Key Points:

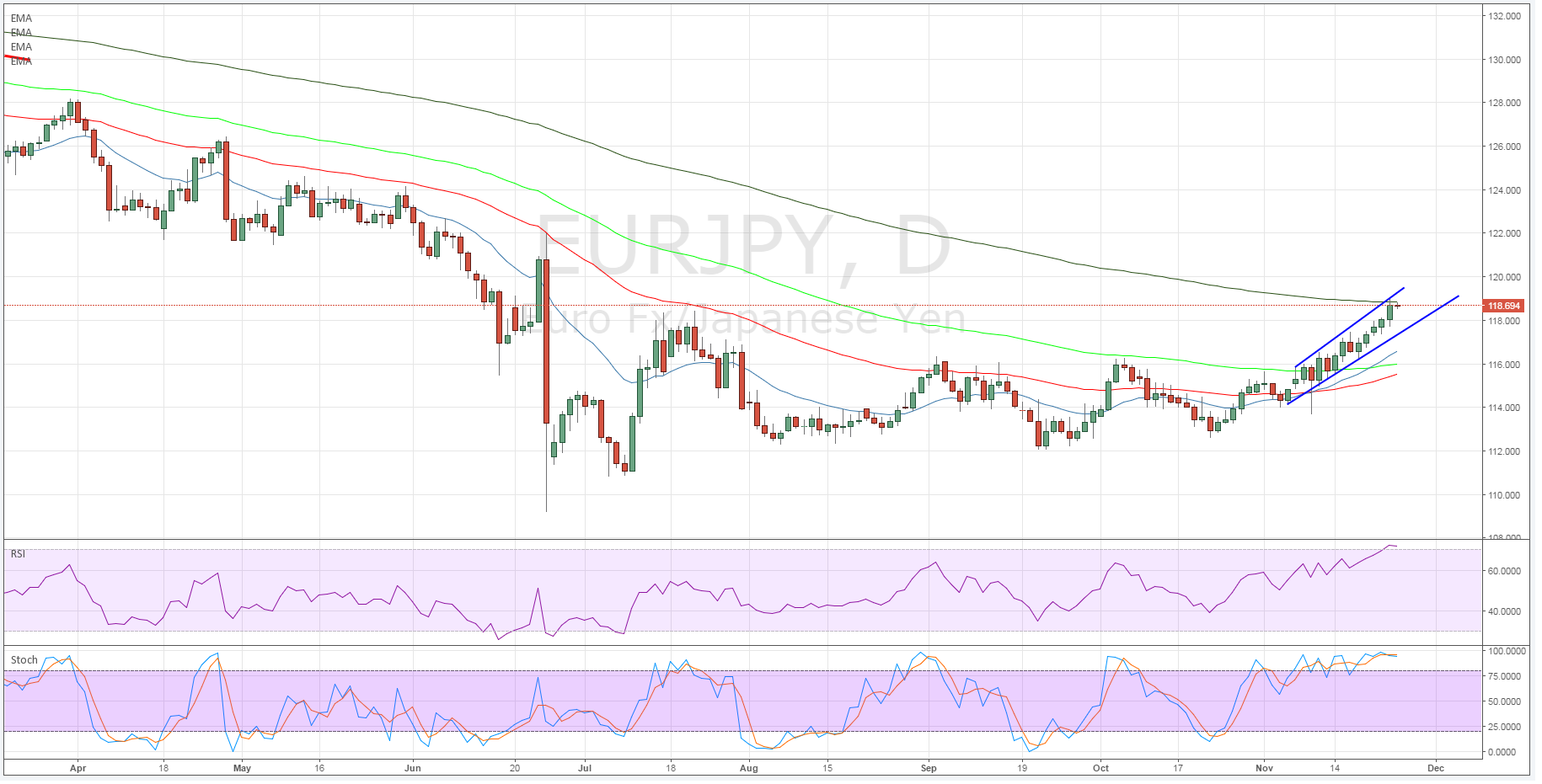

- “C” Leg completes on 4-hr timeframe.

- RSI and Stochastic Oscillator reaches overbought territory.

- A breakdown below the channel is likely in the coming days.

The EURJPY has been one of the exotic currencies to watch over the past few weeks as the pair has marched inexorably higher. Much of the rise has been due to fundamental reasons but there has also been some sharply bullish technical indicators supporting the rally. However, there are some concerning technical signs that the pair could have reached its zenith and is now getting ready to move into a consolidation phase.

In particular, a consideration of the pair’s current daily chart demonstrates the conundrum that it faces. The past few weeks has seen price action largely trending higher within a relatively tight equidistant channel. However, the last leg of the rally has now taken the RSI and Stochastic Oscillators firmly into oversold territory which suggests that the pair is now nearing a key decision point. In addition the 4-hour time frame shows a relatively clear ABCD pattern that appears to have just completed the “C” leg.

Subsequently, there are plenty of technical indicators suggesting that the EURJPY will, at a minimum, require a period of sideways consolidation over the next few sessions. In fact, given the confluence of indicators, there is a real risk of a corrective pullback in the coming session which would see the pair challenge the bottom of the channel towards 116.93. This would subsequently allow the “D” leg to be completed and allow the pair to recommence its rise.

In fact, this pullback/consolidation may have started to occur with the recent failure to breach resistance at 118.80. Subsequently, we are now seeing price action moving towards a convincing attempt at the lower channel extremity. Therefore, expect to see some key moves in the coming session as the trend is finally decided at this key inflexion point.

Ultimately, there are plenty of fundamental and technical reasons to suggest that the EURJPY will need to consolidate over the next few sessions. However, whether a sideways consolidation turns corrective still remains to be seen but the signals are giving every indication that this may very well become the case.