Last week the Bureau of Labor Statistics (BLS) re-estimated their historical employment growth. This allows an analysis of the monthly job growth estimates by the BLS and ADP - as well as the opportunity to continue bashing the way we estimate employment.

Follow up:

You cannot manage anything when the information one is seeing is not correct. The USA data gathering systems are only estimates and extrapolations. Can you imagine what would happen if a CEO of a company was told that the company has "about $10 million of cash available" or "we estimate 2,000 widgets were built" - and this data was given with a 15 day delay and included an estimated error factor.

In the latest case - the employment re-estimate was revised well into the 20th century. Honestly, this gives one less confidence in any employment data even though the revisions were relatively small. From the BLS:

Revisions to Establishment Survey Data

In accordance with annual practice, the establishment survey data released today have been benchmarked to reflect comprehensive counts of payroll jobs for March 2015. These counts are derived principally from the Quarterly Census of Employment and Wages (QCEW), which counts jobs covered by the Unemployment Insurance (UI) tax system. The benchmark process results in revisions to not seasonally adjusted data from April 2014 forward. Seasonally adjusted data from January 2011 forward are subject to revision. In addition, data for some series prior to 2011, both seasonally adjusted and unadjusted, incorporate other revisions.

The total nonfarm employment level for March 2015 was revised downward by 206,000 (-199,000 on a not seasonally adjusted basis, or -0.1 percent). The absolute average benchmark revision over the past 10 years is 0.3 percent.

The effect of these revisions on the underlying trend in nonfarm payroll employment was minor. For example, the over-the-year change in total nonfarm employment for 2015 was revised from 2,650,000 to 2,735,000 (seasonally adjusted). Table A presents revised total nonfarm employment data on a seasonally adjusted basis for January to December 2015.

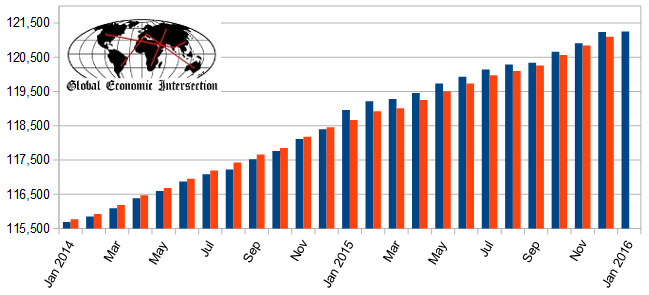

To get a feel of the benchmark changes:

Change in Seasonally Adjusted Non-Farm Payrolls Between Originally Reported (blue bars) and Current Estimates (red bars)

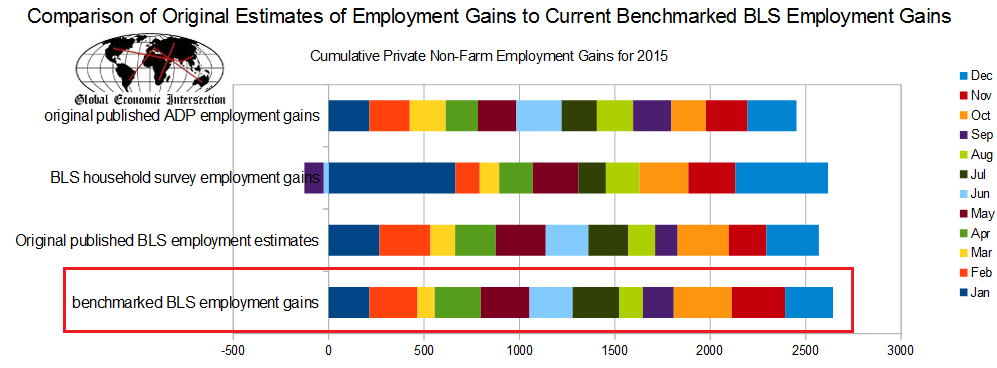

The graph below compares the new benchmarked BLS seasonally adjusted non-farm PRIVATE employment data to the original published monthly seasonally adjusted non-farm PRIVATE employment estimates for the BLS establishment survey, the BLS household survey, and ADP.

ADP says their methodology is geared to estimating the FINAL BLS employment.

.... data set is expected to help enable the ADP National Employment Report to more closely match the final print of the BLS numbers.

If this is true, ADP failed again this year. I do not understand why ADP wants to estimate BLS employment - and why they are not publishing an alternative estimate of jobs growth. Even the BLS publishes two different employment growth numbers monthly (even though the headlines only discuss one of them).

As we are just guessing and extrapolating employment data - the more guesses the better. When the statistical sample size increases the uncertainty in the average becomes smaller. Wouldn't we be better off if there were 3 or 4 (or more) independent estimates of employment?

Other Economic News this Week:

The Econintersect Economic Index for February 2016 declined again, and is barely positive - and still remains at the lowest value since the end of the Great Recession. The tracked sectors of the economy which showed growth were mostly offset by the sectors in contraction. Our economic index remains in a long term decline since late 2014.

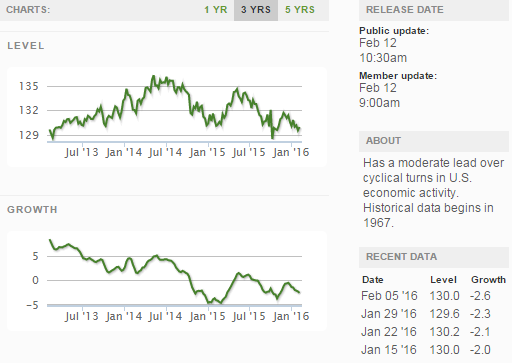

Current ECRI WLI Growth Index

The market (from Bloomberg) was expecting the weekly initial unemployment claims at 272 K to 290 K (consensus 281,000) vs the 269,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 284,750 (reported last week as 284,750) to 281,250. The rolling averages generally have been equal to or under 300,000 since August 2014.

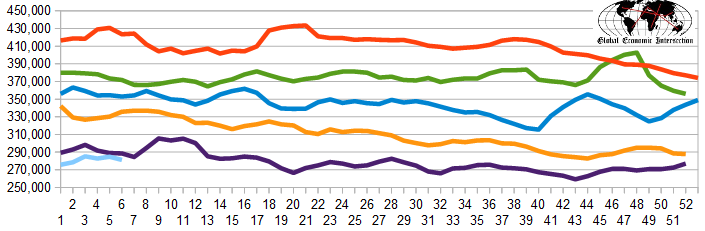

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Noranda Aluminum Holding, Privately-held Sundevil Power

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: