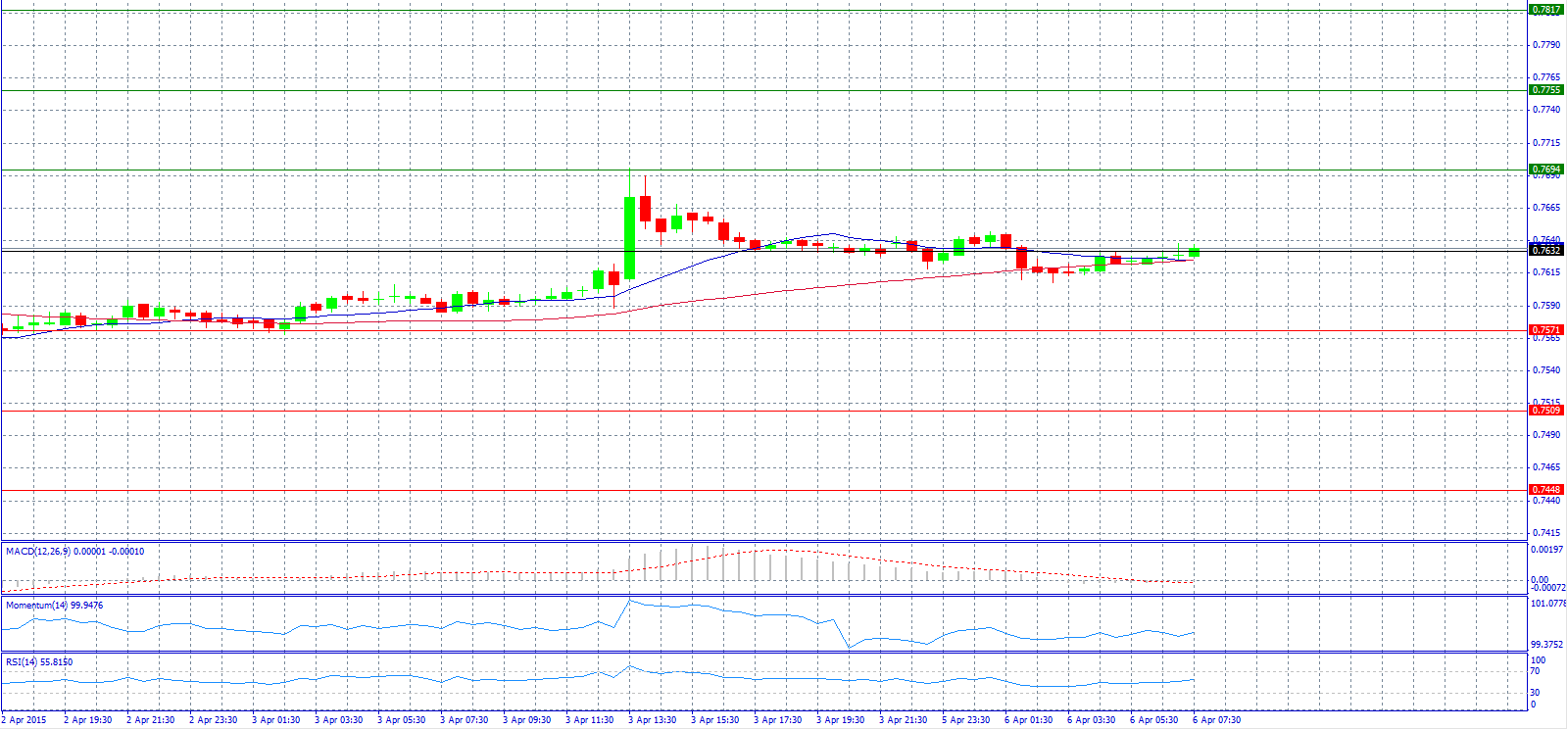

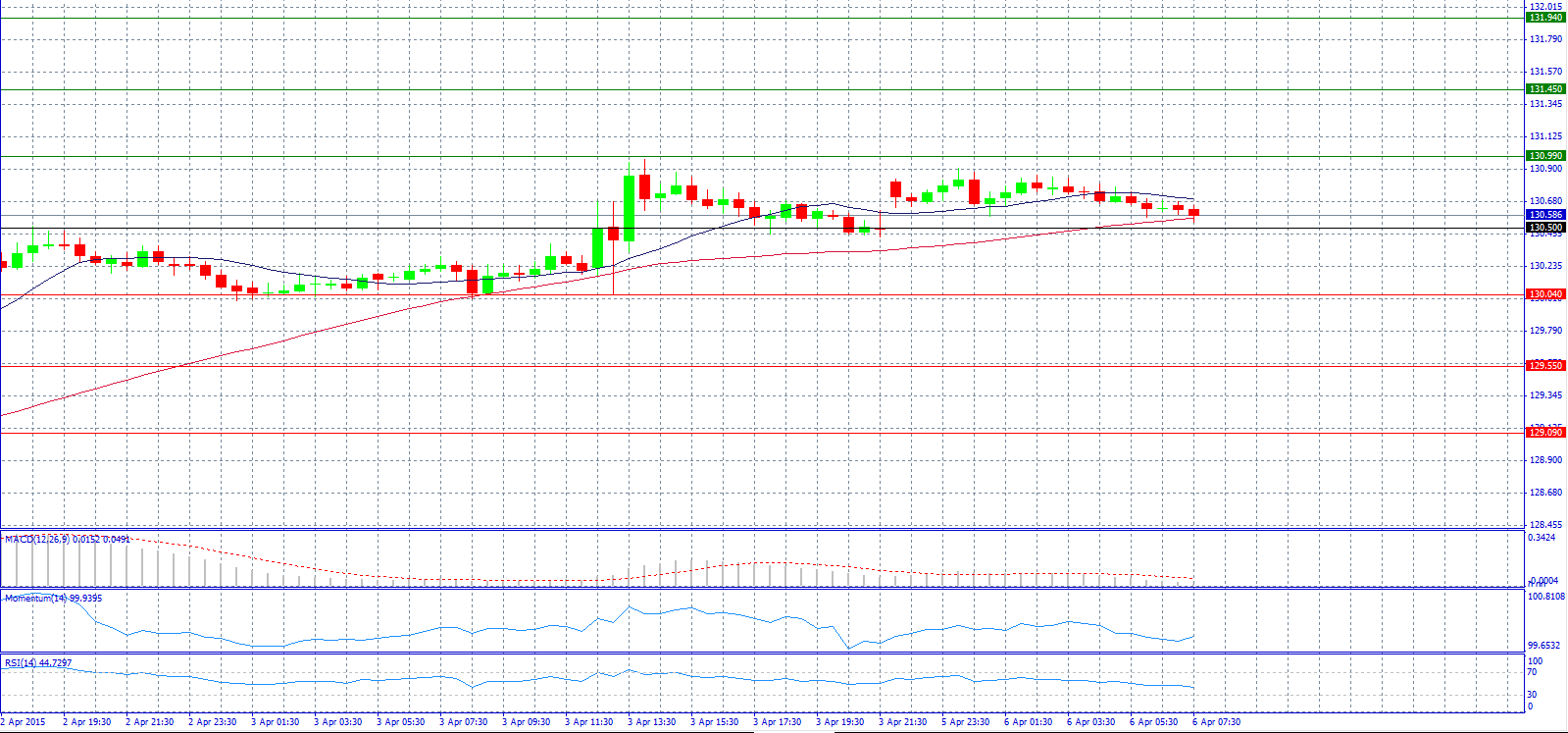

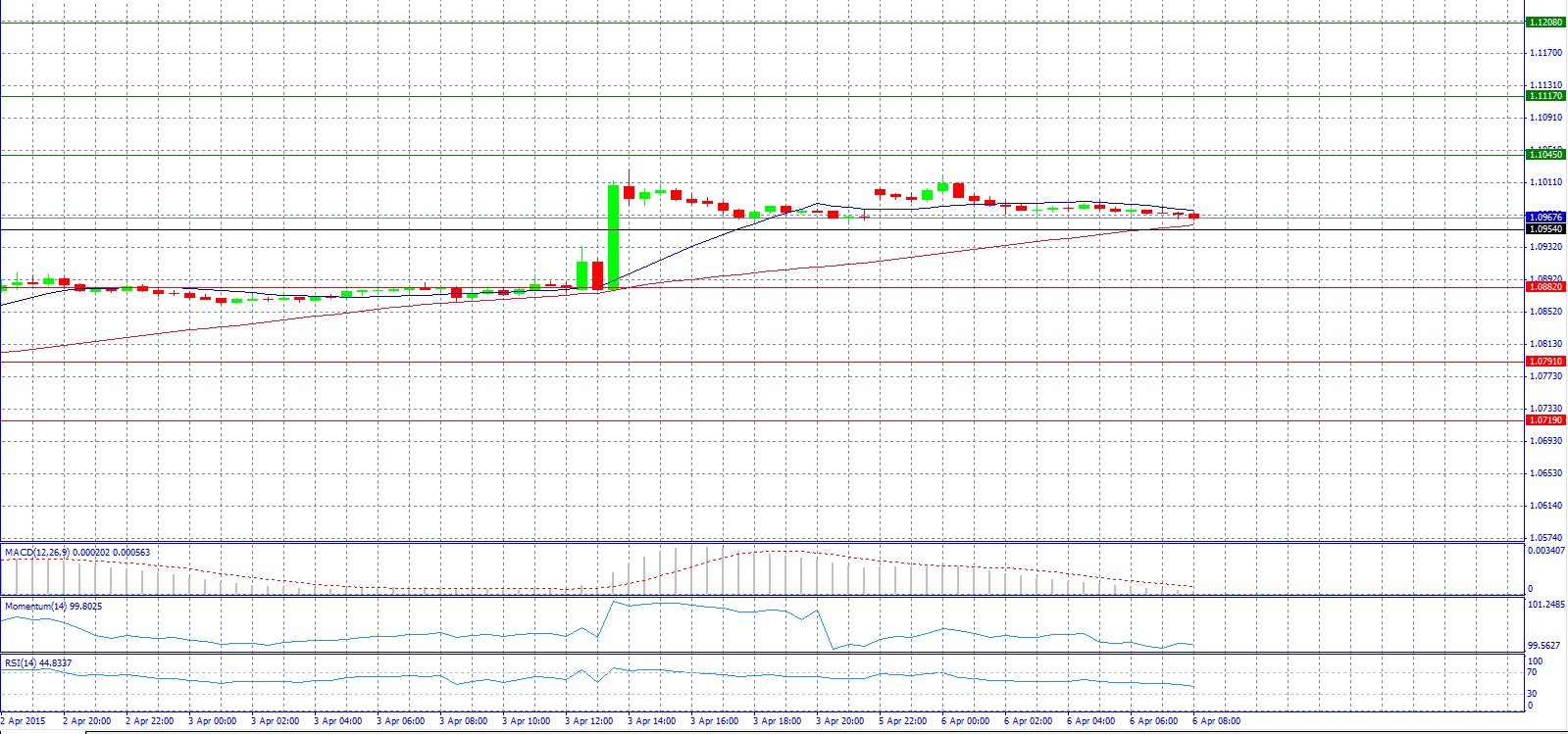

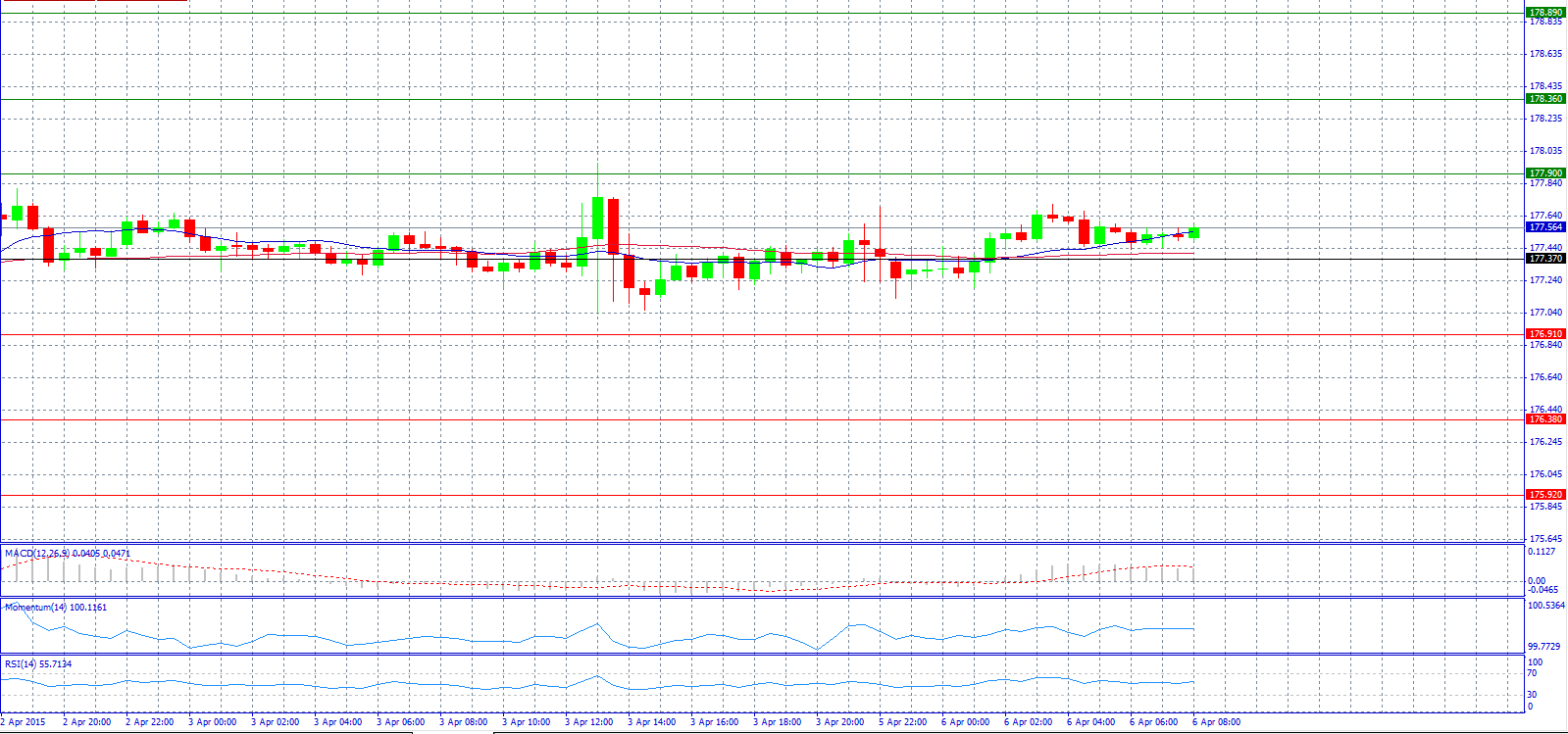

*All the charts are 30M charts with daily pivot points.

Market Scenario 1: Long positions above 0.7632 with target @ 0.7694.

Market Scenario 2: Short positions below 0.7632 with target @ 0.7571.

Comment: The pair is bearish and tries to base around 0.7600.

Supports and Resistances:

R3 0.7817

R2 0.7755

R1 0.7694

PP 0.7632

S1 0.7571

S2 0.7509

S3 0.7448

Market Scenario 1: Long positions above 130.50 with target @ 131.45.

Market Scenario 2: Short positions below 130.50 with target @ 130.04.

Comment: The pair trades above pivot point at 130.50 level.

Supports and Resistances:

R3 131.94

R2 131.45

R1 130.99

PP 130.50

S1 130.04

S2 129.55

S3 129.09

Market Scenario 1: Long positions above 1.0954 with target @ 1.1045.

Market Scenario 2: Short positions below 1.0954 with target @ 1.0882.

Comment: The pair trades steady near 1.0970 level.

Supports and Resistances:

R3 1.1208

R2 1.1117

R1 1.1045

PP 1.0954

S1 1.0882

S2 1.0791

S3 1.0719

Market Scenario 1: Long positions above 177.37 with target @ 177.90.

Market Scenario 2: Short positions below 177.37 with target @ 176.91.

Comment: The pair is slightly bullish and trades near 177.60 level.

Supports and Resistances:

R3 178.89

R2 178.36

R1 177.90

PP 177.37

S1 176.91

S2 176.38

S3 175.92

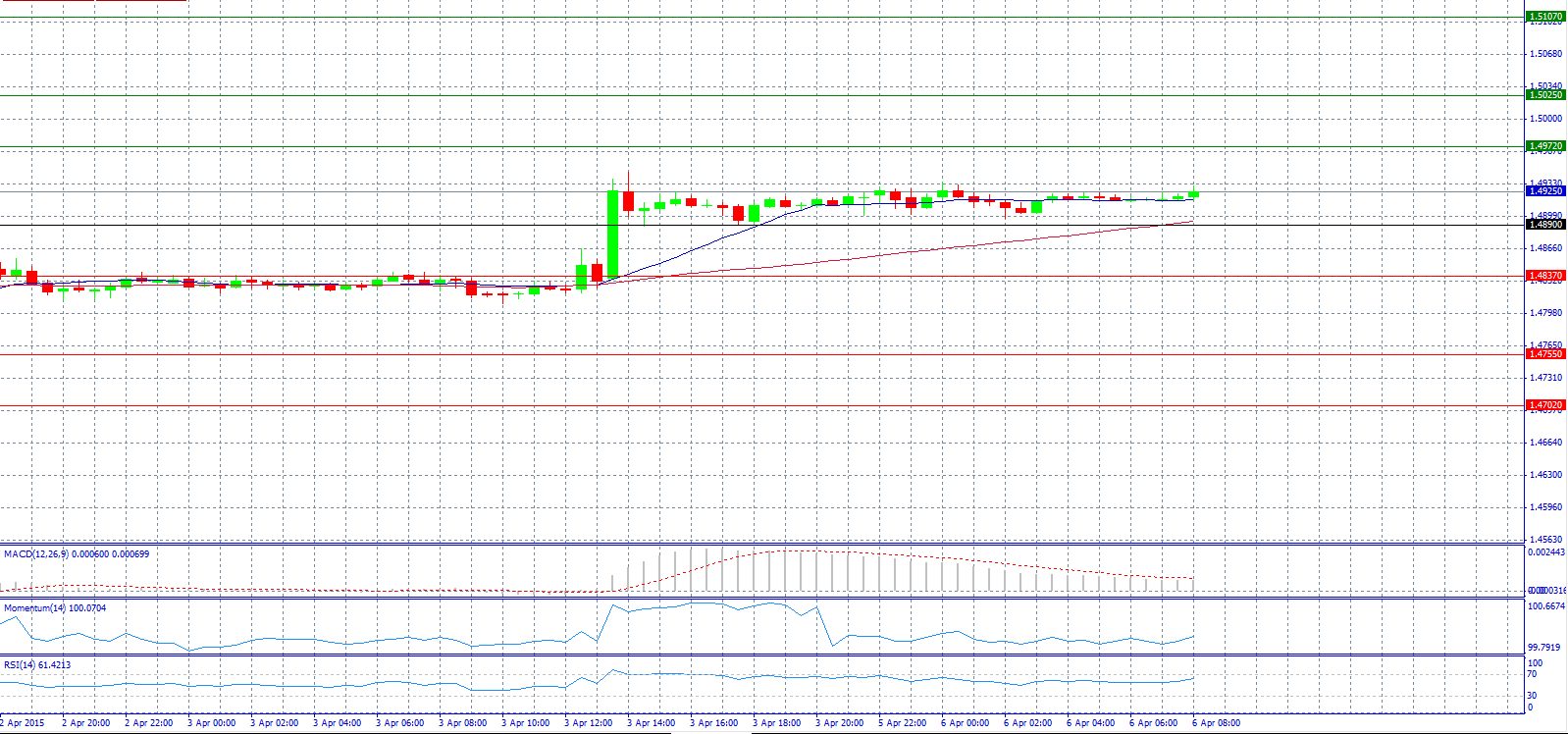

Market Scenario 1: Long positions above 1.4890 with target @ 1.5025.

Market Scenario 2: Short positions below 1.4890 with target @ 1.4837.

Comment: The pair trades muted in the European morning, consolidating dismal NFP backed gains, as lower volumes extends in to the Europe as most markets remain closed on Easter holiday.

Supports and Resistances:

