Alpharetta, GA-based Halyard Health (NYSE:HYH) , a leading medical technology company, recently announced a new license and supply agreement with Sustainable Solutions. The license agreement is aimed at converting recycled HALYARD Wrap into an environment friendly product for healthcare facilities. Per management, this is a major step in the medical space to reduce carbon footprint while treatment.

The development also marks an extension of the company’s BLUE RENEW Wrap Recycling Program. Notably, BLUE RENEW is an exclusive step-by-step program designed by Halyard Health to recycle sterilization wraps in the operating rooms.

The latest development closely follows the company’s recent announcement of availability of the Halyard Enteral Drainage System, which marks a significant addition to its comprehensive portfolio of enteral feeding products (Read more: Halyard Health Announces New Drainage System, Stock Down).

Getting back to the deal, Sustainable Solutions will collect and recycle HALYARD Wrap waste from customers and convert the material into sustainable hospital products, including distribution and product totes, garbage cans, bedpans and washbasins. These products are presented for direct purchase through Sustainable Solutions.

The program is expected to elongate the lifespan of single-use wraps, allowing healthcare facilities to recycle more than 30 million pounds of annual wrap waste.

Share Price & Estimate Revision

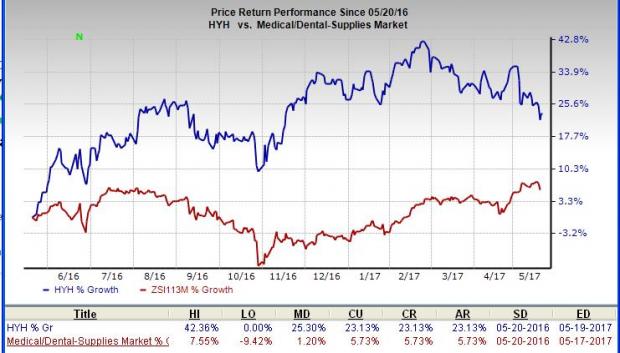

Shares of Halyard Health have inched 1.1% down to close at $35.92, following the news release. However, the company has had a promising run on the bourse over the last one year.

Halyard Health has gained roughly 23.1%, comparing favorably with the Zacks categorized Medical/Dental sub-industry’s addition of almost 5.7%. Furthermore, a long-term expected earnings growth rate of 7.7% instills confidence in investors.

The estimate revision for the stock has been unfavorable. The current quarter has seen three estimates move south over the last two months, compared to no movement in the opposite direction. As a result, earnings estimates for the current quarter have declined by 4 cents to 39 cents over the same time frame.

Halyard Health carries a Zacks Rank #3 (Hold).

Key Picks

Some better-ranked stocks in the broader medical sector include Luminex Corporation (NASDAQ:LMNX) , Hologic, Inc. (NASDAQ:HOLX) and Inogen Inc (NASDAQ:INGN) . Notably, Inogen and Luminex sport a Zacks Rank #1 (Strong Buy), while Hologic carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Inogen promises a long-term adjusted earnings growth of almost 17.5%. The stock returned 81.5% over the last one year.

Luminex has an expected long-term adjusted earnings growth of almost 16.3%. The stock added roughly 6.4% over the last three months.

Hologic has a long-term expected earnings growth rate of 11.33%. The stock has a solid one-year return of roughly 29.2%.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Hologic, Inc. (HOLX): Free Stock Analysis Report

Luminex Corporation (LMNX): Free Stock Analysis Report

Inogen, Inc (INGN): Free Stock Analysis Report

Halyard Health, Inc. (HYH): Free Stock Analysis Report

Original post