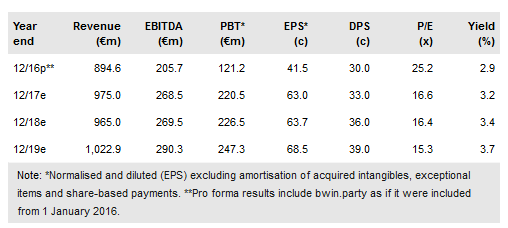

GVC Holdings' (LON:GVC) proposed acquisition of Ladbrokes Coral (LON:LCL) will create a leading global multi-brand gaming business, with revenues of c £3.3bn. Completion is expected in late Q1/early Q218. 90% of the enlarged group’s revenues will be derived from locally regulated and/or taxed markets. As witnessed by the successful integration of bwin, GVC is well positioned to deliver material synergies and, regardless of the outcome of the triennial review, the company expects double-digit EPS accretion after the first year. GVC has reported consistently impressive results throughout 2017 and its shares trade appropriately towards the top end of the peer group, at 12.8x EV/EBITDA and 16.4x P/E for 2018e. We introduce new forecasts to reflect the disposal of the Turkish business.

Material synergies from potential LCL acquisition

The proposed acquisition values LCL’s equity at £3.2-4.0bn, depending on the outcome of the triennial review consultation (FOBT stake limits range from £2-£50/spin). GVC expects to hold 53.5% of the enlarged share capital, with Kenny Alexander as group CEO. The combined business will boast a diversified, global, multi-brand gaming portfolio, equating to revenues of c £3.3bn and EBITDA of c £680m in 2017. Irrespective of the FOBT outcome, GVC anticipates annual cost synergies of £100m+ by 2021. After the first full year of consolidation it also expects double-digit EPS accretion, with less than 3.0x net debt/EBITDA.

To read the entire report Please click on the pdf File Below: