Hambledon Mining, (HMBGF) produced 12,673oz Au in H113, generating revenue of US$20m, at C1 cash costs US$1,055/oz. Hambledon’s net loss for H113 was US$2.3m. While 95% of gold production came from ageing open-pit operations, the newly reinstated Sekisovskoye underground mine produced 690oz at a grade of 4.04g/t Au in June and 1,187oz Au in August. The average gold grade for H113 (effectively the open pit recovered grade) was 1.45g/t Au (12% higher than FY12) at an improved gold recovery of 82.8% (5.3% higher than FY12).

Now under new management, Hambledon seeks to revitalise its investment case for Sekisovskoye by ramping-up its underground operations, and, in doing so, remove a significant amount of meteorological risk. This will allow for mining away from the extremes of Kazakh weather. Underground production also has the added benefit of greater mining flexibility and waste control, factors that have hindered the company’s open-pit operations in recent years. The open pit is expected to close in mid-2015, when all production will be from underground.

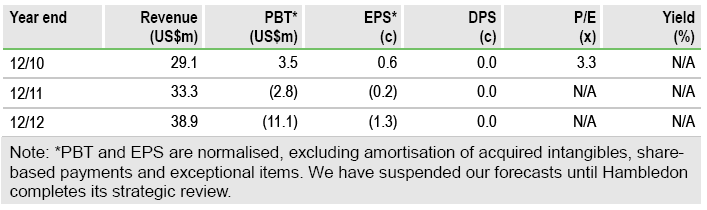

We await Hambledon’s announcement (date TBC) of a revised corporate strategy, allowing for accurate forecasts over life-of-mine to be established, greater clarity on costs and capex requirements, and thus a revision of our base case valuation. We note that in H113 Hambledon spent US$6.2m on G&A, US$3.7m on capex and holds a provision of US$10.4m for fines (US$9.4m) and costs (US$1m) related to the TD3 tailing dam leak of 2011. We also note that as at 30 June 2013 Hambledon is in breach of its debt/equity covenant – one of the stipulations of its US$10m EBRD loan agreement of 2012. While Hambledon is confident of its ability to repay this loan if ordered by the EBRD, current market conditions to raise mine capital could pose a risk to its continuing as a going concern.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Hambledon Mining: Seeks To Revitalise Its Investment Case

Published 09/24/2013, 01:19 AM

Updated 07/09/2023, 06:31 AM

Hambledon Mining: Seeks To Revitalise Its Investment Case

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.