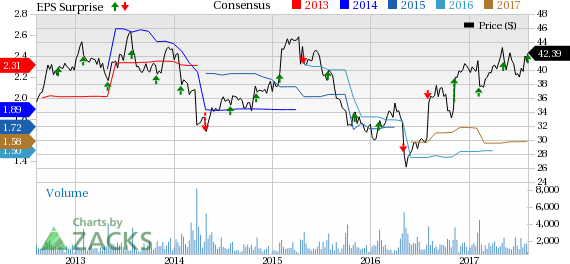

Haemonetics Corporation (NYSE:HAE) reported adjusted earnings per share (EPS) of 33 cents in the first quarter of fiscal 2018, up 32% year over year. The figure also beat the Zacks Consensus Estimate of 31 cents.

On a reported basis, Haemonetics posted net income of $20.1 million or 38 cents per share, as against the year-ago quarter’s net loss of $10.3 million or a loss of 20 cents.

Total Revenue

Revenues inched up 0.5% year over year (up 1% at constant exchange rate or CER) to $210.9 million in the reported quarter but missed the Zacks Consensus Estimate of $214 million.

Per management, within the Hospital business, cell salvage and transfusion management revenues increased 2% at CER year over year as the decline at OrthoPAT and Cell Saver decline was more than offset by growth in BloodTrack and other hospital software products.

Geographically, in the reported quarter, Haemonetics witnessed a 4.3% year-over-year (same at CER) fall in revenues in North America to $130.1 million. Also, international revenues declined 5.2% (down 3.7% at CER) to $79.9 million.

Revenues by Product Categories

Haemonetics reports operating results under four business franchises: Plasma, Haemostasis Management, Cell Processing and Blood Center.

At Plasma, reported revenues of $101.5 million (48.1% of total revenues) were up 4% year over year (up 4.3% at CER).

Revenues at BloodCenter (31.1% of total revenue) declined 7.6% (down 7.1% at CER) to $101.5 million.

Hemostasis Management franchise revenues (8.3% of total revenue) rose 14.8% (up 16.7% at CER) to $17.5 million. Revenues from Cell Processing inched up only 1% (up 1.5% at CER) to $26.3 million (12.5% of total revenue).

Margins

Haemonetics’ first-quarter gross margin was 43.5%, up 10 basis points (bps) year over year on a 0.7% uptick in gross profit.

Operating income was $16.6 million in the first quarter of fiscal 2018, as against operating loss of $7.9 million in the year-ago quarter.

Financial Position

Haemonetics exited the first quarter of fiscal 2018 with cash and cash equivalents of $171.7 million, compared with $139.6 million at the end of the preceding year. The company's long-term obligations (excluding current portion) were $237.2 million in the reported quarter, down from $253.6 million at the end of the fourth quarter of fiscal 2017. Haemonetics generated operating cash flow of $38.4 million at the end of the first quarter of fiscal 2018, compared with $30.7 million in the year-ago quarter. At the end of the first quarter of fiscal 2018, the company reported free cash flow (before transformation and restructuring costs) of $28.9 million, compared with $15.8 million in the year ago quarter.

Fiscal 2018 Guidance

Haemonetics reaffirmed its fiscal 2018 guidance. The company still expects full-year revenues to be in line with fiscal 2017 revenues. The guidance for Plasma revenue growth is in the range of 3% to 5%, inclusive of the SEBRA divestiture which represented 1.4% of annual Plasma revenues. The Zacks Consensus Estimate for 2018 sales is pegged at $891.6 million.

The company also expects 2018 adjusted EPS in the band of $1.55–$1.65. The Zacks Consensus Estimate of $1.59 is within the guided range.

Management continues to expect strong cash generating activity in fiscal 2018 with $140 million of cash on hand to fund business activities.

Our Take

Haemonetics exited first-quarter fiscal 2018 on a mixed note, with earnings beating the Zacks Consensus Estimate and revenues missing the same. Despite the encouraging growth in the Plasma and Haemonetics Management franchises, the underperformance at the other franchise was quite a dampener.

Meanwhile, the company’s strong cash position boosts investors’ confidence. The year-over-year increase in reported sales and gross margin buoys optimism. The company is also optimistic about strong market adoption of its NexSys PCS plasmapheresis system which recently received FDA approval. Further, the company’s reaffirmed guidance for fiscal 2018 is encouraging.

Zacks Rank & Key Picks

Haemonetics has a Zacks Rank #3 (Hold). A few better-ranked medical stocks are Edwards Lifesciences Corporation (NYSE:EW) , INSYS Therapeutics, Inc. (NASDAQ:INSY) and Align Technology, Inc. (NASDAQ:ALGN) . Notably, Edwards Lifesciences, INSYS Therapeutics and Align Technology sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

INSYS Therapeutics has a long-term expected earnings growth rate of 20%. The stock posted a stellar four-quarter average earnings surprise of 60.7%.

Align Technology has an expected long-term adjusted earnings growth of almost 26.6%. The stock has added roughly 25.9% over the last three months.

Edwards Lifesciences has a long-term expected earnings growth rate of 15.2%. The stock has gained around 5.9% over the last three months.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Haemonetics Corporation (HAE): Free Stock Analysis Report

Insys Therapeutics, Inc. (INSY): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Original post

Zacks Investment Research