GVC Holdings PLC. (LON:GVC) H117 results were accompanied by a bullish update for Q317 and positive future indicators. Underlying 20% daily NGR growth in Q317 (to 10 September), combined with continued synergies from the bwin acquisition, should lead to upgrades in consensus estimates. The company is ambitious and well positioned as a consolidator in the gaming industry. Accretive M&A is highly likely in our view. The stock trades appropriately towards the top of its peer group, at consensus 2018e 9.4x EV/EBITDA and 12.9x PE respectively. Our forecasts are currently under review.

H117 net gaming revenues (NGR) grew 10% to €486.2m, with 11% and 8% growth in Sports and Games Brands NGR. Sports Brands gross win margin increased from 9.1% to 9.8% and is currently 10.2% ytd, in line with management’s target of 10%. Games Brands benefited from a 32% increase in partypoker NGR and, apart from bingo, there is significant positive momentum across the gaming segment. Benefiting from scale, volume and synergies, H117 EBITDA margin grew from 24% to 28%.

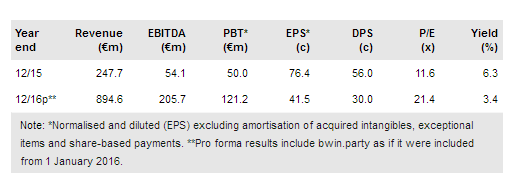

To read the entire report Please click on the pdf File Below: