The pound could be among the best-performing currencies in 2021 now that a no-deal Brexit has been avoided. With the UK also being among the first countries to roll out the COVID vaccines, I reckon the economy could rebound sharply once lockdowns end. Forward-looking investors are thus likely to buy the dips in the pound.

What’s more, after years of sideways consolidation amid Brexit uncertainty, there could be an even bigger move on the cards. This makes the pound appealing in my view, and it is among the key developed currencies to watch out for in 2021.

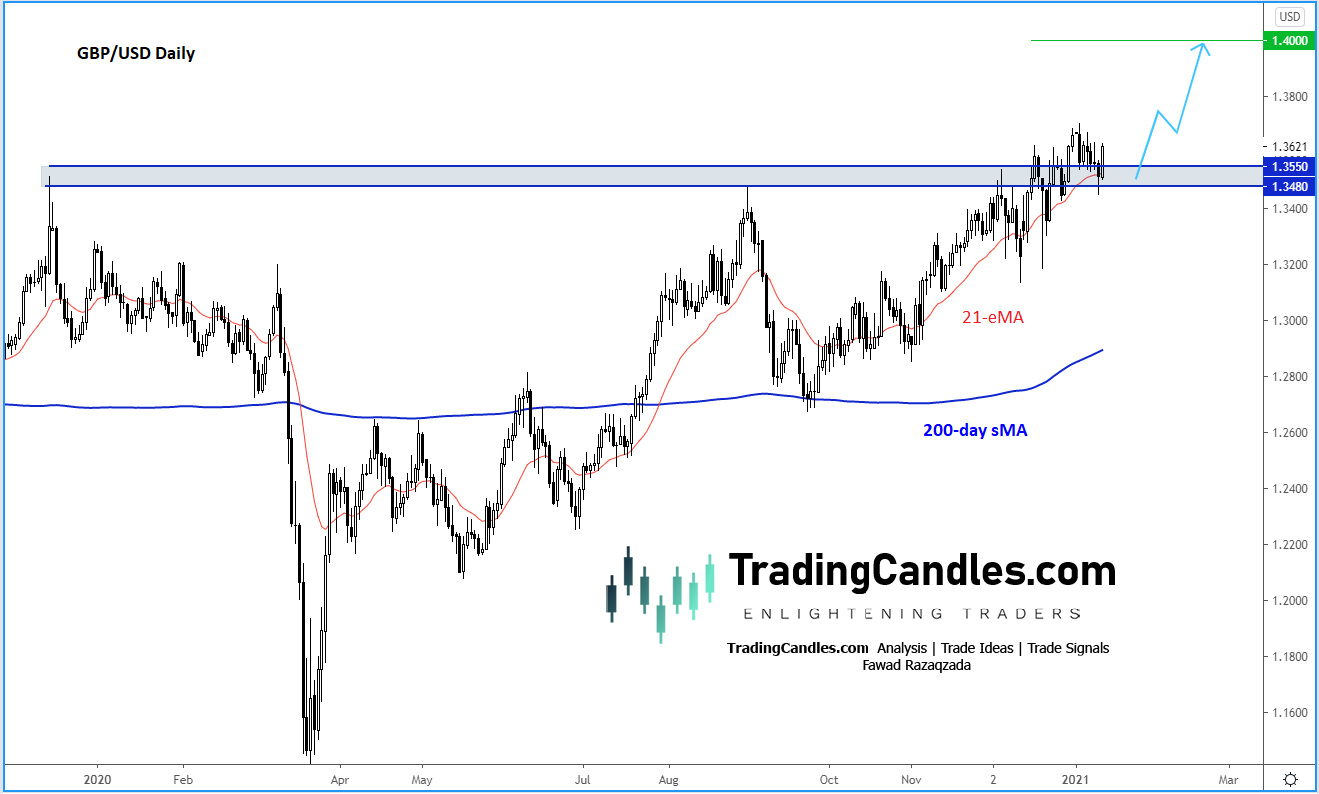

From a technical perspective, and as I wrote for ThinkMarkets about the possibility of a bounce on the cable around the key 1.3480 support area HERE, the bulls seem to have defended their ground successfully:

Going forward, I think the pound will be supported on dips, as the path of least resistance is clearly to the upside.

From here, the next potential upside target is the liquidity resting above last year’s high at 1.37ish/ If we break and hold above that level then there is very little prior price structure until the psychologically-important 1.40 handle.

For the bears, there is currently little reason to enter short and I will not even consider selling GBP until we see a proper breakdown in the market structure or higher highs and higher lows.

So, 1.40 is my main near-term upside target, but we could potentially be talking about significantly higher levels in the months ahead as investors continue to price out Brexit risks and look forward to more normal times ahead.

With the GBP printing bullish price action, I have already been providing long trade ideas for the ledges in the private group. One such setup was provided on Monday on the GBP/JPY, which took no time to bounce off support before rising to my initial target as this before/after chart shows:

I think GBP/JPY is going to extend its gains further over time owing to increased risk appetite and the current reflationary trade.

So if you are a FX trader, ensure you keep a close eye on the GBP/USD, GBP/JPY and pound crosses as the currency could be on the verge of a major rally.