To development...and beyond

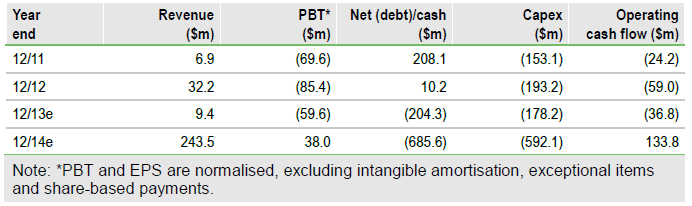

Following publication of Gulf Keystone Petroleum Ltd's, (GKP) FDP, we have remodelled the Shaikan field with a slower ramp-up that implies slightly reduced assumed recovery factors over the production licence timeline. We have also corrected our treatment of domestic revenues, which we now fully include in the PSC terms. These two factors have a material impact on our NAV, which falls to 176p (from over 210p). Development of the massive Shaikan field is well underway. With PF-1 now producing and PF-2 due to start up in early 2014, the first meaningful revenues from the field are around the corner, enabling GKP to ramp up production to its planned Phase 1 target of 100mb/d. Given global peers, we continue to believe the field will be able to sustain higher production rates than 250mb/d (a production milestone agreed with the KRG), but it will take time to fully understand the potential. Upside from exploration at Sheikh Adi and in the deeper Triassic and the Permian at Shaikan could add to this.

Production ramp-up depends on funding

The company has committed to funding the ramp-up of Shaikan without resorting to equity. We expect gross capital expenditure of over $500m to take the capacity to 100mb/d to be funded by recovery of court costs, assumed back-in cost recovery, and, more importantly, a corporate bond. This will depend on Shaikan producing steadily over several months. Growth over 100mb/d should be self-funded.

Recovery factors are critical

It is important to note that a 10-year plateau of 250mb/d – our take on the field development plan (FDP) – only implies a recovery factor for Shaikan as a whole of 12%. This is against the 26% average seen in a global fractured carbonate study and the average of the competent person’s report (CPR) estimate for Genel’s Kurdistan assets. As such, we see the FDP as just a start, but with so many things to be determined, confirmation of the true upside for Shaikan may take some time.

Valuation: NAV falls to 176p/share

We have remodelled Shaikan to demonstrate a variety of scenarios with plateaus ranging from 250-500mb/d and changed the treatment of domestic revenues from previous assumptions that reduce NAV materially. Further updates on the other assets, net debt and court result mean we have reduced our core and discovery NAV to 176p. Including risked exploration in deeper Triassic and Permian at Shaikan and potential upside at Sheikh Adi pushes the RENAV to 184p. A fully unrisked RENAV stands at over 300p/share.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gulf Keystone Petroleum: Recovery Factors Are Critical

Published 12/13/2013, 05:49 AM

Updated 07/09/2023, 06:31 AM

Gulf Keystone Petroleum: Recovery Factors Are Critical

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.