Hansa Trust (LON:HAN) benefited from the diversification of its portfolio in 2018, with its strategic holding in Brazilian maritime services firm Wilson Sons (WSON) and its defensive allocation to hedge funds helping it to post a small positive NAV return, in contrast to most world equity markets. Fund Manager Alec Letchfield is mindful of the challenges facing the global economy in the year ahead, but remains cautiously optimistic for a more positive investment backdrop. Letchfield has transitioned Hansa Trust to a more dynamic approach over the past five years, and the portfolio is now made up of five principal segments: Ocean Wilsons Holdings (OWHL, which includes the WSON stake); core regional funds; thematic funds; diversifying funds (including hedge funds); and direct global equities. As Hansa Trust and OWHL both trade at a discount to NAV, investors effectively gain exposure to £1.56 of assets for each £1 invested.

Investment Strategy: Diversified And Specialist

Hansa Trust seeks to preserve and grow capital by holding a diversified global portfolio of equities and funds, alongside a long-term strategic investment in Ocean Wilsons Holdings (OWHL), which itself owns a majority stake in Brazilian maritime services company Wilson Sons. Lead manager Alec Letchfield sets the overall allocation and selects the funds, which are largely specialist vehicles (including regional equity, thematic and hedge funds) that individual investors would otherwise be unable or unlikely to own. The direct equity portion is managed by Rob Royle.

Market Outlook: Positives Amid Uncertainty

After a strong year in 2017, buoyed by synchronised global economic growth and ample liquidity, many asset markets saw declines in 2018. While the factors that caused the volatility – US protectionism, monetary tightening, slowing growth and geopolitical worries in the UK and EU – have not entirely abated, any positive developments could cause a ‘relief rally’, particularly given more attractive company valuations. However, given the uncertain outlook, prudent investors may prefer to take a more diversified approach, to limit correlation with equity market returns.

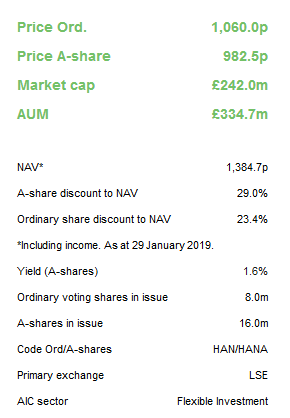

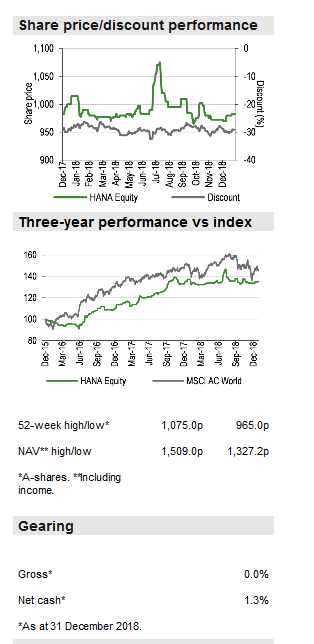

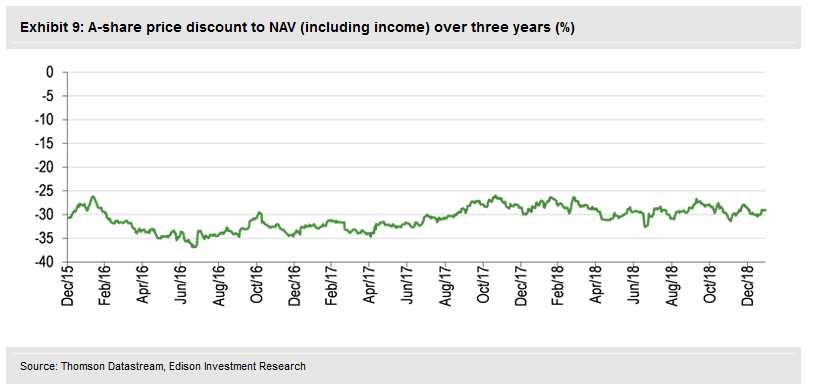

Valuation: Building Awareness To Narrow The Discount

At 30 January, Hansa Trust’s A-shares traded at a 29.0% discount to cum-income NAV, with the ordinary shares at a 23.4% discount. The A-share discount is broadly in line with the one-, three- and five-year averages, although markedly narrower than the 10-year high of 36.9% seen in mid-2016. The board seeks to reduce the discount by raising awareness and understanding of the trust, rather than by undertaking share buybacks, which would reduce the asset base and inflate the size of the OWHL holding as a percentage of total assets. Hansa Trust currently yields 1.6%.

Investment Trusts

Market Outlook: Potential For Positive Surprise?

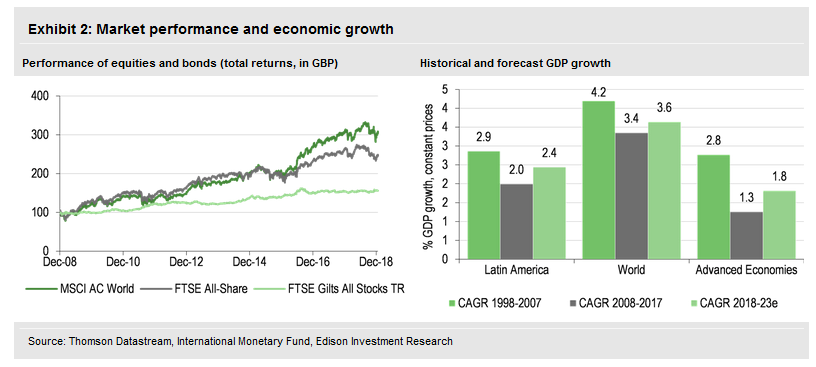

Volatility returned to the world’s stock markets in 2018, after a year in which investor optimism about synchronised global economic growth translated into steady gains for most equity indices. For sterling-based investors, the Brexit-induced weakness of the currency limited losses (in some cases translating into small gains) on overseas assets, but even given UK companies’ high proportion of overseas earnings, the broad FTSE All-Share Index produced a negative total return of 9.5% for the calendar year. As shown in Exhibit 2 (left-hand chart), UK investors have been better served by investing globally over the decade since the global financial crisis, although the majority of gains have come from the US, which now makes up c 50% or more of most global equity indices.

The factors that made investors nervous in 2018 – central bank tightening, slowing global growth (particularly in China), protectionist trade policies emanating from the US, and the geopolitical fallout from the UK’s failure so far to agree an acceptable deal for leaving the European Union – have not gone away. What will, perhaps, define the coming year in asset markets is not just how these themes develop, but how investors choose to react to them. While global GDP growth (right-hand chart) is forecast to slow – the International Monetary Fund has recently revised its 2019 estimate down to 3.5% from 3.7% – the world economy is still growing above the trend of the past 10 years. Advanced economies are forecast to grow by 2.0% in 2019 before slowing in 2020, and emerging markets (4.5% growth forecast for 2019) remain an important engine for the world economy. With the US Federal Reserve signalling a more measured pace of monetary tightening, a ceasefire in Donald Trump’s trade war with the rest of the world, and the possibility that a no-deal Brexit may be avoided, there is potential for equity markets to surprise on the upside, particularly if corporate earnings growth remains positive. However, with so much uncertainty still in the picture, investors may prefer to take a more diversified, multi-asset approach to introduce an element of downside protection.

Fund Profile: Unique Structure With Alignment Of Interest

Hansa Trust began life in 1912 as the Scottish & Mercantile, which was one of several investment companies acquired by the merchant bank Rea Brothers (itself controlled by the Salomon family) in the 1950s. The Salomon family remain majority owners of Hansa Trust’s 8.0m ordinary shares, as well as holding a smaller number of the non-voting A-shares. Hansa Trust is managed by the Salomon family office, Hansa Capital Partners, with Alec Letchfield as lead portfolio manager.

