Differentiated, long-term fund at a large discount

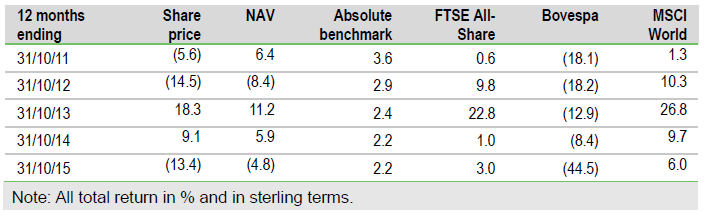

The repositioning of Hansa Trust’s portfolio from April 2014 has had a positive impact on performance, the main change being a reallocation from large-cap UK equity holdings to selected core regional funds. Wilson Sons has outperformed its local market, but the depreciation of the Brazilian real has affected its sterling value and Wilson Sons now constitutes 15% of the portfolio. Hansa (L:HAN) would look to increase uncorrelated investments in due course if it sees the risk/reward balance in equity markets as less attractive. The combination of Hansa’s long-term endowment style of investment and a wide discount to NAV makes for an interesting, differentiated proposition.

Investment strategy: New approach bedded-in

The new investment strategy announced in April 2014 has been in place for some time and the portfolio is allocated to four silos: UK Equity Special Situations (26%); Strategic (Wilson Sons, 15.1%); Eclectic & Diversifying (24.8%) and Core Regional (31.9%). The approach is still long-term and fundamentally based with a disciplined valuation framework to help determine strategic asset class allocation. Tactical adjustments may be made reflecting views on the market’s cyclical position. A significant proportion of the portfolio is invested in liquid securities or funds allowing the manager to act quickly should opportunities arise.

To Read the Entire Report Please Click on the pdf File Below