The U.S. dollar depreciated the most in three weeks against the euro and dipped versus several of the majors before the U.S. released data on Retail Sales. Most economists predicted that the report would denote a decline due to the harsh winter conditions across the country. The recent storm caused thousands of homes to be left without electricity throughout the Southern portion of the United States and prompted over 2,500 flights to be cancelled. Even Federal Reserve chairperson Janet Yellen had to re-schedule her final day of testimony before Congress due to another snow storm which is predicted to hit the East Coast. On the data front, the U.S. Commerce Department announced that Retail Sales fell 0.4 percent last month, following a 0.1 decline in December. The news prompted a further weakening of the greenback, especially as the numbers denoted that the weather continues to negatively impacting the economy. Other releases confirmed that Jobless Claims went up by 8,000 to 339,000 in the week which concluded on February 8. Gold Prices retrieved from three-month highs as market traders awaited the announcement of key economic fundamentals out of the U.S. in order to assess the health of the American economy. Futures for April delivery remained within a range, trading between $1,287.60 and $1,293.20 a troy ounce on the New York Mercantile Exchange.

The euro strengthened versus the majority of its Forex counterparts in anticipation of today’s economic releases which are expected to reveal that the E.U.’s economy expanded 0.2 percent in the last quarter of 2013, denoting a third consecutive quarter of growth. The euro traded to the downside on Wednesday after it was reported that Benoit Coeure, in an interview with Reuters, suggested that the european Central Bank may opt for implementing a negative interest rate. The British pound continued to enjoy high demand by speculators, especially after the Bank of England increased its growth expectation for 2014 from 2.8 to 3.4 percent while indicating that it may boost the interest rate over the coming year. The Sterling came close to trading at the highest rate in two years versus the greenback as the chief economist for the BOE, Spencer Dale, stated that an increase for the key cash rate was reasonable. The Swiss Franc surged a minimum of 0.2 percent against all of its peers as a drop in equities bolstered appeal for harbor currencies.

The yen advanced versus the U.S. dollar following comments from Bank of Japan officials suggesting that policy makers won’t have to “loosen the monetary grip” as current unprecedented monetary policies are providing positive signs of improvement. However, data showed that Core Machinery Orders slipped in the month of December causing concerns over the progress of business investments, a key sector for Prime Minister Shinzo Abe’s recovery plan. Orders contracted for the first time in three months, though the shipments of marine and farm products hit a record high in 2013.

Lastly, in the South Pacific, weak economic data out of Australia impacted the Aussie, causing it to drop versus the greenback and the majority of its most traded counterparts. According to the Statistics Bureau, employers cut payrolls and they did not add jobs as most economists had predicted. Furthermore, the rate of Unemployment surged from 5.8 to 6 percent. The release came in a day after China said that Imports from the Aussie nation climbed 12.8 percent, which was the most in half a year. The currency remained under pressure as market traders believe the economy is facing challenges in making a transition from mining into other possible areas of growth. The New Zealand dollar traded little changed against the greenback after revealing that the Business Manufacturing Index slipped from 56.4 in December to 56.2 last month.

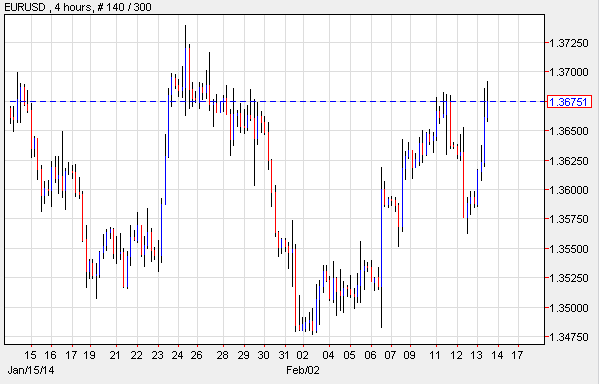

EUR/USD: Economists Expect Growth

The EUR/USD traded higher on Thursday ahead of economic releases slated to show expansion for the region’s economy. Some economists are anticipating that today’s announcement will show that the euro-zone’s economy grew 0.2 percent from October through to December of 2013. The EUR/USD dipped on Wednesday due to dismal economic releases indicating a decline in Production by 0.7 percent as well as comments by ECB Executive Board member Benoit Coeure who suggested that the bank is considering instituting a negative deposit rate. The rate now sits at zero percent. His comments also sparked speculation that the central bank could cut the key cash rate in March.

