Investing.com’s stocks of the week

Whether you love it or hate it, Wal-Mart Stores (NYSE:WMT) has done a fabulous job of drawing in consumers with its “always low prices” since being formed over 50 years ago. Wal-Mart’s low-cost leadership has allowed it to become the largest company in the entire world based on annual revenue.

But its massive size also makes it harder to sustain growth.

Sure, weather may have been mentioned 20 separate times in the first quarter’s earnings call in May, but the retailer is facing much deeper challenges.

Revenue growth has slowed to a crawl. First-quarter sales were up just 0.8% compared with the year prior.

And since U.S. revenue still accounts for 71% of Wal-Mart’s total sales, it makes sense to evaluate the health of the company’s domestic operations. Unfortunately, the company’s total U.S. comparable store sales have declined in four of the last five quarters.

Now, Wal-Mart is undergoing a transformation – one that could severely affect its dividend payments going forward.

A Paradigm Shift in Strategy

When I think of Wal-Mart, I envision a mammoth 200,000-square-foot Supercenter. But that might change soon.

In an attempt to boost revenue by expanding its reach, Wal-Mart plans to open new smaller-store models like the grocery-centric Neighborhood Markets, and (even smaller) Wal-Mart Express stores.

With smaller store fronts peppered in between Supercenters, Wal-Mart will use its bolstered network of stores to create an e-commerce fulfillment network with its ship-from-store services.

Pay-with-cash is also gaining traction. Customers can shop online, but buy items in their virtual cart at the closest store, inevitably picking up a few extra items while in-store.

The integration of this new “bricks and clicks” model may increase online sales growth. But as Amazon.com (NASDAQ:AMZN) has recently shown, online sales aren’t typically associated with high profit margins.

Even so, it wouldn’t be fair to completely discount e-commerce. Globally, online sales grew 27% in Q1.

Unfortunately, Wal-Mart’s online sales account for less than 3% of its overall sales, meaning it won’t be moving the needle anytime soon.

Making matters worse, with the weakest Q1 profit margins since 2003, opening up more stores to bolster e-commerce creates the potential for an even more profound trickle-down effect on dividend growth – something that Wal-Mart is already struggling with.

Smaller Stores, Smaller Yields

We know that the performance of the retail sector can be an early warning sign of turns in the market and economy. And we also know that companies with high dividend growth outperform. After all, consistently and aggressively growing dividends makes a profound statement about a company’s future outlook.

That being said, Wal-Mart is showing some less-than-confident signals.

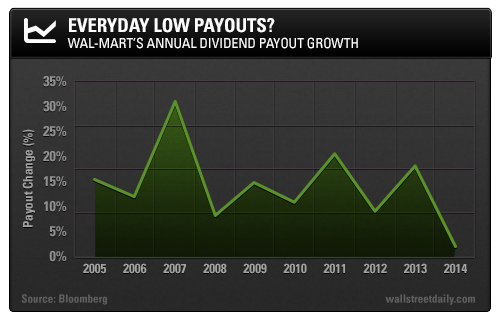

Investors have enjoyed an average 16% dividend payout increase over the past 10 years, but this year’s $0.01 increase amounts to a paltry 2% raise.

Plus, with a dividend yield of 2.5% and a total yield of 3.5%, it’s possible that Wal-Mart is now too big to outperform, and will need to spend more resources managing what it already has.

Indeed, with Wal-Mart rolling back dividend payouts, it could be making a bigger statement about the uncertainty of its business – and the retail market in general.

And as the company continues to spread its resources thin this year, its dividend could shrink even further from here.

While Wal-Mart may not be outrageously expensive, its lack of growth – in its underlying business as well as its dividend – is a good indicator that investors seeking outperformance and high yields should look elsewhere.

Safe (and high-yield) investing.