If the Dow Jones Industrial Average has topped, then that is water under the bridge. Looking forward, anticipating the next few months and years matters. Or, as they say, “forewarned is forearmed.” One of the best ways and tools to do that is by assessing the past and applying the Elliott Wave Principle (EWP). I will determine the DJIA’s big-picture EWP count in this article using price data since 1897. I will apply the EWP’s rules, patterns and past corrections to anticipate how this potential current bear market may unfold logically.

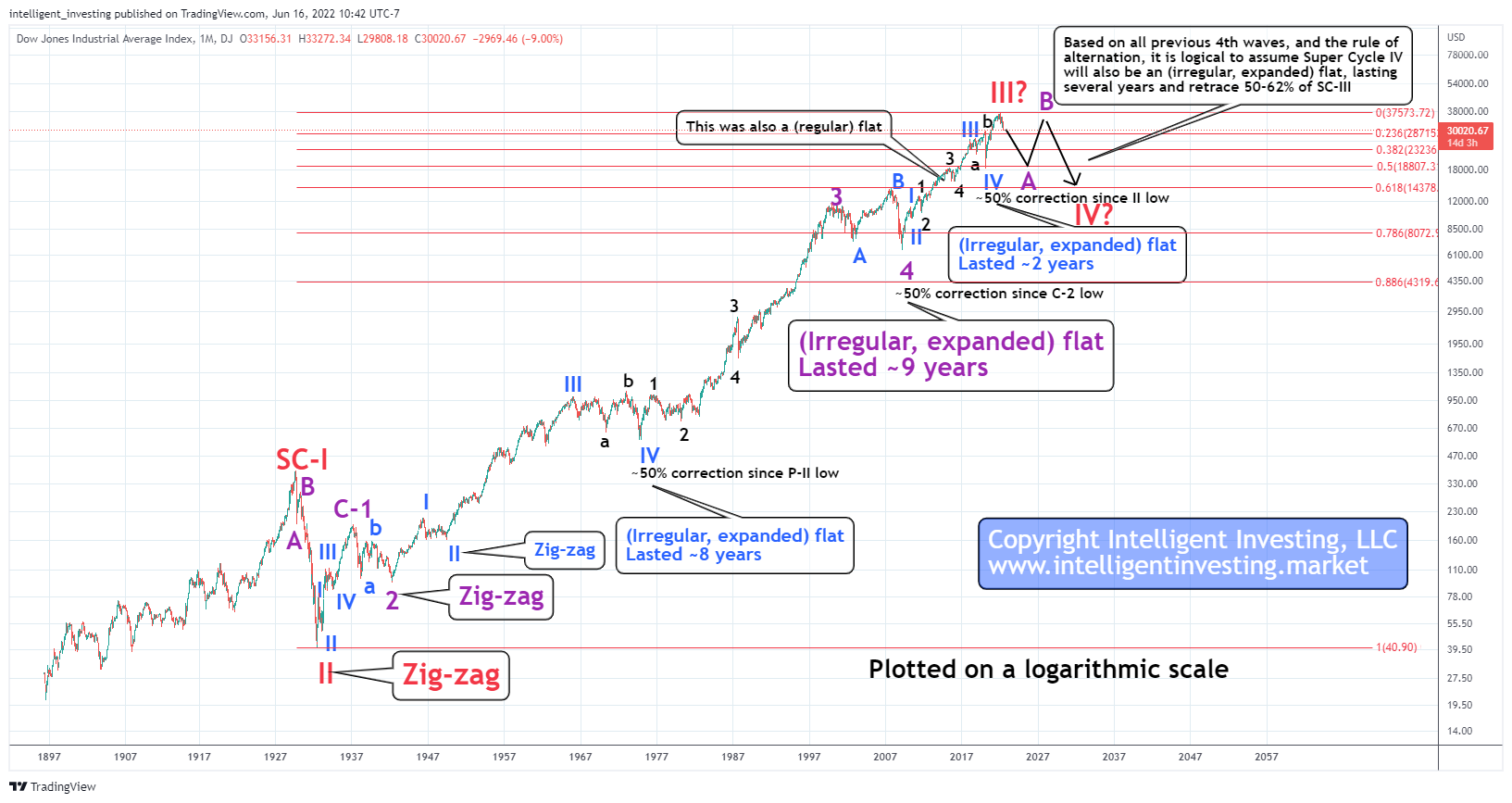

Figure 1. Dow Jones monthly candlestick chart with detailed EWP count

Did Super Cycle III Top? If So, How Will Super Cycle IV Develop?

The infamous 1929 top and subsequent crash into the 1932 low are by most ellioticians regarded as Super Cycle-I and II, respectively. See figure 1 above. In more detail, SC-II was a zig-zag. The subsequent five waves rally into the 1937 high was the one degree lower Cycle-1 wave. C2 bottomed in 1942 and was also a zig-zag. (Blue) Primary-I topped in 1945 (yes, the market rallied 150% during World War II, as it already sniffed out Germany would lose, aka the markets are forward-looking), and P-II was another zig-zag. We can see a nine-wave advance into the 1966 high from that low. Then, the index went through an almost decade-long sideways consolidation. In EWP terms called an irregular, expanded flat wave (IV). Flat corrections consist of three waves: A-B-C. The internal structure of each wave is 3-3-5. In bull markets, the B-wave of an irregular flat makes a new all-time high.

From the EWP, we know that in an impulse, five comes after four, and the market embarked on P-V, which topped in 2000 to complete C3. Another almost decade-long sideways consolidation happened: Cycle 4. This wave was also an irregular expanded flat, with the 2007 all-time high the B-wave top. Cycle-4 bottomed in March 2009, and since then, we have come to enjoy C5 of SC-III. The index went through two more flat 4th waves between then and now. The smaller one (2015-2016) was a regular flat, whereas the larger one (2018-2020) was –once again– an irregular expanded flat. The “COVID crash” was the C-wave of that flat. The subsequent rally from the March 2020 low was Primary-V of Cycle-5 of Super Cycle-III. The latter may now have topped. This means Super Cycle-IV is now under way.

Given the “rule of alternation” in the EWP: “If Wave 2 unfolds as a simple ABC correction, probabilities favor Wave 4 is more likely to unfold as a complex correction. And vice-versa, if Wave 2 is complex, then wave 4 will likely unfold as a simple ABC pattern.” In this case, I established all the 2nd waves (SC-II, C-2, P-II) were simple zig-zags and all fourth waves (P-IV, C-4, M-4, P-IV) were complex flat corrections. Thus, based on this pattern, it is logical to assume the current SC-IV wave will also be of the complex kind: a flat. At this stage, it cannot be known if SC-IV will become an irregular expanded flat, meaning wave-B of IV will make a new all-time high or “only” a regular flat (A=B=C). However, based on the historical evidence, it will likely become an irregular and expanded flat.

Besides, if SC-IV follows the prior 4th waves paths, I expect SC-IV to ideally bottom between $14,400-$18,800. Based on the timeline of these previous 4th waves, I expect SC-IV to last potentially up to a decade. In more detail, wave-A of SC-IV has then just gotten started, and the first leg lower (wave-a of A) should wrap up soon, to be followed by a multi-month relieve rally/dead cat bounce (wave-b of A) before the next leg lower starts (wave-c of A).