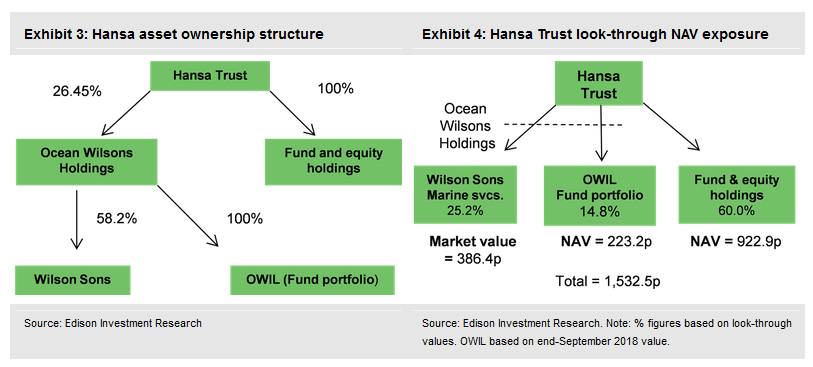

The trust has a somewhat unusual structure (see Exhibit 3), as its largest asset is a c 26% holding in Ocean Wilsons Holdings (OWHL), which was acquired by Rea Brothers in the late 1950s. OWHL (which is listed on the London Stock Exchange) in turn owns a majority stake in Brazilian maritime services company Wilson Sons, which has listings on the Sao Paulo and Luxembourg stock exchanges. OWHL owns a portfolio of funds (Ocean Wilsons Investments, or OWIL), which is also advised by Hansa Capital Partners. Hansa Trust’s asset ownership structure is illustrated in Exhibit 3. Both Hansa Trust and OWHL (as a holding company) trade at a discount to the underlying value of their assets, shown in Exhibit 4. The look-through NAV at 29 January 2019 is c 10.7% higher than Hansa Trust’s reported cum-income NAV.

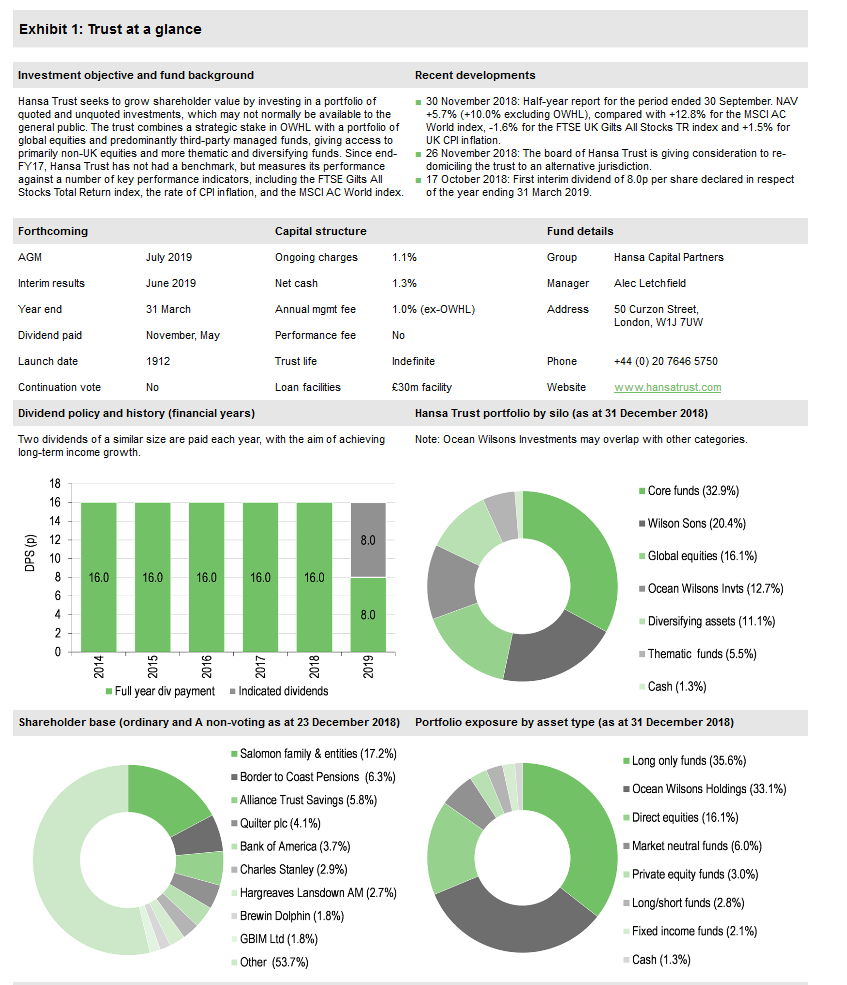

The OWHL investment (including WSON and OWIL) has become a major part of the Hansa Trust portfolio largely as a result of WSON’s strong historical performance, and made up 33.1% of net assets (20.4% WSON and 12.7% OWIL) at 31 December 2018. The balance of the Hansa Trust portfolio is invested in a blend of third-party funds and direct global equities, with the aim of achieving long-term preservation and growth of capital from a spread of investments that individual investors would be unable or unlikely to access. There is a degree of overlap between the OWIL and Hansa Trust fund holdings, although OWIL also has an allocation (of around one-third of its assets) to private equity and private debt funds.

Hansa Trust is a member of the Association of Investment Companies’ (AIC) Flexible Investment sector. It has no benchmark, but measures its performance against a range of key performance indicators (KPIs), including the total returns from UK and global stock markets, UK government bonds, and the annual rate of UK CPI inflation. While the trust has a £30m gearing facility, this remains undrawn.

The fund manager: Alec Letchfield

The manager’s view: Seeking balance in uncertain times

Letchfield notes that after a banner year for markets in 2017, the past year was a rare period in which all asset classes – equities, bonds, real assets and commodities – saw negative returns. While this was “a nightmare scenario for multi-asset investors”, the manager notes that the Hansa Trust portfolio did relatively well in the challenging conditions, posting a positive NAV total return of 0.5% for the year.

The headwinds of 2018 included declining economic growth in most regions except the US, tightening monetary policy after the ultra-loose liquidity conditions that followed the global financial crisis, Donald Trump’s protectionist trade war, and negative geopolitical developments in the European Union, such as the Brexit impasse and the election of an anti-EU coalition government in Italy. While few of these concerns have abated (with the exception of Italy, which did manage to agree a budget that kept within EU fiscal rules), Letchfield believes asset markets could still make progress in 2019, although the best years of the current cycle are almost certainly behind us. Recession is a major cause of bear markets in equities, and Letchfield argues that leading indicators do not yet suggest an economic contraction is imminent. The current global economic expansion, while entering its 10th year, has been relatively lacklustre, and, although employment rates are high in most developed economies, there is no sign yet of real capacity constraints.

The manager sees the biggest risks to the global economy as the effect of slowing growth in China, and the possibility of a misstep in central bank policy. China’s large economy and high growth rate compared with more developed countries have meant it has supplied around one-third of global GDP growth in recent years. Although the Chinese government has proved adept at managing past slowdowns, the addition of punitive US trade tariffs to the mix could make the coming year harder for it to navigate. However, Letchfield believes there is sufficient flexibility in the Chinese economy to avoid a significant deterioration. Meanwhile, central banks seem cognisant of the risk that over-tightening of monetary policy could precipitate a recession, although they equally would not want to enter such a recession with ultra-low interest rates denying them the important lever of rate cuts.

Other signs that have historically pointed to an approaching bear phase include excess and exuberance, but Letchfield argues that – with the possible exception of the credit market, where corporate debt is higher, and the proportion of riskier credit is growing – there is no evidence yet of excess on the scale of the 1990s tech bubble or the 2008 subprime mortgage disaster. The manager says his central scenario is still for positive (although slower) economic growth, reasonably accommodative liquidity conditions, and a continuation of corporate earnings growth. The sell-off in equity markets has meant many now look quite attractively valued on a forward P/E multiple basis. However, the risk of a more negative scenario – with a meaningful slowing in economic growth and/or a significant rise in interest rates and bond yields – means that Letchfield continues to take a balanced approach to investing across regions and asset classes, and may in time add to the defensive portion of Hansa Trust’s portfolio.

Asset Allocation

Investment process: Focus on capital preservation and growth

Since early 2014, Hansa Trust has adopted a more diversified approach, blending higher-risk and more defensive assets to enable it to adapt to changing market conditions. Fund Manager Alec Letchfield – who joined Hansa Capital Partners in late 2013 from HSBC – is a multi-asset specialist, and aims to build a portfolio of assets that individual investors would be unable or unlikely to access by themselves. In addition to the long-term strategic holding in Ocean Wilsons/Wilson Sons, the fund manager has organised the Hansa Trust portfolio into a number of ‘silos’, with a portfolio of direct global equities managed by Rob Royle (who joined from Smith & Williamson in late 2016), a core regional funds allocation, a small number of thematic funds in areas such as healthcare and technology, and a diversifying portfolio including hedge funds. Letchfield seeks to invest with third-party managers who share Hansa Trust’s focus on capital preservation and alignment of interests, including other family offices and boutique fund groups where the founders have invested significant amounts of their own capital.

