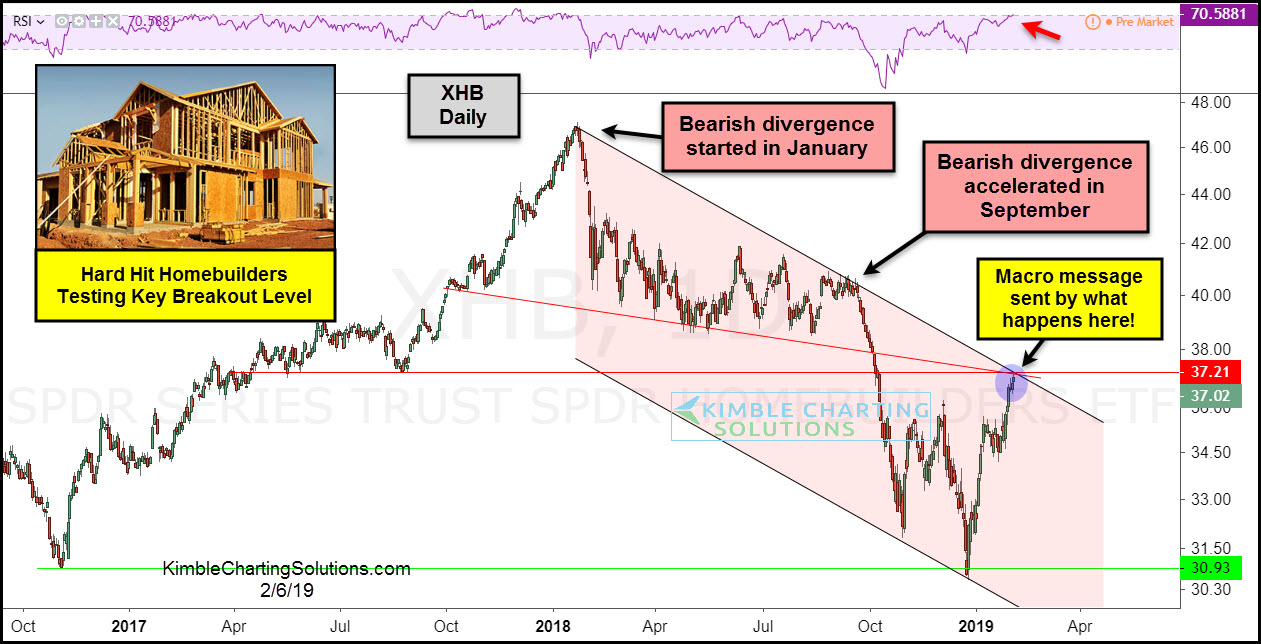

Housing and home-building related stocks have been hit hard over the past year. Case in point: The Homebuilders ETF (NYSE:XHB).

Looking at the chart, it’s clear that XHB has been in a downtrend since January of last year (see pink shaded area). The downtrend started with a bearish divergence and accelerated with another bearish divergence in September of last year. That lead to the December lows.

The current rally has carried XHB up into a critical breakout level, which is made up of a key confluence of lateral and trend-line resistance.

What happens here will send an important message about the economy to the stock market.

The bullish case for the economy and stocks is a breakout here. BUT the bullish case will receive a concerning canary message if heavy selling takes place at this key resistance level.