R3 1.5107

R2 1.5025

R1 1.4972

PP 1.4890

S1 1.4837

S2 1.4755

S3 1.4702

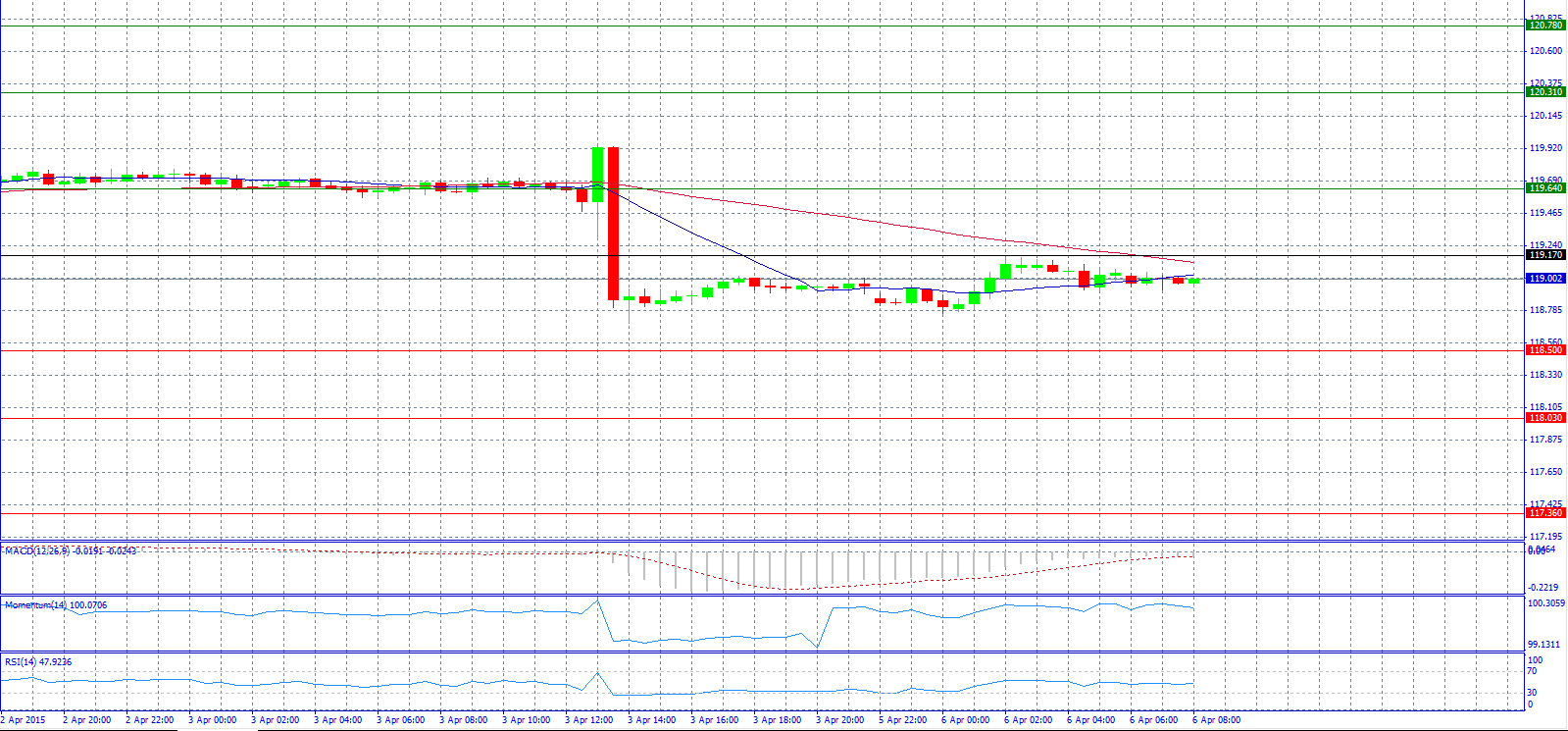

Market Scenario 1: Long positions above 119.17 with target @ 119.64.

Market Scenario 2: Short positions below 119.17 with target @ 118.50.

Comment: The pair trades modestly flat near 119.00 level, extending its side trend from Asia