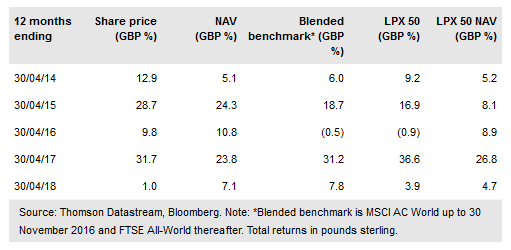

HarbourVest Global Private Equity Ltd (LON:HVPEa) aims to provide shareholders with access to the best private markets opportunities globally, through investing in a portfolio of HarbourVest funds. HVPE’s portfolio is broadly diversified by underlying manager, vintage, strategy, stage and regional exposure. Its recent performance has been strong in its US dollar functional currency, with a 16.2% NAV total return in FY18, although currency moves have weighed on its performance in sterling terms. After three years of strong portfolio distributions, the 2018 commitment plan has been drawn up with a view to ensuring that HVPE moves closer to a fully invested position over the next two to three years.

Investment strategy: Selective diversification

HVPE makes regular commitments to new HarbourVest primary, secondary and direct co-investment funds, with reference to its long-term strategic asset allocation targets, resulting in a steady pace of investment. HarbourVest takes a disciplined approach to selecting third-party private equity managers’ funds, using its network of specialists and relationships built up over 35 years, aiming to select the highest-quality opportunities. The result is that HVPE’s portfolio has exposure to c 5% of available private markets investments, with a focus on proven managers with whom HarbourVest has built strong relationships through multiple fund cycles.

To read the entire report Please click on the pdf File Below: