Halliburton Company (HAL) reports preliminary financial results for the quarter ended December 31, 2014.

Amidst a sharp fall in oil prices and roiling oil markets, oil services company Halliburton announced strong quarterly earnings on Tuesday, January 20, 2015, with solid Q4 revenue of $8.8 B, up 15 percent compared to the same quarter last year. Net earnings at $900 million were also strong, an increase from $770 million Q4 2013.

Despite this strong Q4 performance, oil market fundamentals have changed substantially with the recent plunge in oil prices. Halliburton, which assists drilling firms in setting up oil wells, expects operators to cut capital expenditures, resulting in lower revenue from reduced activity and pricing cuts. If the price of oil stays lower for a sustained period of time, the company will have a difficult time staying ahead of the curve by cutting costs, resulting in lower or negative revenue growth.

Halliburton has announced a merger with Baker Hughes Incorporated (BHI), one of the top oil service companies in the world, which will result in a company to rival Schlumberger in size.

This earnings release follows the earnings announcements from the following peers of Halliburton Company – Schlumberger NV and Baker Hughes Incorporated (SLB-US and BHI-US).

Highlights

- Summary numbers: Revenues of USD 8.770 B, Net Earnings of $900 million, and Earnings per Share (EPS) of $1.06.

- Change in operating cash flow of -39.5 percent compared to same quarter last year trailed change in earnings,

- Earnings potentially benefiting from some unlocking of accruals.

- Earnings growth partially due to contribution of one-time items.

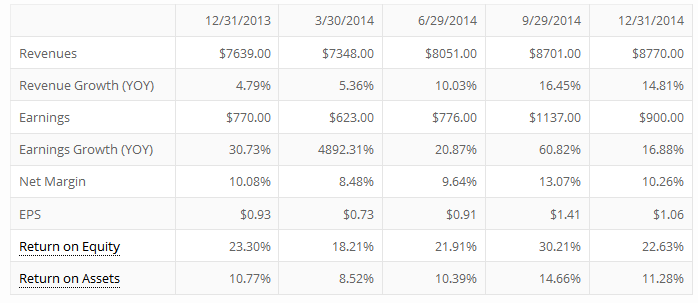

The table below shows the preliminary results and recent trends for key metrics such as revenues and net income growth:

Market Share Versus Profits

Companies sometimes focus on market share at the expense of profits or earnings growth.

