The yen briefly pushed to its weakest level in three months last week, thanks to some poor Japanese economic results. An eternally optimistic BoJ, refusing to acknowledge the current recession, held off adding stimulus, so what does that mean for the yen?

The news of Japan slipping back into recession sent the pair charging higher, pushing out the recent six month high. Japanese GDP returned a very poor -0.2% q/q result which came on the back of -0.3% last quarter to confirm the recession. The only positive point to note was a lift in the GDP price index to 2.0% y/y.

The Yen has been suffering at the hands of poor economic results for some time. The Unemployment rate has lifted from 3.3% to 3.4%, Core Tokyo CPI remains flat at -0.2% and household spending disappointed at -0.4% y/y. The manufacturing sector has been a worry with machine tool orders at -23.1% y/y, however industrial production was revised upwards to 1.1% from 1.0% m/m. The economic troubles in China are certainly being felt in Japan.

The Bank of Japan met to discuss monetary policy which went as expected. The eternally optimistic BoJ said the economy continues to recover well despite the glaring contradiction to the GDP result earlier in the week. What it meant for the yen was that it strengthened when stimulus was not expanded and it doesn't look like it will be until the BoJ acknowledges the poor performance of the economy.

Putting the expectation of a liftoff in US interest rates aside, the yen is unlikely to depreciate any further despite how bad the economic indicators get. The fact that the Bank of Japan will not expand stimulus in the face of a recession means they are unlikely to expand it at all. That will certainly limit the upside to the USD/JPY pair and questions will begin to be asked about the fitness of the BoJ to respond to an economic crisis, or at least acknowledge the reality.

This week will see the headline CPI figures released which could actually return a positive result if the GDP price index is anything to go by. Volumes will be light with the US on holiday and that could lead to some disproportionate movements in the USD/JPY pair.

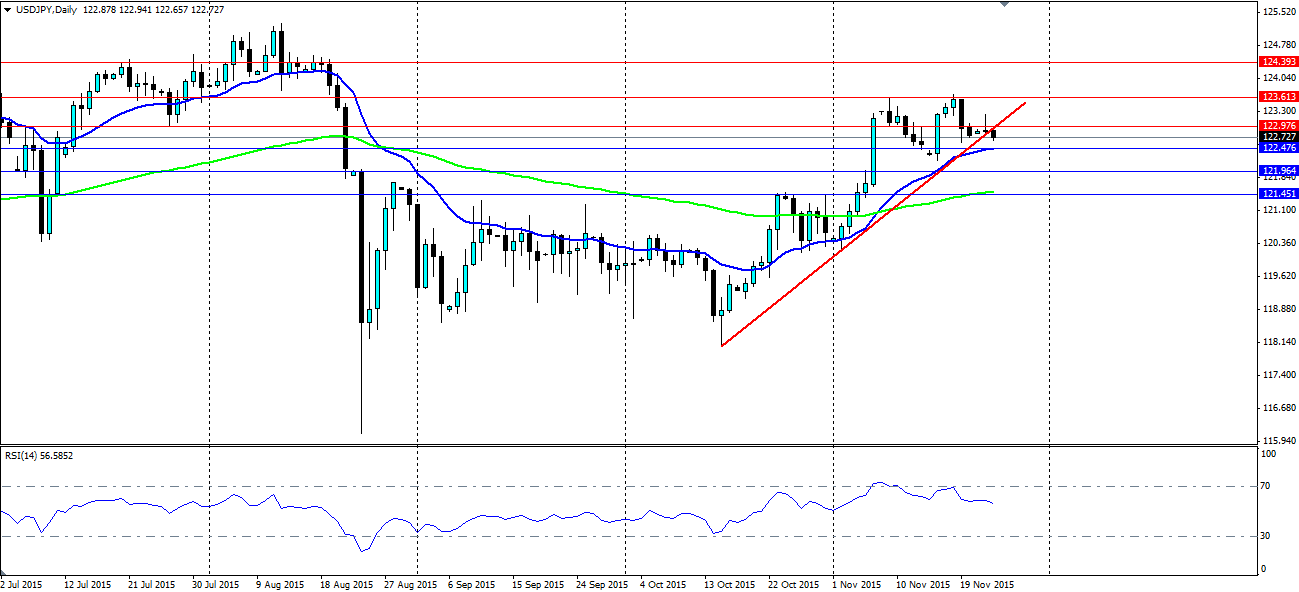

Technicals show the bullish trend coming under pressure, and that could potentially give way as a head and shoulders pattern forms at the current levels. The moving averages still look to be pushing higher so there is a good chance the trend will continue, especially as the market now expects US interest rates to rise in December. Look for support at 122.47, 121.96 and 121.45 while resistance is found at 122.97, 123.61 and 124.39.