On Jul 8, 2016, Zacks Investment Research upgraded Halyard Health Inc (NYSE:HYH) to a Zacks Rank #1 (Strong Buy).

Why the Upgrade?

Halyard’s expanding product pipeline is the primary reason behind the upgrade. The company expects to launch 10 new products across Surgical and Infection Prevention (S&IP) and Medical Devices segments in the near future.

Moreover, positive outlook on ON-Q painbuster pumps and COOLIEF interventional pain solution product lines are expected to drive top-line growth.

Meanwhile the acquisition of CORPAK Medsystems is a significant addition to Halyard’s product portfolio. CORPAK develops, manufactures and markets a broad portfolio of enteral access devices. The company reported sales of $54 million in full-year 2015.

CORPAK’s nasogastric tubes are complementary to Halyard's existing enteral feeding products. The combination will help Halyard to offer a complete enteral feeding solution for the patients and caregivers. The company recently noted that the integration of CORPAK is on track.

The takeover will boost Halyard’s full-year 2016 bottom line by a nickel. The company forecasts adjusted earnings in the range of $1.50 to $1.70 per share. For full-year 2017, the acquisition is expected to be accretive by 15 cents.

Further, Halyard has been reporting consistent earnings results. Notably, the company’s earnings have beaten the Zacks Consensus Estimate in three of the last four quarters, with an average positive surprise of 18.63%.

Estimate Revisions

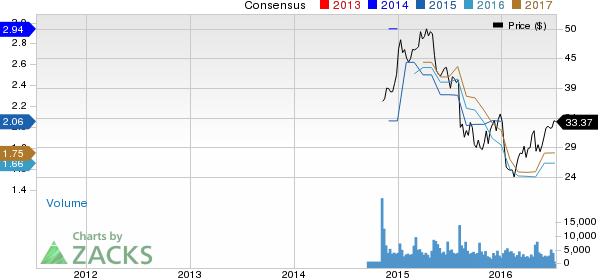

The Zacks Consensus Estimate for fiscal 2016 increased couple of cents to $1.66 per share over the last 60 days. Similarly, for fiscal 2017, estimates increased 3 cents to $1.75 per share over the same time frame.

Other Stocks to Consider

One may also consider some other players in the industry that look attractive at current levels. These include Derma Sciences (NASDAQ:DSCI) , ICU Medical (NASDAQ:ICUI) and Nxstage Medical (NASDAQ:NXTM) . All the three stocks carry the same Zacks Rank as Halyard.

NXSTAGE MEDICAL (NXTM): Free Stock Analysis Report

ICU MEDICAL INC (ICUI): Free Stock Analysis Report

DERMA SCIENCES (DSCI): Free Stock Analysis Report

HALYARD HEALTH (HYH): Free Stock Analysis Report

Original post