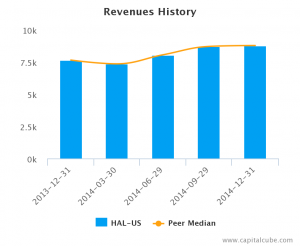

Revenues Trend

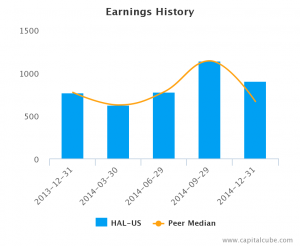

Earnings Trend

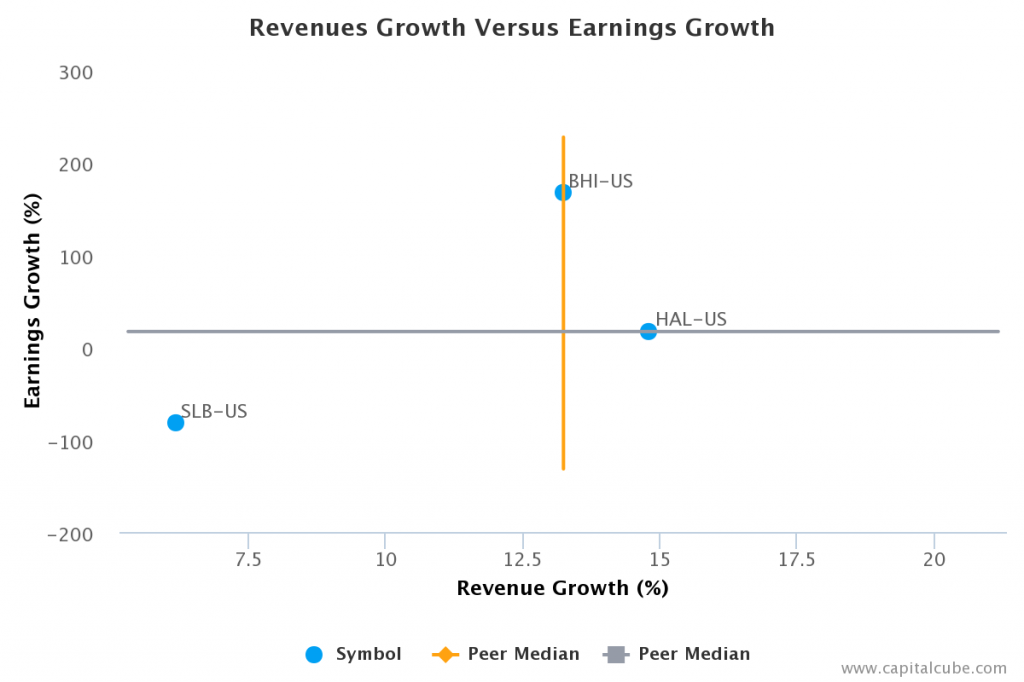

Compared to the same quarter last year, Halliburton’s change in revenue trailed its change in earnings, which was 16.9 percent. The company's performance this period suggests a focus on boosting bottom-line earnings. It is important to note that the quarterly change in revenue was among the highest in the peer group thus far. Also, for comparison purposes, revenue changed by 0.8 percent and earnings by -20.8 percent compared to the quarter ended September 30, 2014.

Revenues vs Earnings

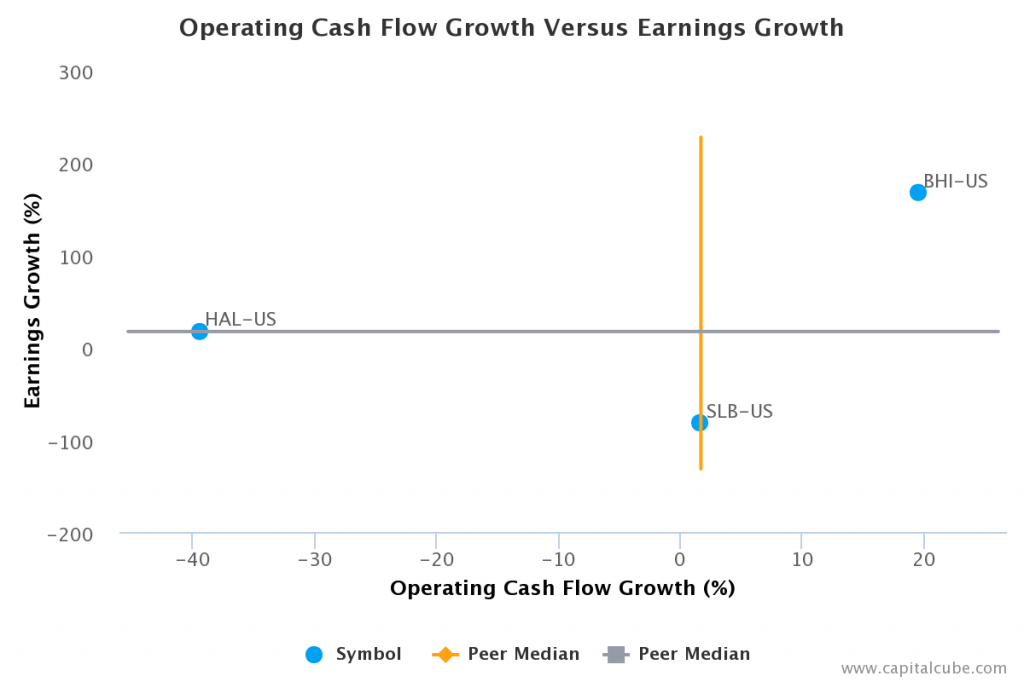

Cash Versus Earnings – Sustainable Performance?

