Hawkish commentary from Fed officials in recent weeks has fueled speculation that the central bank may be poised to raise rates for a second time. Maybe so, but the newly retired governor of India’s central bank warns that the low- and negative-interest-rate regimen that’s become a staple in monetary policies around the world since 2008 won’t be easily reversed. “Often when monetary policy is really easy, it becomes the residual policy of choice,” Raghuram Rajan tells The New York Times.

The observation resonates in the US in the wake of last week’s hefty slowdown in job growth. Private-sector employment increased by 126,000 in August, the softest monthly advance since the workforce posted a small contraction in May. The downshift has pared expectations that the Federal Reserve will raise interest rates at the September 21-22 Federal Open Market Committee Meeting (FOMC). The probability of a rate hike for this month’s confab is just 21%, according to Fed funds futures via CME data at last week’s close.

But some analysts haven’t thrown in the towel on expecting tighter policy for this month. “The speech by Chair Yellen at Jackson Hole suggested a relatively low bar” for employment growth, Goldman Sachs) outlined in a note to clients over the weekend.

“Back in the spring, the committee was ready to go in June or July, but then the weak May payroll report and the Brexit vote interfered. Now both of these worries have dissipated.”

But Dennis Gartman, who pens a widely read newsletter, begs to differ, CNBC reports:

In his Monday letter, Gartman said the one-tenth decline in hours worked from 34.4 hours to 34.3 hours was “the rough equivalent of actually losing at least 200,000 non-farm payroll workers in the period in question.”

The work week decline, reported in the last monthly payrolls release before the Federal Open Market Committee meeting on Sept. 20-21, effectively scotched a rate hike, he said.

“This is the number that caught us off, and this is the number that we think shall make it all but impossible for the FOMC to vote to raise the (overnight) fed funds rate at the (September) meeting,” Gartman wrote.

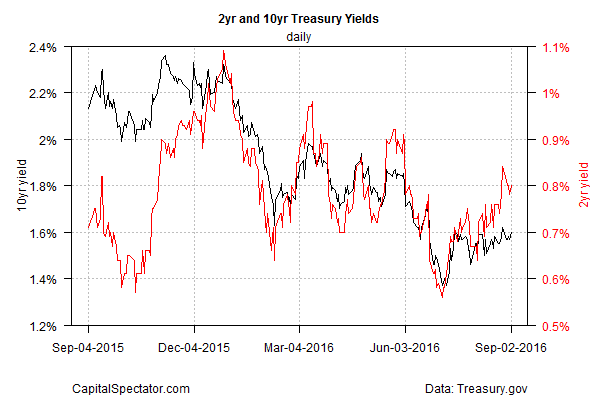

The Treasury market offers a degree of support for thinking that the Fed may forgo another rate hike this month. The 2-year yield, which is highly sensitive to policy changes, is still above its recent lows, but the 0.80% rate as of Sep. 2 still reflects a downward bias for the year-to-date trend.

The hawks counter that the outlook for a third-quarter rebound in economic growth remains intact. The Atlanta Fed’s current nowcast (as of Sep. 2) for GDP in Q3 projects a solid 3.5% rise (seasonally adjusted annual rate), which marks a strong revival after Q2’s weak 1.1% increase. The only problem: there’s a long way to go between now and Oct. 28, when the Bureau of Economic Analysis publishes the “advance” GDP data for Q3.

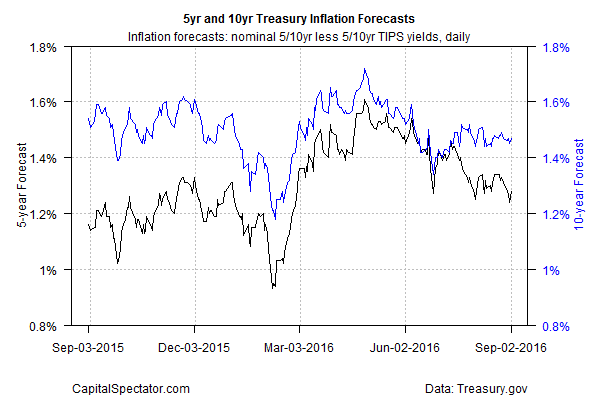

Economist Tim Duy at the Fed Watch blog writes that “if the Fed errors by being too loose now, they have plenty of wiggle room on inflation and policy to respond.” But if the Fed errs on the side tightening policy, “they don’t have much policy room and they risk holding inflation below 2 percent for another decade. What’s that going to do for inflation expectations?”

The market’s implied inflation forecast at the moment continues to reflect a downward bias, based on the yield spread for the nominal 5-year Treasury less its inflation-indexed counterpart. The equivalent for the 10-year maturity is a bit firmer, but the overall profile of market-based expectations continues to point to inflation that’s on track to remain well below the Fed’s 2% target.

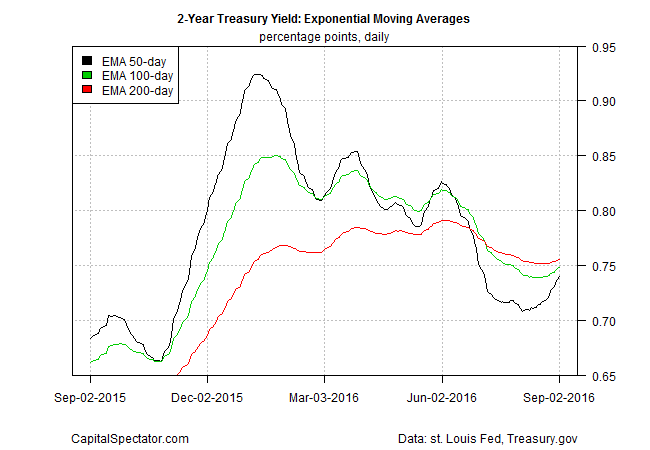

The bottom line: the case is still weak for expecting a rate hike this month. If that’s about to change, an early signal in the days ahead may unfold in a hawkish pattern for the 2-year yield, based on a set of exponential moving averages (EMAs). There’s been some movement on that front in recent weeks. If the 2-year yield’s 50-day EMA crosses above its 100- and 200-day counterparts, the shift will indicate the crowd’s bet that the Fed will squeeze policy this month. For the moment, however, the market isn’t willing to cross that line and it’s not obvious that the incoming economic data between now and Sep. 21 is going to change the calculus.

“With equity futures rising, the dollar weakening, gold strengthening, and the 10-year yield pulling back, the market has voted and says a September rate hike is off the table,” says Prudential) market strategist Quincy Krosby.