Hurricane Harvey is a still evolving situation but the real story may be the U.S. turning the screws on Venezuela, bringing default closer.

It has all been about Hurricane Harvey this morning as oil markets digest the impact of the storm on U.S. production and refining capacity. It appears that flooding is a major concern now with an incredible 76 cm of rain dumped in the Houston area. Details of the actual damage remain sketchy, but what is for certain is that there may be meaningful and long-term damage to Texas’ refining capacity.

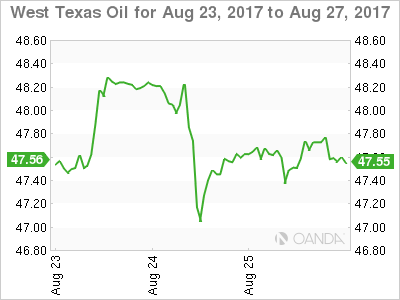

This has been mostly seen in gasoline futures this morning, erupting higher by some seven percent in what would admittedly be a very thin market. It is therefore somewhat surprising that WTI has had a quiet start trading sideways since the futures open at 47.60 around its Friday close. It may well be that the market feels the choke point in petroleum’s value chain is not production but refined products of which Texas is 11.0 percent of the U.S. capacity.

Nevertheless, it is hard to imagine there won’t be a knock-on effect on crude eventually with WTI spot’s technical picture implying that it is poised for a meaningful breakout. The converging triangle has resistance at this morning’s high of 48.00 and support at 47.10, a break of which is implying a move in the two to three dollar range. The danger appears to be to the topside for now with a break targeting 48.70 initially and then potentially 50.00 a barrel.

Lost in the winds of Hurricane Harvey was the news that the U.S. has tightened sanctions on Venezuela. It will effectively cut off both the government’s and PDVSA’s access to financing by U.S. regulated institutions. This will surely bring Venezuela’s inevitable bankruptcy closer to fruition, and the resulting drop in oil exports could have the effect of tightening crude supplies and giving a fresh tailwind to OPEC/Non-OPEC’s efforts to offset increased Libyan and Nigerian supply. The effect should be seen on WTI rather than Brent as Venezuela’s crude is heavy crude for which U.S. refineries are optimized.

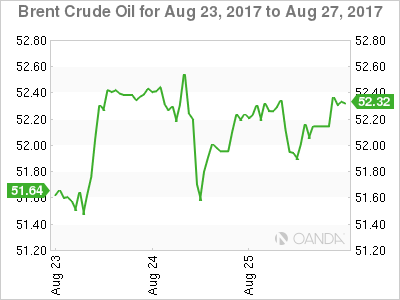

Brent spot itself should open slightly higher this morning around 52.50, having consolidated its gains of the last ten days nicely into Friday's New York close. Brent spot has solid support at 51.50 with resistance nearby at 52.85, a break of which, opens a run at 53.50 and possibly 54.50 should the Venezuela situation degenerate.