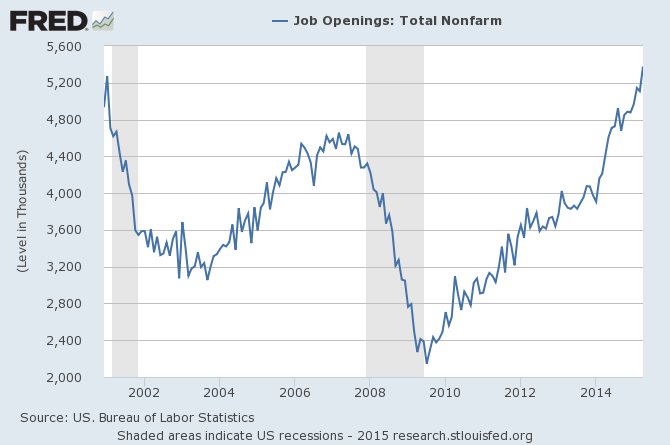

It seems the little noticed Job Openings and Labor Turnover (JOLTS) report this past week have a few believing happy days are here with record high job openings. The authors of the report stated:

Job openings rose to 5.4 million on the last business day of April, the highest point since the series began in December 2000.

Follow up:

There is little question this is a positive event - but this data series has significant backward revision and cannot be relied upon in real time. [Note that it is not timely as it lags the BLS Jobs Situation report by over one month.]

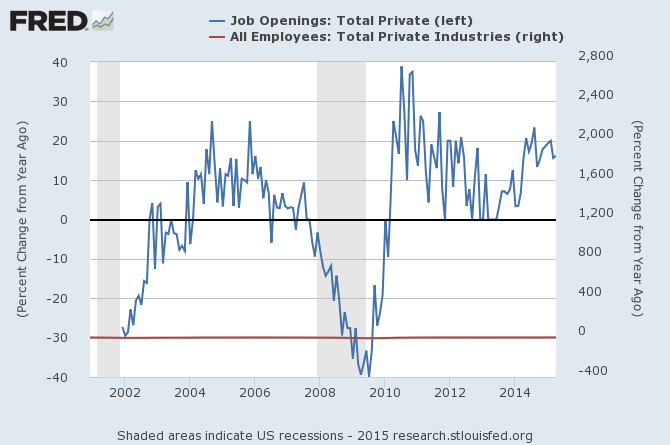

1. Rate of growth of job openings is not in record territory

Looking only at the totals is misleading. What one should be looking at is the rate of growth which is good, not excellent.

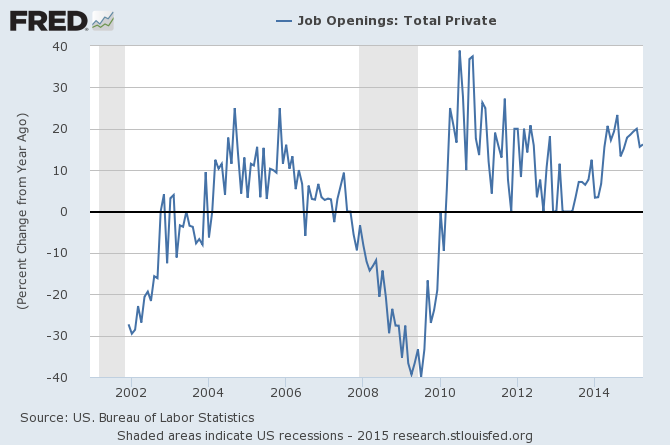

2. There are seasonality issues

Beginning mid-2014, there has been a noticeable divergence recently between the unadjusted and seasonal adjusted data. What this might signify is not clear - the data sets have insufficient history to make comparisons meaningful. The blue line in the graph below is unadjusted, whilst the red line is seasonally adjusted.