EUR/USD Hourly Chart" title="EUR/USD Hourly Chart" width="474" height="242" />

EUR/USD Hourly Chart" title="EUR/USD Hourly Chart" width="474" height="242" />

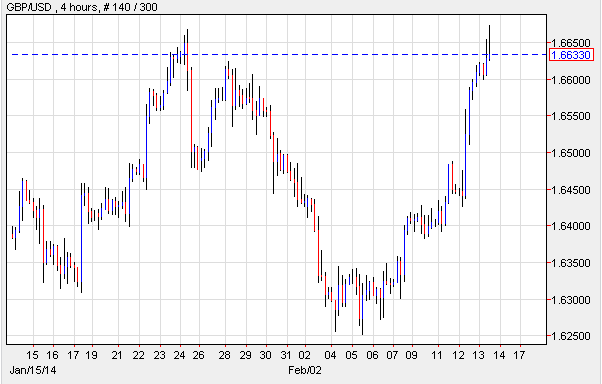

GBP/USD: Sterling Hits 2½ Year High

The GBP/USD surged to a 2½ year high as the chief economist of the Bank of England, Spencer Dale, suggested that it was not unreasonable for investors to anticipate a rate hike. The GBP/USD rallied for a third day in a row on signs that the British economic recovery remains strong and as a dip in U.S. Retail Sales raised concerns the American economy may be cooling off.

GBP/USD Hourly Chart" title="GBP/USD Hourly Chart" width="474" height="242" />

GBP/USD Hourly Chart" title="GBP/USD Hourly Chart" width="474" height="242" />

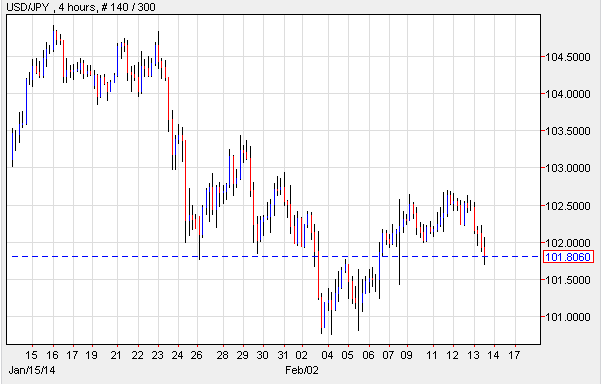

USD/JPY: Orders Drop

The USD/JPY fell as the U.S. Commerce Department announced that Retail Sales slipped 0.4 percent in January, as winter storms continue to pound several regions of the United States. The latest announcements denote that states from Louisiana to Maine were under storm alerts, and Washington D.C could expect to see 8 inches of snow. In Japan, the Core Private sector Machine Orders declined in December at the quickest pace on record. The numbers showed a seasonal modified drop of 15.7 percent. In addition, the orders for non-volatile items, which do not include machinery for ships, contracted for the first time in three months. However, Marine and Farm product exports jumped 22.4 percent given the increase in demand from Asian emerging markets as well as from the U.S.

USD/JPY Hourly Chart" title="USD/JPY Hourly Chart" width="474" height="242" />

USD/JPY Hourly Chart" title="USD/JPY Hourly Chart" width="474" height="242" />

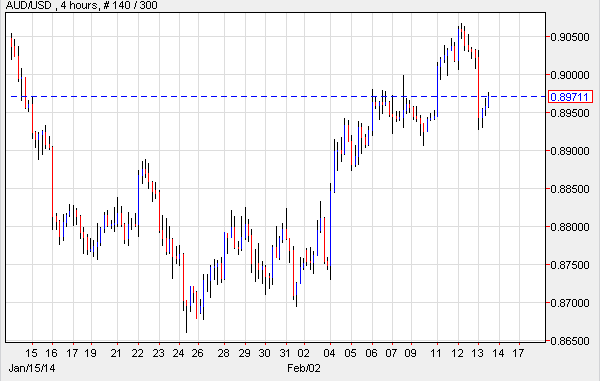

AUD/USD: Jobless Rate Increases

The AUD/USD fell the most in four weeks subsequent to the release of economic fundamentals which revealed that employers reduced payrolls and the Unemployment Rate went up. According to the Statistics Bureau, Australian Employers reduced jobs by 3,700 in January, missing expectations for an increase of 15,000 payrolls. The Unemployment Rate went up from 5.8 to 6 percent. Meanwhile, a member of the International Monetary Fund indicated that with the Aussie still trading high, several economic sectors (not including mining) were feeling the impact and therefore, the current accommodative monetary policy appears to be adequate. Lastly, other releases showed that Inflation Prospected remained at 2.3 percent in January.

AUD/USD Hourly Chart" title="AUD/USD Hourly Chart" width="474" height="242" />

AUD/USD Hourly Chart" title="AUD/USD Hourly Chart" width="474" height="242" />

Daily Outlook: Today’s economic calendar shows that the euro region will report on GDP and Trade Balance. And the U.S. will issue the Import Price Index, Industrial Production and Michigan Consumer Sentiment.