Asset class and regional allocations across the portfolio are an output of Hansa’s top-down house view, although within each allocation, the investments themselves are selected on a bottom-up basis, using fundamental analysis. Letchfield’s focus on preservation and growth of capital means the overall portfolio is biased towards equities, although the diversifying element – which aims to have a low correlation with equity market returns – contains property and credit specialists alongside the allocation to hedge funds. In the direct equity portfolio, Royle seeks to invest in cash-generative businesses with improving prospects, that are able to invest for long-term growth. Mirroring the approach in the rest of the portfolio, Royle also looks for alignment of interests in the management teams he invests alongside, with average insider ownership in the global equity portfolio at more than 10%. The shared focus on capital preservation is expressed through the view of risk not as volatility but on an absolute basis. Royle seeks to avoid a permanent impairment of capital by investing with a margin of safety.

Portfolio turnover is generally low, although somewhat higher in the global equity portfolio.

Current Portfolio Positioning

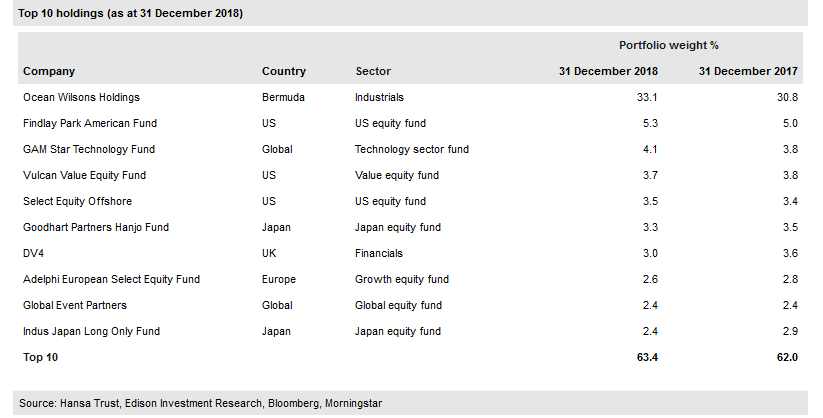

At 31 December 2018, Hansa Trust had 58 holdings, compared with 57 a year earlier. These included 24 direct equity positions, 17 core regional funds, 12 diversifying funds, three thematic funds, the OWIL funds portfolio (which has some overlap with other fund holdings) and the strategic stake in WSON. The top 10 holdings made up 63.4% of the portfolio (30.3% for the top nine excluding OWHL), compared with 61.9% (31.2%) at 31 December 2017.

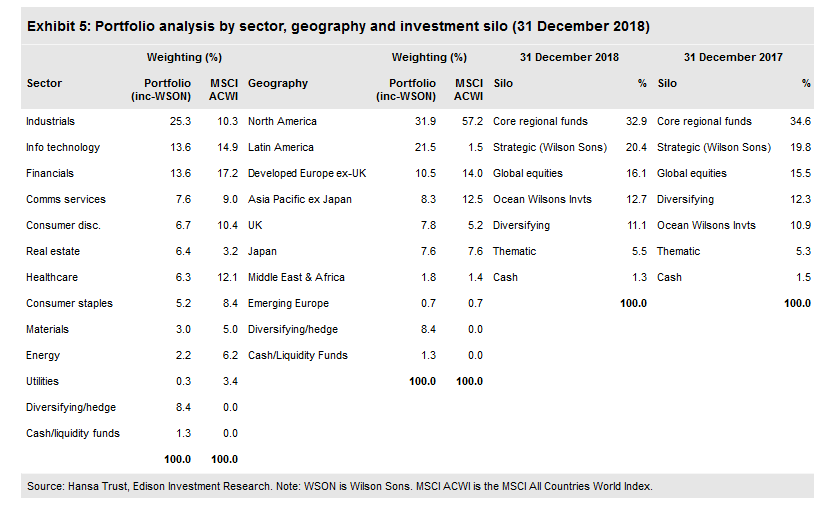

As shown in Exhibit 5, on a look-through basis, the largest sector weighting was in industrials. However, this includes WSON; excluding WSON, the largest weightings were in information technology (including second-largest fund holding GAM Star Technology and a direct holding in Samsung (KS:005930)) and financials, including an MSCI World Financials index-tracking fund and a direct holding in the Warren Buffett vehicle Berkshire Hathaway (NYSE:BRKa). Geographically, the largest exposure was to North America, with holdings including specialist regional fund Findlay Park American and direct equity investments such as Alphabet (NASDAQ:GOOGL) (Google) and TripAdvisor. Because of the large exposure to Latin America (mainly through WSON), Hansa Trust has underweight positions in most regions compared with the MSCI AC World index.