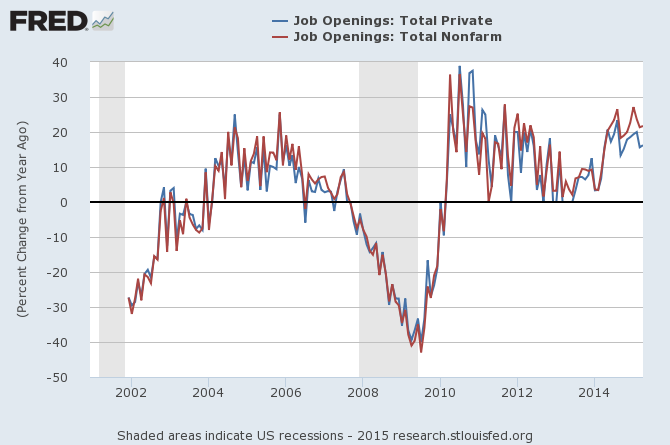

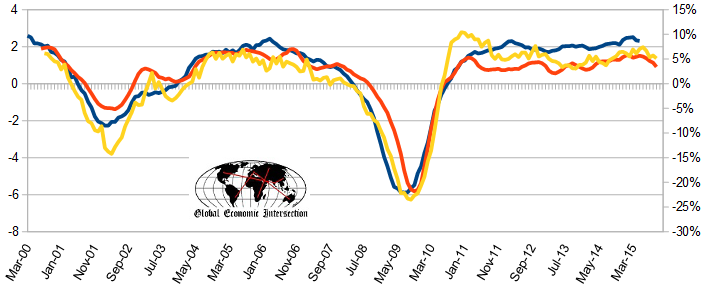

3. There is a loose correlation between JOLTS and jobs growth

In general, when JOLTS rate of job openings grow - the rate of jobs growth grows. The recent peak of JOLTS rate of jobs growth was in August 2014 - and is currently in a downward trend.

4. We have been predicting a decline in the rate of jobs growth

Not only Econintersect, but also the Conference Board has been forecasting a decline in the rate of jobs growth. Of course, the decline being forecast is rather mild - but the methodologies used to forecast are as different as day-and-night. Econintersect does not use jobs data to derive its forecast - but uses non-monetary data points which are not subject to backward revision.

Comparing BLS Non-Farm Employment YoY Improvement (blue line, left axis) with Econintersect Employment Index YoY Improvement (red line, left axis) and The Conference Board ETI YoY Improvement (yellow line, right axis)

Conclusion

Reading too much into a single data set leads to incorrect conclusions. I am rather pleased with the rate of employment growth in spite of the headwinds of global trade (and the slow growth in some global economies and slowing growth in others) and robotics. Historical correlations are problematic as the labor environment continues to change. The JOLTS report is good news, just not excellent news.

Other Economic News this Week:

The Econintersect Economic Index for June 2015 continues to weaken. Most tracked sectors of the economy are relatively soft with most expanding well below rates seen since the end of the Great Recession. When data is this weak, it is not inconceivable that a different methodology could say the data is recessionary. The significant softening of our forecast this month was triggered by marginal declines in many data sets which are dancing closer and closer to zero growth. Please note that most 6 month outlook forecasts are for a marginally improving economy.

The ECRI WLI growth index is now in positive territory but still indicates the economy will have little growth 6 months from today.

Current ECRI WLI Growth Index

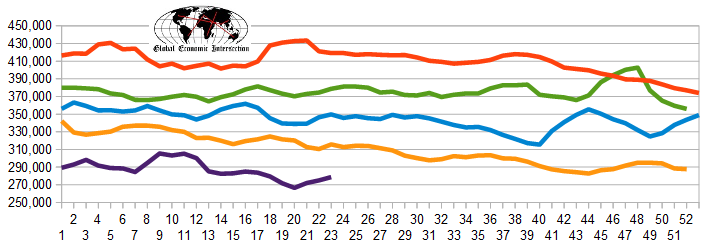

The market was expecting the weekly initial unemployment claims at 270,000 to 280,000 (consensus 275,000) vs the 279,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 275,000 (reported last week as 274,750) to 278,750. The rolling averages have been equal to or under 300,000 for most of the last 7 months.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Privately-held Health Diagnostic Laboratory (aka HDL), Privately-held Boomerang Tube

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: