Steps forward in MS spasticity

The commercial prospects for Sativex in MS spasticity have improved in the US and EU. Partner Almirall has resolved the German pricing issue and achieved acceptable reimbursement in Europe’s largest MS market. In the US, the opening of an IND paves the way for a pivotal Phase III study starting H214. Including these opportunities increases our Sativex peak sales by £93m to £512m ($820m). Our valuation rises to £236m ($378m).

A step forward in the EU: German pricing agreement

A step forward in the EU: German pricing agreement

In March 2013 the German state insurers (GKV-SV) set a reimbursed price for Sativex in multiple sclerosis (MS) spasticity c 60% lower than other launched EU territories. Partner Almirall and GKV-SV have now agreed a commercially acceptable (but undisclosed) price. This early (and amicable) resolution avoids a further cost-benefit review and potential legal action. Moreover, Germany represents the largest EU market opportunity for Sativex, as evidenced by solid patient uptake (c 4,000 prescribed the drug) since its launch in 2011.

A step forward in US: Edging closer to Phase III start

GW has applied to the FDA (IND application) to undertake US Phase III development of Sativex for MS spasticity. Pending FDA feedback, GW plans to initiate a single pivotal study in H214, employing a ‘randomised withdrawal’ design similar to the positive Phase III trial that secured EU approval. As such, GW is likely to seek FDA agreement (Special Protocol Assessment) on the Phase III design, endpoints and planned statistical analysis. As with the ongoing cancer pain Phase III studies, US partner Otsuka is funding all US clinical costs in MS spasticity.

Forecasts: Increasing MS spasticity projections

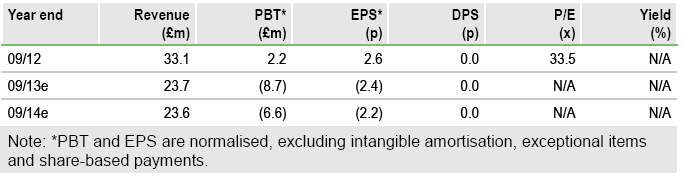

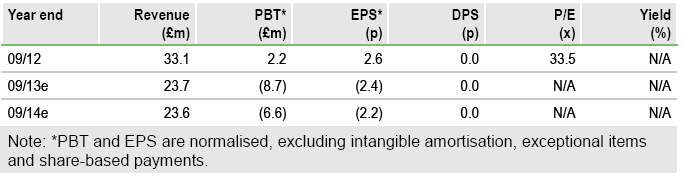

Our updated model reintroduces German Sativex sales projections (removed in April pending pricing resolution) and includes new US forecasts for Sativex in MS spasticity. While FY13 estimates are unchanged, our FY14 revenues rise to £23.6m (prior £23.0m) and pre-tax loss increases to £6.6m (prior £5.3m). Inclusion of Germany increases peak (ex-US) sales in MS spasticity by £12.5m to £63.8m. In the US, we see an FY18 launch and in-market sales of £110m by FY22.

Valuation: DCF rises to £236m

Our DCF valuation rises by £57m to £236m ($378m), which equates to 133p/share or $25.50/ADR. Our valuation comprises Sativex for MS spasticity (65% probability of success in the US) and cancer pain (65% probability) plus projected end-FY13 cash (£37.2m). The five R&D programmes currently offer pure upside to our DCF.

To Read the Entire Report Please Click on the pdf File Below.

The commercial prospects for Sativex in MS spasticity have improved in the US and EU. Partner Almirall has resolved the German pricing issue and achieved acceptable reimbursement in Europe’s largest MS market. In the US, the opening of an IND paves the way for a pivotal Phase III study starting H214. Including these opportunities increases our Sativex peak sales by £93m to £512m ($820m). Our valuation rises to £236m ($378m).

A step forward in the EU: German pricing agreement

A step forward in the EU: German pricing agreementIn March 2013 the German state insurers (GKV-SV) set a reimbursed price for Sativex in multiple sclerosis (MS) spasticity c 60% lower than other launched EU territories. Partner Almirall and GKV-SV have now agreed a commercially acceptable (but undisclosed) price. This early (and amicable) resolution avoids a further cost-benefit review and potential legal action. Moreover, Germany represents the largest EU market opportunity for Sativex, as evidenced by solid patient uptake (c 4,000 prescribed the drug) since its launch in 2011.

A step forward in US: Edging closer to Phase III start

GW has applied to the FDA (IND application) to undertake US Phase III development of Sativex for MS spasticity. Pending FDA feedback, GW plans to initiate a single pivotal study in H214, employing a ‘randomised withdrawal’ design similar to the positive Phase III trial that secured EU approval. As such, GW is likely to seek FDA agreement (Special Protocol Assessment) on the Phase III design, endpoints and planned statistical analysis. As with the ongoing cancer pain Phase III studies, US partner Otsuka is funding all US clinical costs in MS spasticity.

Forecasts: Increasing MS spasticity projections

Our updated model reintroduces German Sativex sales projections (removed in April pending pricing resolution) and includes new US forecasts for Sativex in MS spasticity. While FY13 estimates are unchanged, our FY14 revenues rise to £23.6m (prior £23.0m) and pre-tax loss increases to £6.6m (prior £5.3m). Inclusion of Germany increases peak (ex-US) sales in MS spasticity by £12.5m to £63.8m. In the US, we see an FY18 launch and in-market sales of £110m by FY22.

Valuation: DCF rises to £236m

Our DCF valuation rises by £57m to £236m ($378m), which equates to 133p/share or $25.50/ADR. Our valuation comprises Sativex for MS spasticity (65% probability of success in the US) and cancer pain (65% probability) plus projected end-FY13 cash (£37.2m). The five R&D programmes currently offer pure upside to our DCF.

To Read the Entire Report Please Click on the pdf File Below.