as the US dollar attempts a recovery following Friday’s discouraging payrolls figures which pulled the pair to fresh one-week lows.

Supports and Resistances:

R3 120.78

R2 120.31

R1 119.64

PP 119.17

S1 118.50

S2 118.03

S3 117.36

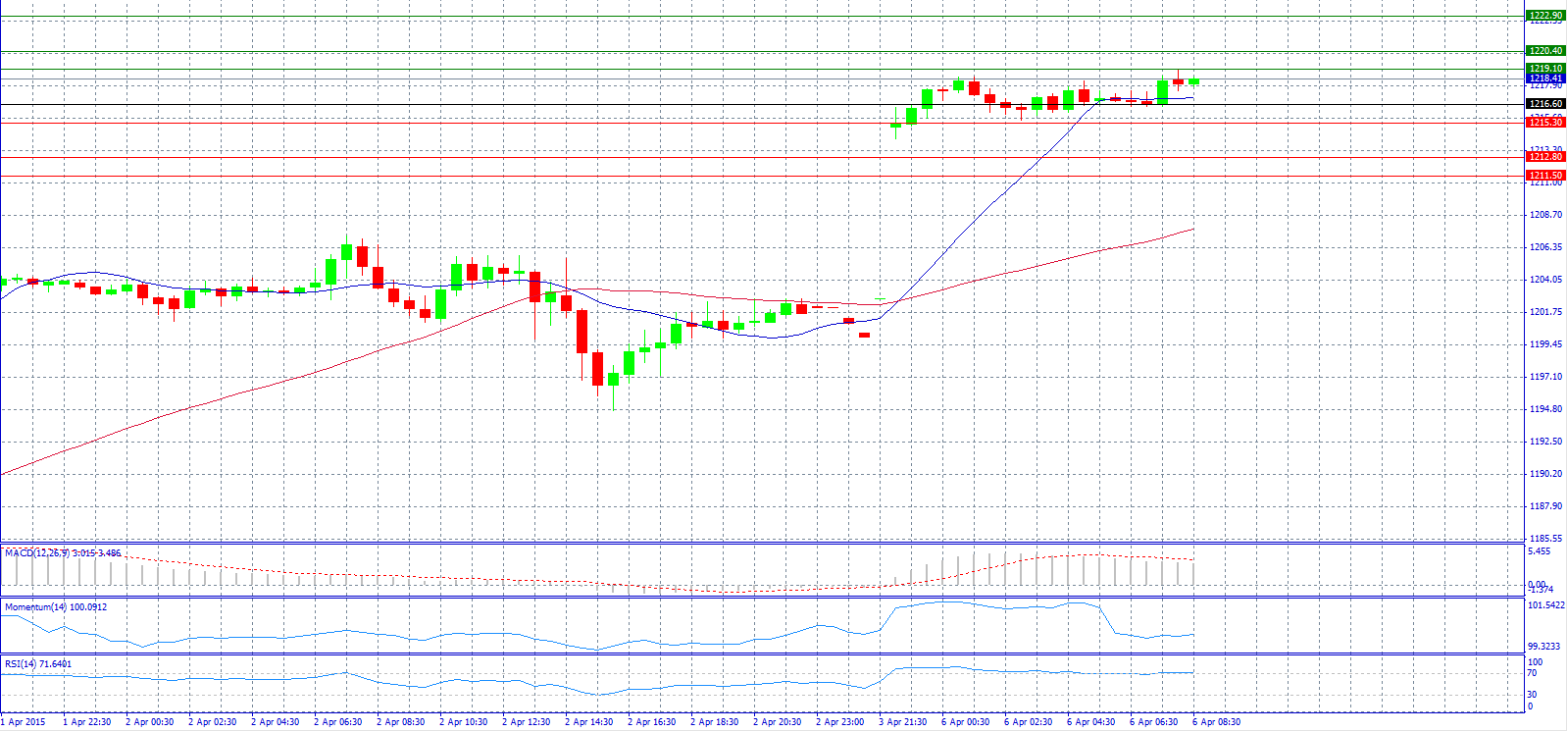

Market Scenario 1: Long positions above 1216.60 with target @ 1222.90.

