Investing.com’s stocks of the week

Strong momentum going into deal close

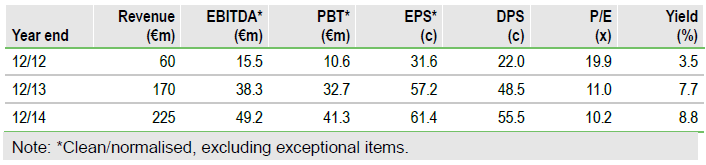

GVC Hldgs Plc (L:GVC) has reported Q415 daily revenue up 10.0% (constant currency +21.3%) over Q414, revealing a company going into its game-changing acquisition of bwin.party from a position of strength. This follows on from bwin’s recent trading update, which revealed its first quarterly y-o-y growth (up 5%) in more than two years. The bwin.party deal is scheduled to close on 1 February, after which we will reintroduce forecasts. GVC already has a detailed plan in place for achieving €125m of cost synergies, while also seeking to set bwin on a path of sustainable top-line growth to maximise the returns to shareholders from the deal.

Revenue up 11.7% y-o-y in Q415

GVC has reported average daily revenue of €712k in Q415, up 10.0% on Q414. Both Sports and Gaming performed well, up 5.6% and 13.9% respectively. These numbers are particularly impressive when set against the backdrop of significant currency depreciation in two of GVC’s most important markets: Turkey, where the lira is down c 20% y-o-y versus the euro, and Brazil, where the real has been off by as much as 40% against the euro during the period. On a constant currency basis GVC recorded growth of 21.3% y-o-y between Q414 and Q415.

To read the entire report Please click on the pdf File Below