The Federal Reserve is expected to cut interest rates this week. The question is whether the bond market has fully priced in the start of policy easing?

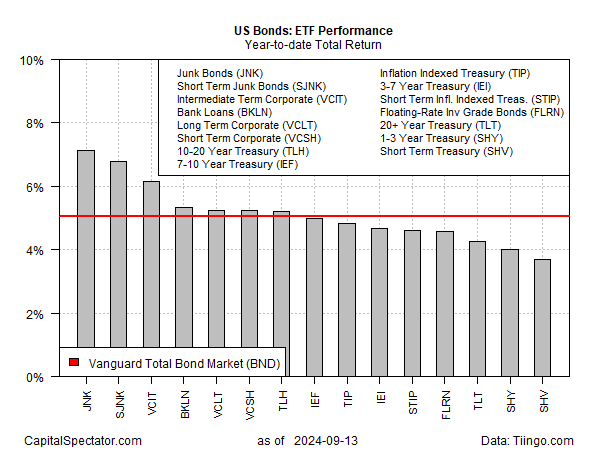

It’s tempting to say “yes” after reviewing recent performance data. Year to date, all the primary categories of US fixed-income markets are posting gains, based on a set of ETFs through Friday’s close (Sep. 13).

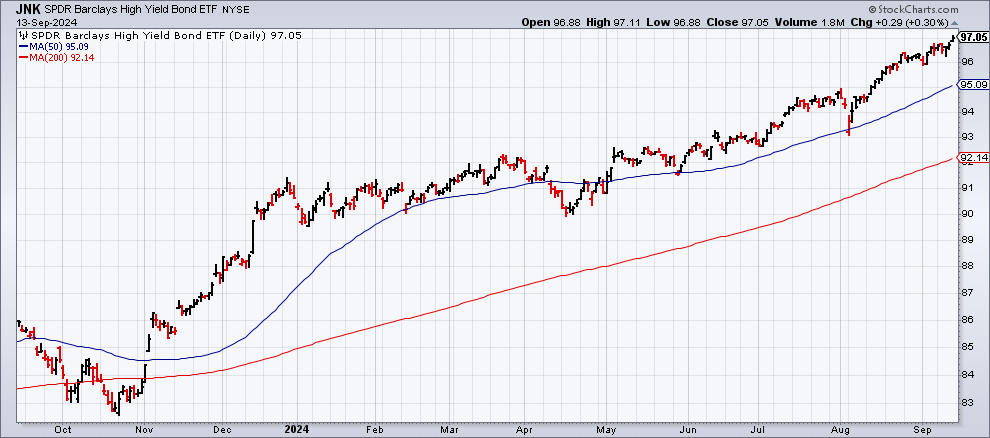

The leader so far in 2024: junk bonds (JNK) with a solid 7.1% advance.

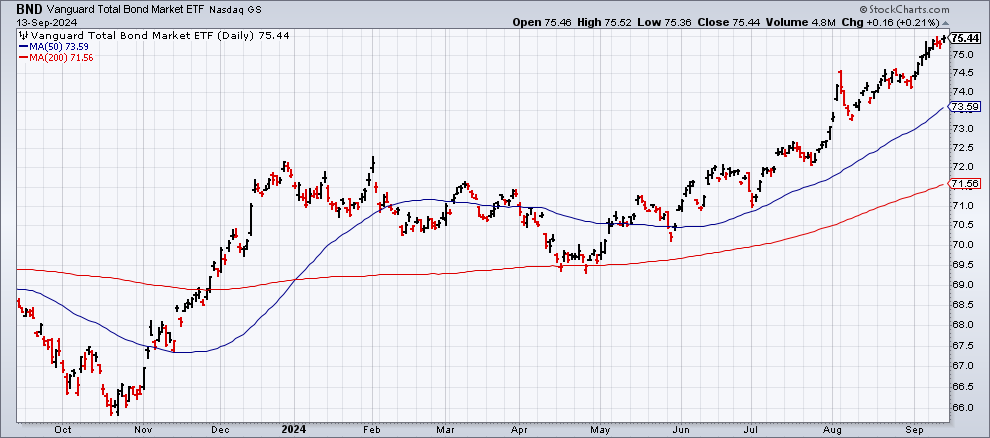

The investment-grade benchmark for US bonds (BND) is higher by 5.1% in 2024.

The fund has been on a mostly non-stop rally since May, presumably animated by rising confidence that the central bank will announce a rate cut on Wed., Sep. 18.

The rally in junk bonds (JNK) has been even stronger and more consistent for longer. In contrast to the broad investment-grade market (BND), which is currently at a two-year high, JNK’s rally has pushed it into record-high terrain.

A key debate for how bonds fare in the weeks and months ahead is linked to expectations for the US economy.

If the so-called soft-landing prevails – slower but still positive growth – the case for more rate hikes may be muted. By contrast, if the economy is weaker than optimists assume, an extended run of rate cuts to juice growth may be the likely path ahead, in which case bond prices may still have room to run higher.

A key economic report (retail sales) scheduled for tomorrow (Tues., Sep. 17) will be closely read ahead of the Fed’s policy announced the following day. Economists are looking for a monthly decline for spending in August following a sharp rise in July, based on Econoday.com’s consensus point forecast.

“Weak enough retail sales on Tuesday could push the Fed to cut 50 basis points,” says Andrew Hollenhorst, chief economist at Citi.

The Fed funds futures market this morning is pricing in a 59% probability for a 50-basis-points cut vs. a 41% probability for a 25-basis-points cut.