Market Scenario 2: Short positions below 1216.60 with target @ 1211.50.

Comment: Gold prices extend gains on dismal US jobs data and hover around 3-week high.

Supports and Resistances:

R3 1222.90

R2 1220.40

R1 1219.10

PP 1216.60

S1 1215.30

S2 1212.80

S3 1211.50

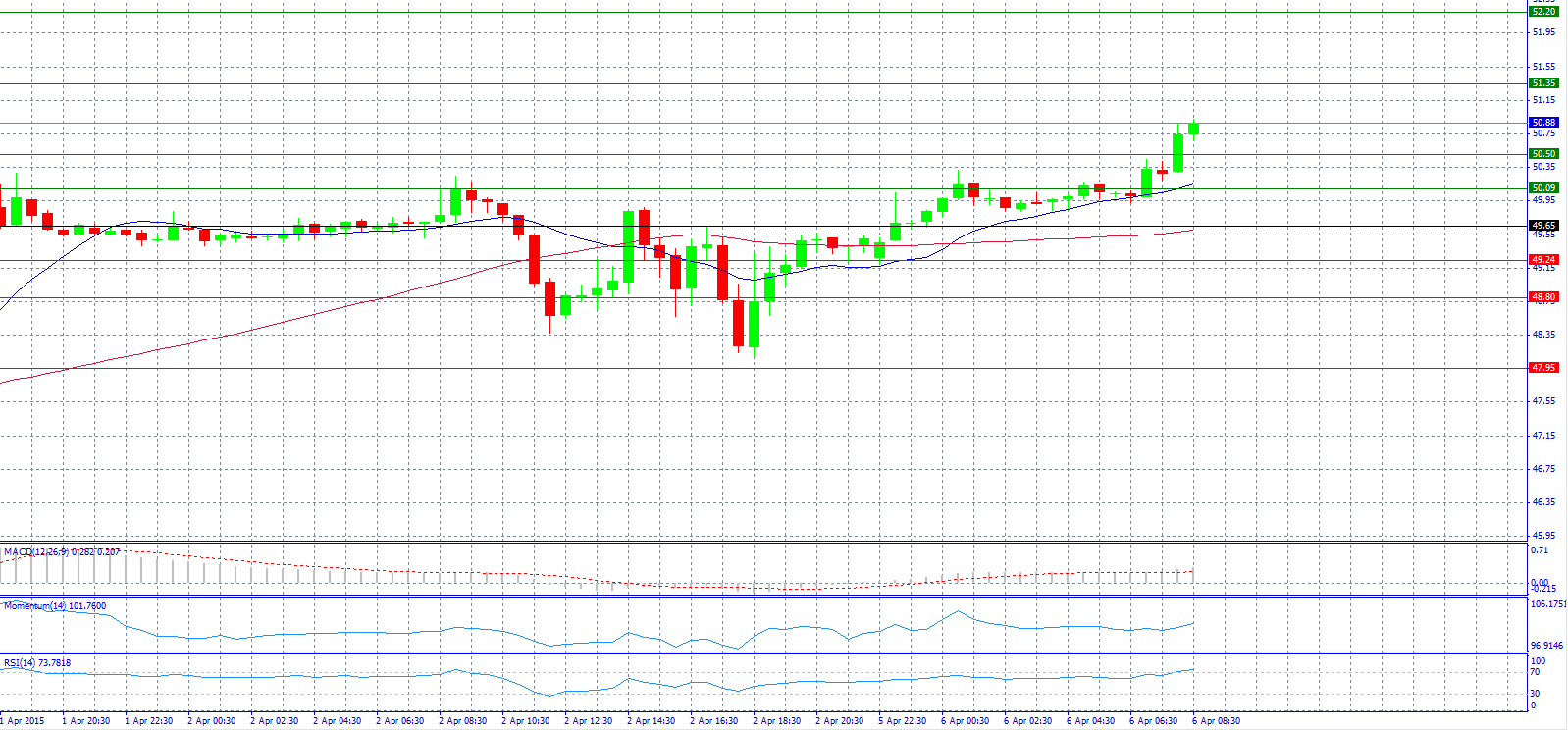

Market Scenario 1: Long positions above 49.65 with target @ 52.20.

