. economy, the action in the 10-year Treasury demonstrated that the market isn’t so sure about the rest of the world’s economies.

The market doesn’t believe interest rates are going anywhere fast. And even though inflation is just starting to tick up, traditional “safe” investments are struggling to keep pace with it. So in spite of the Fed’s tightening, investors are searching for protection against inflation.

An Inflation Hedge That Grows in Any Environment

Dividend-paying stocks are a hedge against inflation. And that hedge still works well in today’s low interest rate environment.

When times are good and inflation is rising, more dollars are needed to buy a good or service. Since companies generally raise their prices faster than they raise their costs, they should be able to pay out more in dividends.

On the other hand, companies with strong balance sheets and robust business models will still raise their dividends when times are bad. The Oxford Club’s Chief Income Strategist Marc Lichtenfeld calls these stocks “Perpetual Dividend Raisers.”

The right portfolio of Perpetual Dividend Raisers will provide you with a steady stream of income. And you’ll be able to count on these checks no matter what’s happening with the economy, inflation or interest rates.