Halliburton’s year-on-year change in operating cash flow of -39.5 percent trailed its change in earnings. This leads CapitalCube to question whether the earnings number might have been achieved from some unlocking of accruals. On a positive note, the increase in operating cash flow was better than the average announced thus far by its peer group.

Operating Cash Flow Growth vs Earnings Growth

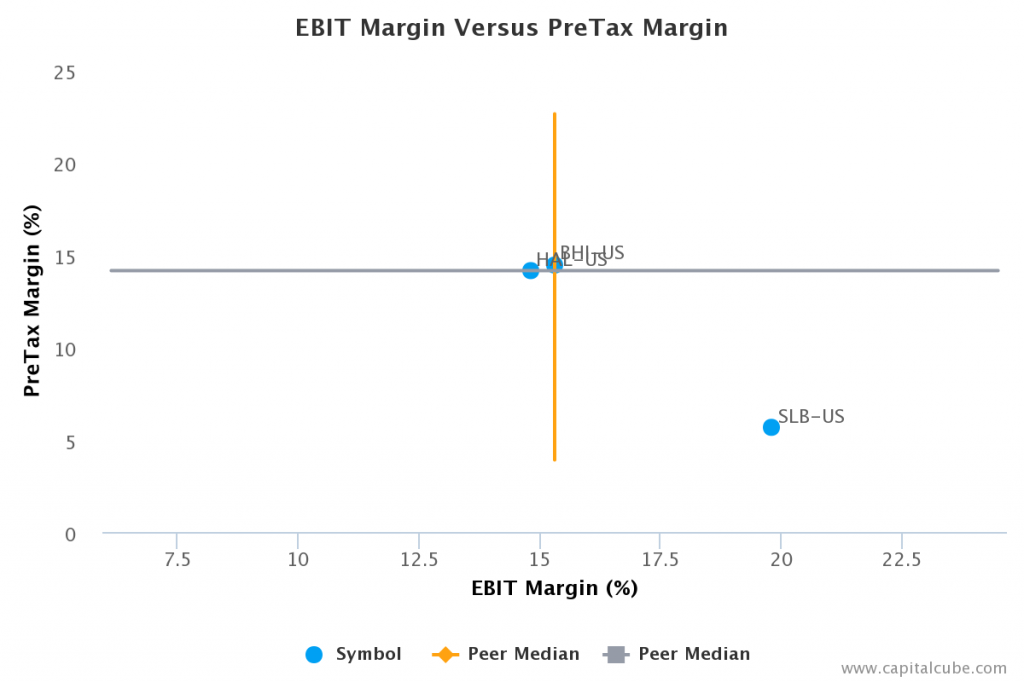

Margins

The company's operating (EBIT) margins contracted from from 15.5 percent to 14.8 percent. In spite of this, the company's earnings rose. This was influenced primarily by one-time items, which improved pretax margins from 13.6 percent to 14.1 percent.

EBIT Margin vs Pretax Margin

Company Profile

Halliburton Co. provides services and products to the energy industry related to the exploration, development, and production of oil and natural gas. The company operates through two segments: Completion & Production and Drilling & Evaluation. The Completion & Production segment delivers cementing, stimulation, intervention, pressure control, specialty chemicals, artificial lift, and completion services. This segment consists of Halliburton production enhancement, cementing, completion tools, boots & coots, multi-chem and artificial lift. The Drilling & Evaluation segment provides field and reservoir modeling, drilling, evaluation, and wellbore placement solutions that enable customers to model, measure, and optimize their well construction activities. This segment consists of Halliburton drill bits and services, wireline and perforating, testing and subsea, baroid, sperry drilling, landmark software and services, and Halliburton consulting and project management. The company was founded by Erle P. Halliburton in 1919 and is headquartered in Houston, TX.

Disclosure: CapitalCube does not own any shares in the stocks mentioned and focuses solely on providing unique fundamental research and analysis on approximately 50,000 stocks and ETFs globally.