Looking at the silo exposure, OWIL, WSON and global equities all increased in percentage terms over the 12 months to 31 December 2018, while the core regional funds and thematic/diversifying allocations reduced slightly. Cash was broadly stable, at 1.3% compared with 1.5% a year earlier. Hansa Trust now splits out its thematic and diversifying exposures; at 31 December 2018, the diversifying portfolio was 11.1% of net assets and the thematic portion was 5.5%.

In terms of portfolio activity, the thematic part of the portfolio (with sector specialist funds in technology, financials and healthcare) remains unchanged, as does the core regional allocation (although the holdings in two Japan funds have been switched into unhedged yen share classes), illustrating the manager’s long-term, patient approach. In the diversifying portfolio, two new funds have been bought, and two have been sold, while Letchfield has also topped up the holding in discretionary macro fund Hudson Bay International. The position in Field Street Offshore (a global macro hedge fund) was sold after a period of disappointing performance and staff turnover, while JLP Credit Opportunities was exited as Letchfield felt the outlook for stressed credit was poor. New positions were taken in the Apollo Total Return Bond fund and BioPharma Credit (BPCR). The Apollo fund has a dynamic approach and invests in a variety of credit strategies (including direct lending) with the aim of achieving uncorrelated total returns. BPCR is a specialist credit fund that makes loans to biotechnology and healthcare companies, secured on royalty streams from approved drugs. This is a specialist market that is underserved by banks, and BPCR benefits from the innovation of these companies, while remaining uncorrelated with their volatile share prices. The manager says he may add one or two further names to the defensives allocation in the medium term, in expectation of more challenging market conditions.

Letchfield says the global equity portfolio is now in a good position, with Manager Rob Royle having reshaped it since taking responsibility in early 2017. Under the previous manager, John Alexander, it was a UK-focused selection, but now contains a spread of geographies and sectors. Royle remains focused on stock picking and in the past 12 months has been finding opportunities in the unloved telecom sector, with purchases of Orange in France and KT in Korea. Both companies have high free cash flows and growing dividends. Royle believes the market is overlooking any potential improvement in pricing power that may come from consolidation and the implementation of 5G, and as such both companies trade with attractive free cash flow yields of over 10%.

