Iconic motorcycle manufacturer Harley-Davidson (NYSE:HOG) stock has gone through a rollercoaster 2020 but managed to recover back to pre-COVID levels heading into 2021. Outdoor leisure stocks have been pandemic winners in 2020 as COVID-19 restrictions prohibited conventional travel and vacation destinations.

With the acceleration of COVID-19 vaccine distributions, a return to ‘normalcy’ in 2021 should see a recovery in the “epicenter” industries hit hardest in 2020. With that said, Harley-Davidson carries a dual narrative as an outdoor leisure play and as a transport recovery trade. There is also the iconic “all-American” theme embedded into the brand, very much like Levi Strauss & Co. (NYSE:LEVI).

The Company saw a boost with the summer recovery but should see continued follow through with the return to normalcy in 2021 and a more accommodative presidential administration. Prudent investors looking for a dual narrative play that should benefit on the ‘new normal’ recovery can watch for opportunistic pullback price levels in Harley-Davidson shares to scale into positions.

Q3 FY 2020 Earnings Release

On Oct. 27, 2020, Harley-Davidson released its fiscal third-quarter 2020 results for the quarter ending September 2020. The Company reported an earnings-per-share (EPS) profit of $1.05 excluding non-recurring items versus consensus analyst estimates of $0.28, a $0.77 beat. Revenues fell (-9.8%) year-over-year (YoY) to $964.8 million beating analyst estimates of $853.71 million. US retail motorcycle sales fell (-10%) YoY and Worldwide sales fell (-8%) YoY. The Company declared a $0.02 per share cash dividend and is expected to deliver $250 million in cash savings for 2020.

Conference Call Takeaways

Harley-Davidson CEO, Jochen Zeitz, provided color on the Q3 and updates on the “Rewire” overhaul initiative outlined earlier. The US continues to be the “most important market priority market”. The Company has refocused and is exiting 40 markets with low volume and establishing dealer direct distributor models in 17 markets and 36 highest potential markets.

The Company downsized the product portfolio by (-30%) eliminating models with the lowest profit potential to reduce “complexity” for dealers and “confusion for customers” while remaining “more competitive” with winning products. CEO Zeitz clarified:

“Our Rewire playbook has expanded our business focus beyond motorcycles… going forward we intend to strengthen the link to our brand heritage, re-establish design and quality principles and focus on the most profitable SKUs in critical categories.”

Restructuring charges were $44 million for year-to-date (YTD) restructuring charges to $86 million with total 2020 restructuring charges to come in around $169 million. Annual 2021 cost savings are expected to come in around $115 million. Worldwide motorcycle inventory fell by (-34%). Consolidated net income grew 39.8% YoY. The Company ended the quarter with $3.56 billion in cash and cash equivalents. Operating cash flow was $1.14 billion. YTD tax rate with 10.8% compared to 24.6% the prior year. Harley-Davidson has committed to EV motorcycles and their LiveWire was “elected as the best electric motorcycle in 2020 by Motorcycle News”, exclaimed CEO Zeitz.

Bearish Wall Street

Despite the blowout Q3 results, a number of Wall Street analysts downgraded shares afterwards. On Oct. 28, 2020, Morgan Staley cut their rating to Equal-Weight from Overweight with a $38 price. On Nov. 2, 2020, UBS downgraded Harley-Davison shares to Neutral from Buy but raised their price target to $35 for $31. On Nov. 30, 2020, William Blair resumed coverage with a Neutral rating and no price target.

To be frank, the conference call was an abundance of corny slogans centering around the Rewire initiative progressing to the “Hard Wire” initiative with very little details or substance. The pitch was shallow to say the least. Whatever attempt at improving the narrative completely backfired with tacky “wire” references (rewire, livewire, hardwire) that felt more like a local cable-TV commercial than a meaty conference call providing solid substance and insights. Management provided no guidance. Nonetheless, shares are providing opportunistic pullbacks for prudent investors looking for exposure in this iconic brand.

HOG Opportunistic Pullback Levels

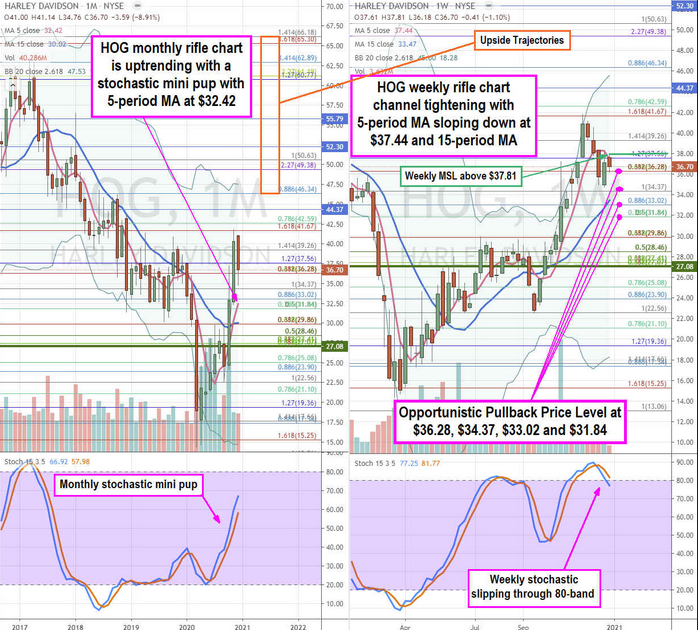

Using the rifle charts on the monthly and weekly time frames provides a broader view of the playing field for HOG shares. The monthly rifle chart is uptrending with the 5-peiod moving average (MA) at $32.42 powered by the monthly stochastic mini pup. The monthly upper Bollinger Bands sit at $47.53. The monthly market structure low (MSL)triggered above $27.08.

The weekly rifle chart peaked out at the $41.67 Fibonacci (fib) level forming an nearly identical market structure high (MSH) trigger below $37.81 and a weekly MSL trigger above $37.81. It’s safe to say that $37.81 is a LINE IN THE SAND. The weekly 5-period MA is sloping down at $37.44. Prudent investors can look for opportunistic pullback levels at the $36.28 fib, $34.37 fib, $33.02 fib and the $31.84 fib. The upside trajectories range from the $46.34 monthly upper BBs/fib up towards the $66.18 fib level.