Does Harmonic Elliott Wave work? What percentage of accuracy do you achieve using Harmonic Elliott Wave? How does your system work?

These are three questions that are frequently asked and even appear as search criteria in browsers. They seem quite reasonable questions to ask.

To the first question I can categorically say that Harmonic Elliott Wave works. I have been a practitioner of R.N. Elliott’s impulsive structure since 1989. Until I discovered the true structure that I called Harmonic Elliott Wave I avoided equity markets like the Plague of London. I could never fathom how to forecast, how many extensions could develop and failed miserably at forecasting them.

Around 2005-2006 I became convinced that the wave relationships were between 3-wave moves and not 5-wave. However, it was only after the “Eureka” moment came when I realised how Fibonacci and harmonic ratios should be applied, the projection clusters and how the fractal nature of waves were related did I begin to venture into equities. My very first forecast on the Dow Jones Industrial Average was made in July 2010 when I was writing my book. At the time it had just bounced from the 9,300 area and I forecast the rally to 12,600 +/- 200 points from where it would suffer a price drop of 20%. Once that correction was complete it would move higher to approach the 2007 high at 14,198.

We are approaching that level now…

That single story demonstrates how Harmonic Elliott Wave works because I could have never envisaged being able to make that forecast with R.N. Elliott’s structure.

So does it always work? The answer is “yes” but of course I don’t get it right every time. There are too many twists and turns, a misjudgement here, a recycling there. I wrote an article way back in March 2012 on the U.S. Equity and Dollar Major Reversal that I considered would occur. The end result still looks the same but the route both the dollar took and the Dow Jones Industrial Index took weren’t quite as I had anticipated. However, it is closer than ever before now. Was I right or was I wrong? The end result is right – the process of getting there was just more complicated.

I made a forecast in early October 2012 for USD/JPY. To date this has developed almost perfectly. There is still much to be proven. I have had two subscribers write to me this past week, one saying “I closely follow your calls on JPY, euro and GBP. Besides these your weekly report on gold and AUD. I am still amazed on the level of precision you give. Brilliant!!!” and the other was a trader who used traditional Elliott Wave and wanted to see what the fuss was about.

I made a misjudgement in the euro but then, understanding what had happened forecast the euro with high accuracy for the following 10 days. He wrote “I was really impressed by your accuracy in predicting the currency moves over the last 3-4 weeks which helped me a lot to position myself correctly.”

I feel these examples demonstrate that Harmonic Elliott Wave can be extremely accurate, at time to the very point. However, I do make misjudgements. If these occur in the larger wave degree (let’s call that a daily structure) then the impact can look a lot worse as the degree of error appears appalling! These are all part and parcel of forecasting but the more important issue is recognition of what has happened and making the adjustment that solves the problem.

It is always encouraging to receive positive comments but during that time I have had some traders on a free trial cancel. I’m always bemused by this but is more likely down to the final question, “How does your system work?”

The key word is “system.” Many people consider Elliott Wave and Harmonic Elliott Wave to be a system. However, it is not. It is a price indicator. In my first book, “Integrated Technical Analysis” I wrote about the importance of combining complementary analysis techniques that provide information about different facets of the market. These can be momentum, time related analysis, pattern analysis, volume and of course a forecasting technique such as Harmonic Elliott Wave.

I can generate favoured target areas but there can be multiple projections – 198.4%, 223.6%, 261.8% or more. In the majority of circumstances there is a way to estimate the general area where this wave should stall. However, even then the difference between the 198.4% and 261.8% can be quite large.

In these circumstances it is vital to use other techniques to confirm which will hold. The projections of the lower wave degree will normally provide good supporting evidence, sometimes even the higher wave degree. However, there are always occasions where a misjudgement is made and price extends more forcefully through the targets. Here is where the other complementary analyses should be employed.

Is momentum slowing or is it accelerating with the trend? Is it safe just to make a trade because one projection has been forecast? Of course not. Everyone has head of the phrase “the trend is your friend.” You don’t trade but wait for confirmation from a reversal pattern.

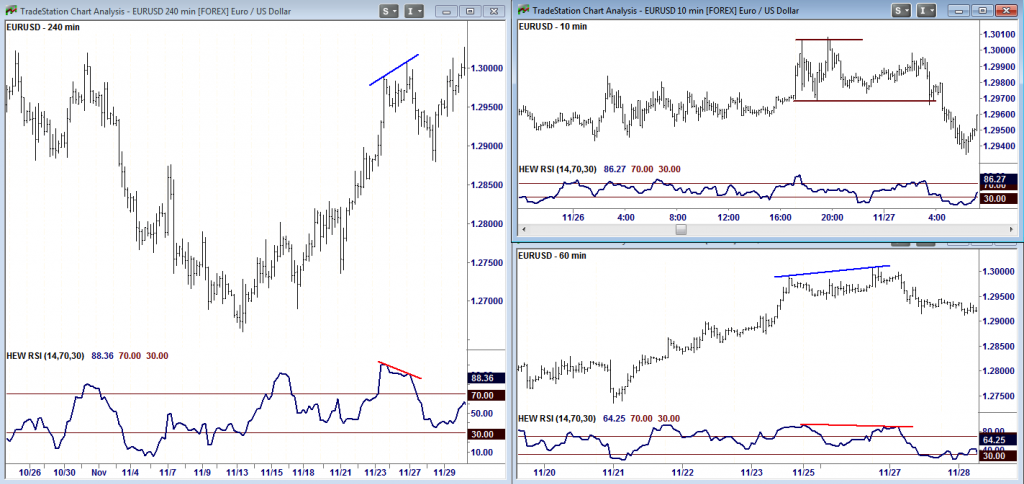

Look at the following two charts and just note the difference. EUR/USD 1" title="EUR/USD 1" width="1024" height="484">

EUR/USD 1" title="EUR/USD 1" width="1024" height="484"> EUR/JPY" title="EUR/JPY" width="1024" height="485">

EUR/JPY" title="EUR/JPY" width="1024" height="485">

The top was a forecast I made in my report and the weekly outlook video on the 26th November for a top between 1.3003-13 in EURUSD. On top of the Harmonic Elliott Wave target, we had bearish divergences in both hourly and 4-hour charts and in the 5-minute chart a double top that confirmed the reversal.

The lower forecast was for a 50%-61.8% projection in a Wave v in EUR/JPY just above 108.00. As price approached this target both hourly and 4-hour saw momentum rising sharply. In these circumstances the odds are against selling into a robust rally. In fact, we are now approaching the not-so-frequently-seen 85.4% projection and both 4-hour and hourly momentum are developing bearish divergences.

Thus, by utilising a suite of indicators the ability to identify which projection will hold becomes stronger buy confirmation of complementary analysis.

In summary, I hope that the question of whether Harmonic Elliott Wave works has been established but the perception that it is a system is incorrect but can be judged with a stronger sense of complementary analysis.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Harmonic Elliott Wave: A System?

Published 12/16/2012, 03:01 AM

Updated 07/09/2023, 06:31 AM

Harmonic Elliott Wave: A System?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.