It has been about a month since the last earnings report for Halliburton Company (NYSE:HAL) . Shares have lost about 14.7% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Second-Quarter 2017 Results

Halliburton reported better-than-expected second quarter profit thanks to improved utilization and pricing gains in North America.

Halliburton’s adjusted income per share from continuing operation (excluding special items) came in at $0.23, above the Zacks Consensus Estimate of $0.19 – the twelfth consecutive quarterly outperformance. Moreover, revenues of $4,957 million missed the Zacks Consensus Estimate of $4,844 million.

North American Market Continues to Gather Strength

Along the results, Halliburton also sounded optimistic in its view that the North American land market is improving rapidly, driven by increased utilization and pricing - particularly for pressure pumping. As it is, rig counts have generally been rising during the last year since plunging to an all-time low of 404 in May 2016, with the addition of a flood of new units. As a proof of the recovery, Halliburton grew its domestic land revenue by nearly 25% sequentially, ahead of the U.S. land rig count growth of 21%.

Additionally, the international market seems to have bottomed out, with regional sales rising 7% from the first quarter on heightened Latin American activity, together with increased well completion and drilling services in Europe and Africa. However, pricing pressure continued with the slowdown in Middle East stimulation services.

Segmental Performance

Operating income from the Completion and Production segment was $397 million, turning around from the year-ago loss of $32 million and the previous quarter’s income of $147 million, helped by strong pressure pumping activity and improved pricing in the U.S. land market.

But Halliburton’s Drilling and Evaluation unit profit dropped – from $154 million in the second quarter of 2016 to $125 million this year and was only marginally ahead of the $122 million earned in the Mar quarter. The setback was on account of pricing pressure, partly offset by higher drilling activity in Mexico, Venezuela, and Colombia, a seasonal rebound in the North Sea and Russia, plus increased fluid services in Asia Pacific.

Balance Sheet

Halliburton’s capital expenditure in the second quarter was $327 million.

As of Jun 31, 2017, the company had approximately $2,139 million in cash/cash equivalents and $10,816 million in long-term debt, representing a debt-to-capitalization ratio of 54.7%.

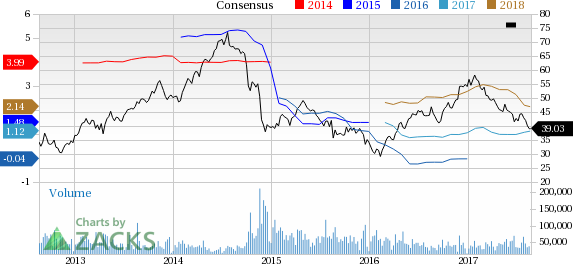

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed an upward trend in fresh estimates. There have been six revisions higher for the current quarter. While looking back an additional 30 days, we can see even more upward momentum. There have been eight moves up in the last two months. In the past month, the consensus estimate has shifted by 7.4% due to these changes.

VGM Scores

At this time, Halliburton's stock has a poor Growth Score of F, however its Momentum is doing a lot better with a B. However, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of F. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for Momentum based on our styles scores.

Outlook

Estimates have been trending upward for the stock. The magnitude of these revisions also looks promising. Notably, the stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

(NOTE: We have reissued this article to correct an error. The original version, published earlier today, August 24, 2017, should no longer be relied upon.)

Halliburton Company (HAL): Free Stock Analysis Report

Original post

Zacks Investment Research