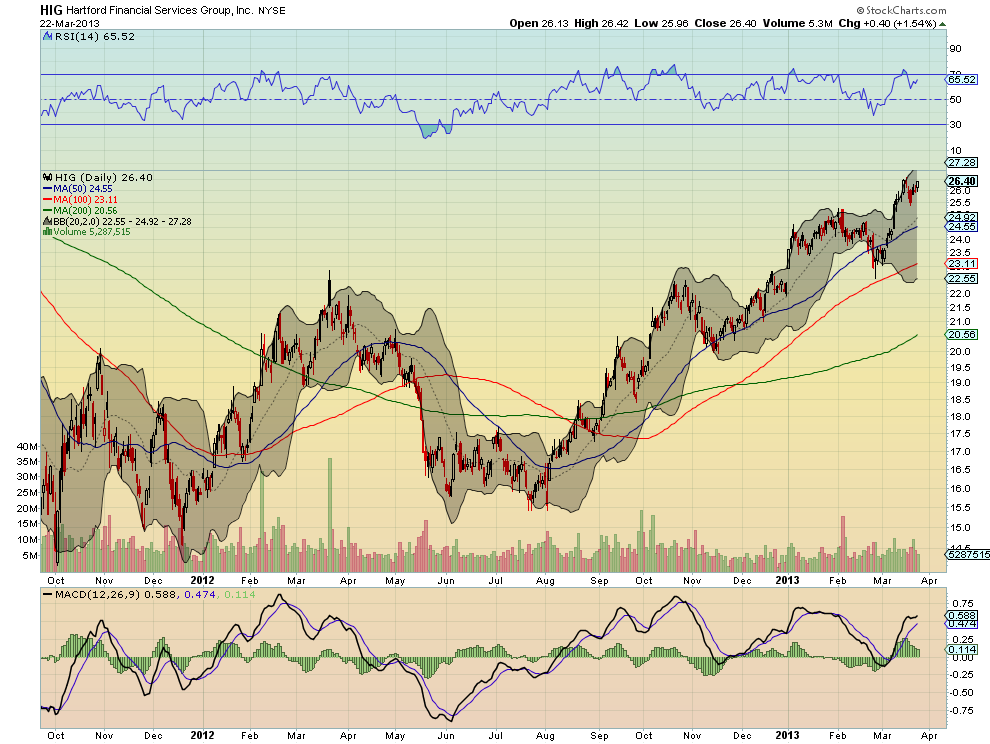

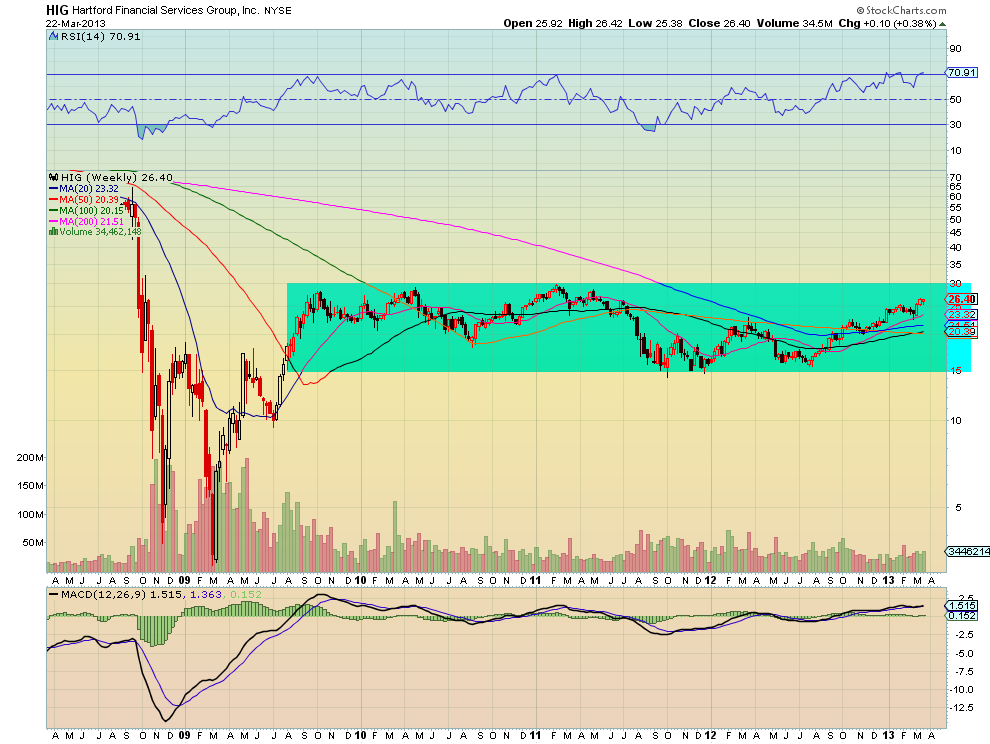

Hartford Financial has been rising steadily since a basing bottom between 15.50 and 17.50 over last summer. Currently at minor resistance at 26.60 within the move higher that carries it to 28.25 on a Measured Move higher, it has support for more upside from a rising and bullish Relative Strength Index (RSI) and a Moving Average Convergence Divergence indicator (MACD) that is positive. It also has a 3-box reversal Point and Figure chart price objective at 29.50, not far above the Measured Move. The weekly chart below shows this run is still within a massive nearly 4 year consolidation. If it can get over 30 there is a ton of tied up energy to release.

Trade Idea 1: Buy the stock on a move over 26.60 with a stop at 25.75.

Trade Idea 2: Buy the April 27 Calls (offered at 49 cents late Friday) on a move over 26.60.

Trade Idea 3: Buy the June 27 Calls ($1.16) on a move over 26.60.

Trade Idea 4: Buy the April/June 28 Call Calendar (58 cents) on a move over 26.60.

Trade Idea 5: Buy the April/June 28 Call Calendar selling the June 23 Put (16 cents) on a move over 26.60.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Saturday which, heading into what should be a light shortened week starting with Passover and ending with the Good Friday market holiday the markets remain biased higher but the mix is shifting. Gold appears ready to continue the bounce in its intermediate downtrend while Crude Oil consolidates in its uptrend. The US Dollar Index seems ready for some consolidation or a pullback after its recent run while US Treasuries are biased higher in the intermediate downtrend. The Shanghai Composite looks ready to continue the rebound higher while Emerging Markets continue to the downside. Volatility looks to remain subdued, keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are biased higher as well but the QQQ looks the best and on the longer timeframe with the SPY next and the IWM perhaps ready for a pullback. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post