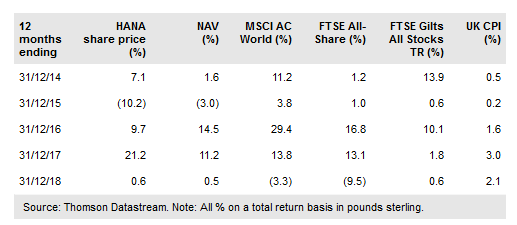

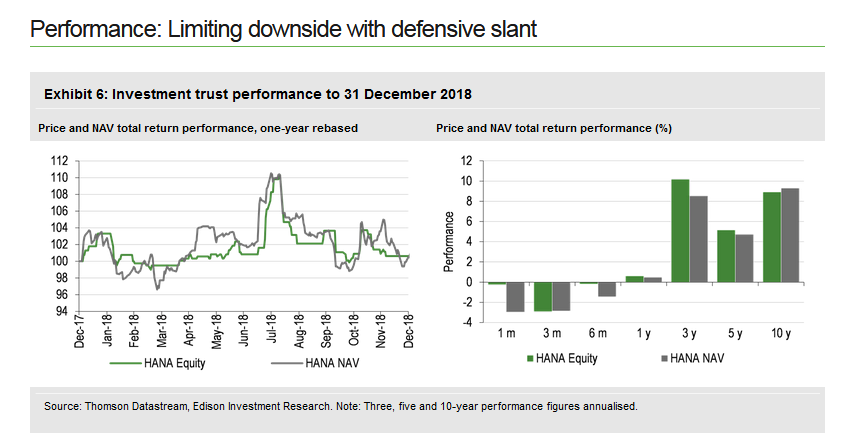

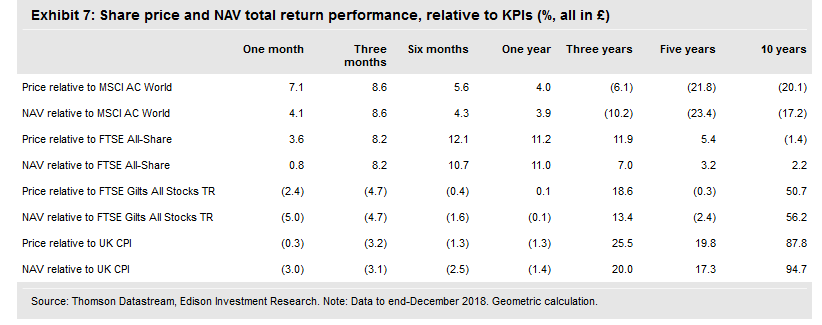

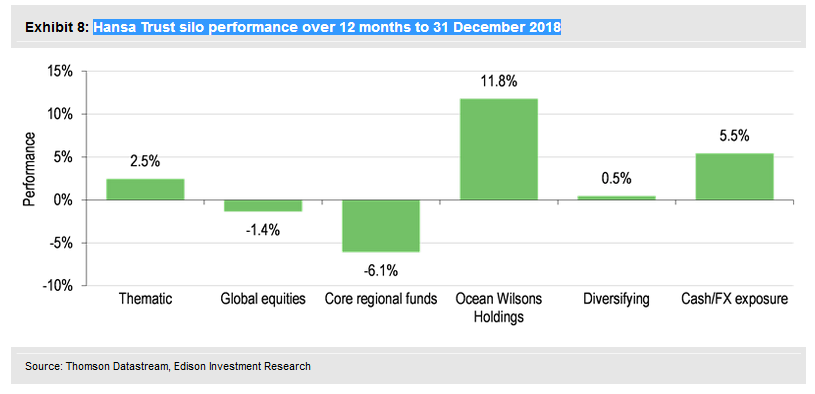

Hansa Trust’s performance was broadly flat in the difficult markets of 2018 (Exhibit 6), ending the year with an NAV total return of 0.5% and an A-share price total return of 0.6%. Longer-term returns have been better, at c 8–10% pa over three and 10 years, and 4–5% pa over five years. The trust has no benchmark, but measures itself against a range of key performance indicators (Exhibit 7). Hansa Trust markedly outperformed UK and global equity indices in 2018, broadly matched the return on UK gilts, and slightly lagged UK inflation. As shown in Exhibit 8, the largest positive contribution in 2018 came from OWHL (the ex-OWHL NAV total return for the year was -2.4%). Investors reassessed Brazilian equities following the election in October of Jair Bolsonaro – seen as market-friendly – as president, and the market reversed its prior declines to post full-year gains in sterling terms. The biggest detractors from Hansa Trust’s performance in 2018 were its Japanese equity funds. However, the diversifying funds portfolio protected against some of the downturn in wider equity markets, and the weakness of sterling also had a beneficial effect on overall returns.

Discount: Trading In Line With Medium-Term Average

At 30 January 2019, Hansa Trust’s A-shares traded at a 29.0% discount to cum-income NAV, while the ordinary shares were at a 23.4% discount. The A-shares’ current discount is broadly in line with both short- and medium-term averages (29.1%, 30.8% and 29.1% over one, three, and five years, respectively), and somewhat wider than the 10-year average of 24.8%. The current discount on the A-shares is in the middle of a relatively tight range over the past 12 months, from a low of 26.3% in March 2018 to a high of 32.6% in July. However, there has been an appreciable narrowing from the 10-year high of 36.9%, reached in July 2016. OWHL also trades at a discount to its underlying assets; taking into account WSON’s share price at 29 January 2019 and the latest reported value of the OWIL portfolio, this gives a look-through discount on Hansa Trust’s A-shares of 35.9%.

Capital Structure And Fees

Hansa Trust is a conventional investment trust with two classes of share. The 16.0m A-shares do not carry voting rights, while the majority of the 8.0m ordinary shares with voting rights are owned by or on behalf of members of the Salomon family. Although the trust has the authority to repurchase up to 14.99% of the A-shares each year in order to manage a discount, in practice this is not used, as buying back shares would reduce the size of the trust and therefore inflate the already large holding in OWHL as a percentage of the portfolio.

