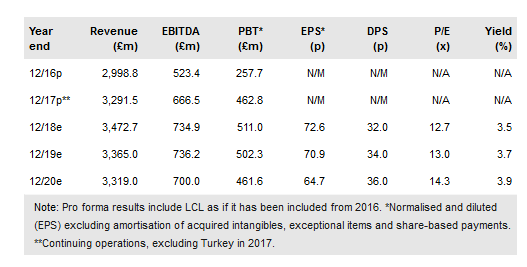

The Budget has provided long-awaited clarity on a number of gaming-related issues. The implementation of the £2 FOBT stake reduction will begin in October 2019, at the same time as a 600bp increase in remote gaming duty (RGD), from 15% to 21%. This is 1% higher than market expectations, but lower than recent rumours of 25%. We now include a £30m annual EBITDA impact in our forecasts. Also adjusting for an earlier implementation of the FOBT stake limit, we have lowered our FY19e EBITDA by 7%. Our FY20e EBITDA declines by 4%. The stock has fallen c 22% since August and trades at 9.8x EV/EBITDA and 13.0x P/E for FY19e.

RGD at 21% and FOBT cuts start in October 2019

GVC Holdings PLC (LON:GVC) has significant exposure to both online and retail gaming in the UK and the business has been greatly affected by recent regulatory changes. The timing for FOBT stake reduction (from £100 to £2) is now set for October 2019, at the same time as an increase in RGD (from 15% to 21%). This compares to the widely expected 20% rate (but less than the feared 25% from April 2019) and will affect all online gaming operators (not sports) in the UK. Other ongoing regulatory pressures include social responsibility, AML, source of funds, etc. All this is likely to lead to a continued market shake out, with dominant players likely to benefit. We note that, as a result of its Ladbrokes (LON:LCL) acquisition, GVC is the largest online gaming operator in the UK, and remains particularly well positioned.

To read the entire report Please click on the pdf File Below..