GW Pharmaceuticals (GWP.LSE) plans to raise up to US$40m via an IPO on the US NASDAQ exchange. This will allow GW to accelerate its R&D pipeline and comes as Sativex advances in the US for cancer pain (Phase III data mid 2014) and MS spasticity (Phase III start H114). The negative Sativex pricing decision in Germany, while clearly a setback in Europe, could be resolved. Our pre-money DCF valuation of £165m ($254m) could rise to £200m ($308m) with Sativex approval for cancer pain. The R&D pipeline and US opportunity for Sativex in MS spasticity offer pure upside.

Step forward in the US…

In the context of a buoyant US market for biotech and increased US acceptance (public, political, regulatory) of cannabinoid therapies, we see three elements to the strategic rationale for the US listing and financing: (1) accelerating the R&D pipeline; (2) supporting ongoing Sativex Phase III studies in the initial target indication of cancer pain, and (3) pursuing MS spasticity as a follow-on indication in the US.

… Mitigates stumble in the EU

The commercial prospects for Sativex in Germany, Europe’s largest pharmaceutical market, are in limbo following a negative pricing decision for MS spasticity under the country’s new AMNOG system. Almirall has three potential routes forward: (1) appeal the decision, (2) withdraw Sativex and re-launch following cancer pain approval, or (3) legal action. While we see potential for resolution, the path and timeline is difficult to call; pending clarity, we remove Germany from our model.

Financials: Revised Sativex forecasts

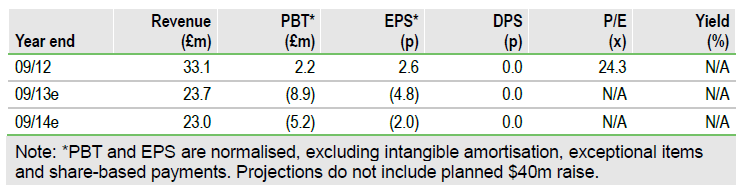

Key changes to our model include revised Sativex sales in MS spasticity (£49m peak in-market sales), fine tuning of cancer pain forecasts (£380m peak), inclusion of new milestones ($5m for starting US Phase III in MS Spasticity), increased opex (£8-10m annual R&D spend), and increased tax credits (£2.5m annually) that translate into cash. We stress that our model excludes the potential $40m fund-raising, as the net amount and number of shares are yet to be determined.

Valuation: DCF valuation of £165m ($254m)

We value GW Pharma at £165m ($255m), or 124p (US$1.90) per share, based on a DCF analysis. Our valuation includes Sativex for MS spasticity and cancer pain (65% probability of success) and projected end-FY13 cash (£19.9m). Unwinding our risk adjustment for cancer pain increases the valuation to £200m ($308m). We currently exclude the US opportunity for Sativex in MS spasticity and the entire R&D pipeline – these represent pure upside to our DCF valuation.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

GW Pharmaceuticals: Step Forward In The US…

Published 04/15/2013, 07:45 AM

Updated 07/09/2023, 06:31 AM

GW Pharmaceuticals: Step Forward In The US…

Grass is greener

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.