Gearing of up to £30m is available via a short-term borrowing facility, which, if fully drawn, would equate to gross gearing of c 9% based on 30 January 2019 net assets. The purpose of the gearing facility, which is currently undrawn, is to give the manager flexibility over the timing of investments, rather than to increase market exposure on a long-term basis.

Hansa Capital Partners is paid an annual management fee of 1.0% of net assets, after deducting the value of the OWHL holding, on which no fee is payable. There is no performance fee, and ongoing charges for FY18 were 1.08%.

Dividend Policy And Record

Hansa Trust pays dividends twice a year, in November and May. For the last five financial years, total dividends of 16.0p have been paid, and this pattern is set to be repeated in FY19 (ending 31 March), with a first interim dividend of 8.0p having been paid in November 2018. The board sets out its expected dividend for the following financial year in each year’s annual results, meaning investors have some certainty over the level of income they will receive.

Dividends have been partly uncovered by income in five of the past six financial years, but Hansa Trust has sizeable revenue and capital reserves from which it can make up any shortfall. It is worth noting that all expenses are currently charged to the revenue account; any change to this policy (many peers divide the allocation of charges in line with the expected split of income and capital returns, for example) would have the effect of boosting the revenue return per share.

Based on the current share prices and the expected dividends for FY19, Hansa Trust’s ordinary shares have a dividend yield of 1.5%, and the A-shares have a yield of 1.6%.

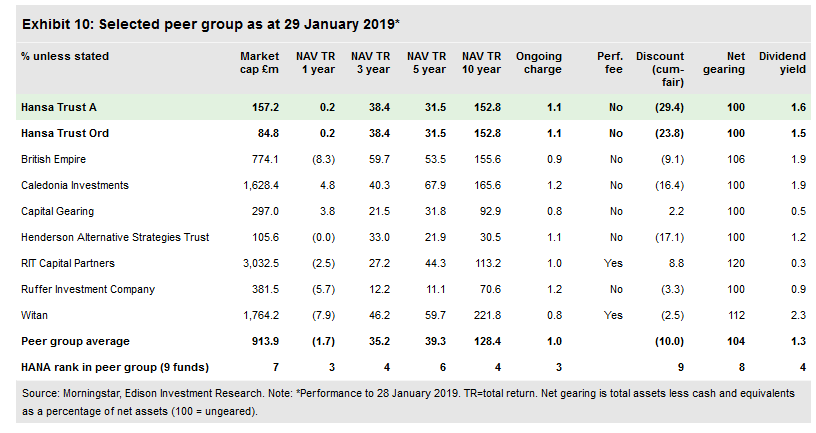

Peer Group Comparison

Formerly a member of the AIC’s Global peer group, Hansa Trust moved to the Flexible Investment sector in 2018. Below in Exhibit 10 we show the group of funds that Hansa Trust’s board and managers see as the most appropriate peers; most are drawn from the Flexible Investment sector, with the exception of British Empire and Witan, which are in the Global sector. While all the funds below follow a more or less multi-asset or fund of funds approach, none is directly comparable to Hansa Trust on account of its unique structure. Hansa Trust’s NAV total returns have been above average over one, three and 10 years, and below average over five years. Ongoing charges are broadly average and, in common with the majority of peers, there is no performance fee. Gearing is a little below average, while the dividend yield is a little above average. In a group where some funds trade at a premium or a very small discount, Hansa Trust is notable for its much wider-than-average discount to NAV.

The Board

Hansa Trust has five directors, four of whom are independent of the manager. The chairman (since 2004), Alex Hammond-Chambers, has served on the board since 2002. Geoffrey Wood was appointed in 1997. Raymond (Lord) Oxford and Jonathan Davie both joined the board in 2013. William Salomon was appointed in 1999 and is deemed non-independent owing to his positions as senior partner of Hansa Capital Partners and deputy chairman of OWHL and WSON. The other directors have professional backgrounds in investment management, academia and the diplomatic service. The board and management of Hansa Trust undertake regular visits to Brazil in order to ensure oversight of the large holding in OWHL/WSON.