At a time when international central banks are printing money in massive amounts and governments, Australia included, are borrowing heavily, one could expect to see gold in demand as investors fear currency debasement. But the opposite has happened, with the gold price falling for most of this year. This fall has been particularly dramatic over the past few weeks.

Under the Radar: Going for gold

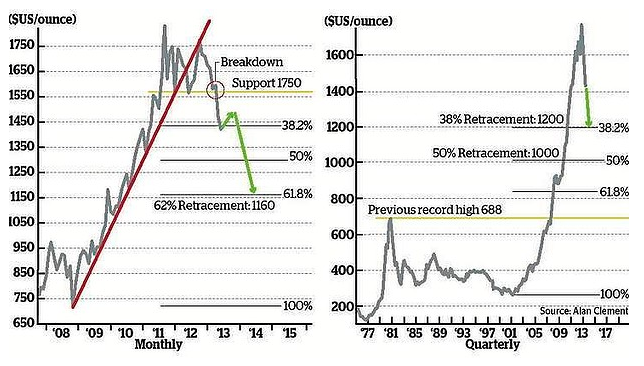

Using a longer time frame, we see a different picture. As shown by this week's charts, produced by Alan Clement, a member of the Australian Technical Analysts Association, gold has enjoyed massive price gains this century. As the quarterly chart shows, it has run up almost 600 per cent, from $US257 an ounce in 2001 to a quarterly high of $US1773 in 2012. On the daily chart (not shown here), gold peaked in September 2011 at $US1907.

The monthly chart demonstrates how the gold market took off after the global financial crisis as investors sought safe havens. The commodity price boom that followed the Chinese government's massive post-GFC stimulus pushed gold further.

In 2012, as commodity prices began to weaken and the sharemarket began to climb, sentiment in the gold market changed. It appears that funds slowly began to move away from gold in favour of shares, and the gold price dramatically capitulated, falling through what had been a support level of $US1574 at the end of March this year.

The question is: Has gold got further to fall? Given that steep rises such as those gold has enjoyed are usually followed by heavy falls, Clement sees gold's decline as having considerable momentum behind it, and it is therefore likely to continue for some time.

Using the Fibonacci number theory, we can point to likely levels of support on the charts. On the quarterly chart, if we measure the levels from the 2001 low to the 2012 high, we see the likely first port of call would be a 38 per cent retracement at about $US1200. On the monthly chart, measured from the GFC low to the 2012 peak, the 62 per cent retracement level is $US1160, which ties in with the target on the quarterly chart.

Generally, when Fibonacci levels on different time periods for a market align, it gives increasing weight to their potential as support levels, Clement says. In the short term, he says, gold looks oversold, so we should expect a bounce soon.

''However, it would be folly to think that any increase in price was any more than a retracement in a down trend. Gold has clearly had a lot of technical damage done to it, and it will take many months - if not years - to repair before any sustained move higher,'' he says.

In the long term, gold's trajectory will be influenced by other markets, such as commodities and stocks. While medium-term weakness is expected, Clement says gold would need to fall below about $US1000 to break the long-term up trend on the quarterly chart. That represents a 50 per cent Fibonacci retracement from the peak. Investors can gain exposure to gold on the long and short side using futures, options, ETFs and CFDs. Or, you can hold the metal.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Has Gold More Shimmer To Shed?

Published 05/22/2013, 03:44 AM

Updated 05/14/2017, 06:45 AM

Has Gold More Shimmer To Shed?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.