Market Scenario 2: Short positions below 49.65 with target @ 47.95.

Comment: Crude oil gained 3% on 6 April after Saudi Arabia raised prices for crude sales to Asia for a second month, indicating better demand in the region.

Supports and Resistances:

R4 52.20

R3 51.35

R2 50.50

R1 50.09

PP 49.65

S1 49.24

S2 48.80

S3 47.95

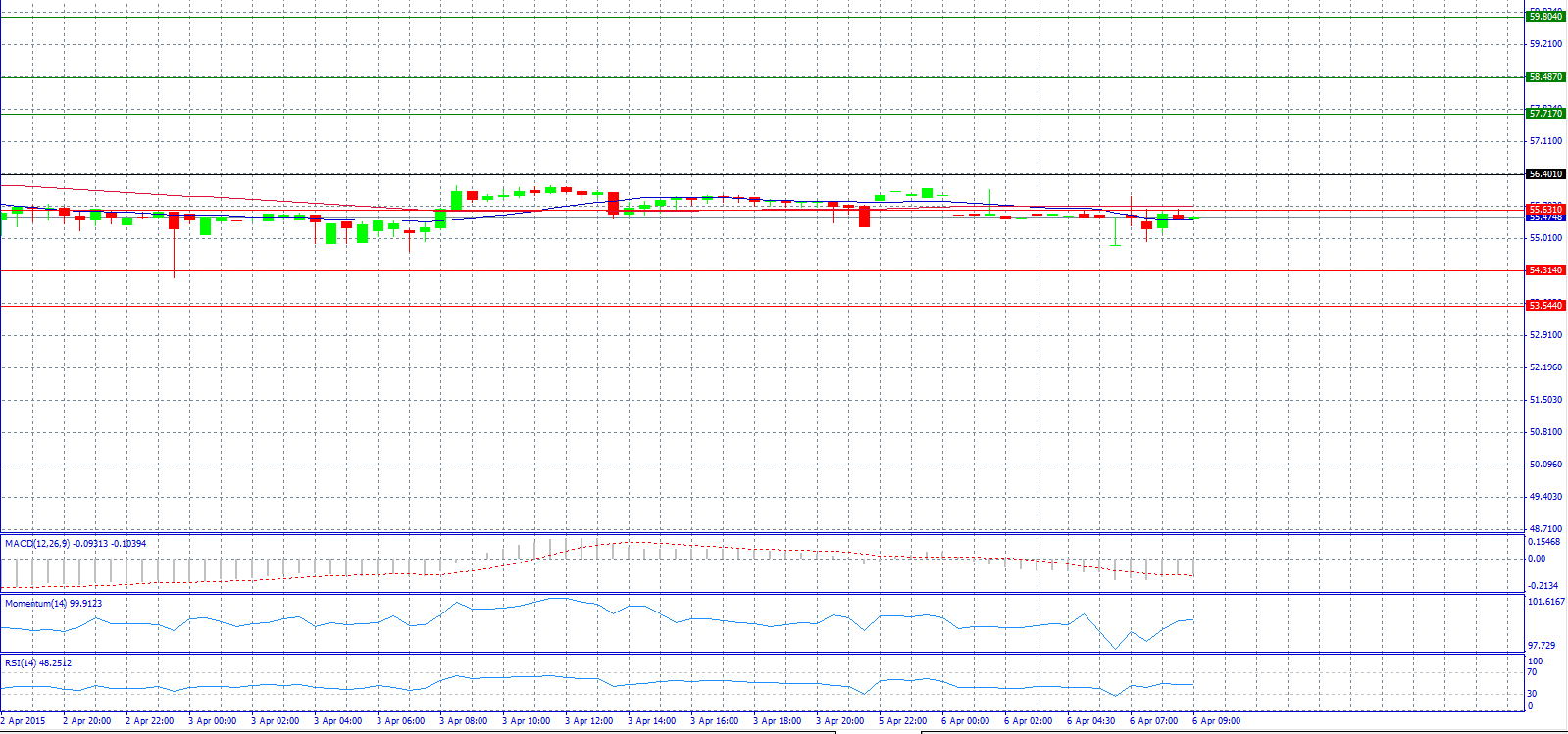

Market Scenario 1: Long positions above 56.401 with target @ 57.717.

Market Scenario 2: Short positions below 56.401 with target @ 54.314.

Comment: The weak US jobs data puts a bearish pressure to the pair as the Federal Reserve is more likely to wait until the second half of 2015 before raising interest rates.

Supports and Resistances:

R3 59.804

R2 58.487

R1 57.717

PP 56.401

S1 55.631

S2 54.314

S3 53.544