German Finance Minister Wolfgagng Schauble is reported to have said he is not worried by Italy’s bond spreads (553 basis points above 10-year German bonds) right now because they are similar to those in the days before the introduction of the euro. Although he is right on that point, the current 10-year yield on Italian bonds at 7.23% is seen by many as having reached alarming levels. Development on the political front (change of the guard in the Italian parliament) might ease tensions. Still a long term solution to the European debt will require structural changes. Back in the 1990`s Canada also had to take the turn towards sustainable fiscal policies. Fortunately, Canadian policy makers have had the advantage of implementing their reforms in a time when the global environment was relatively tranquil and economic growth south of the border was robust.

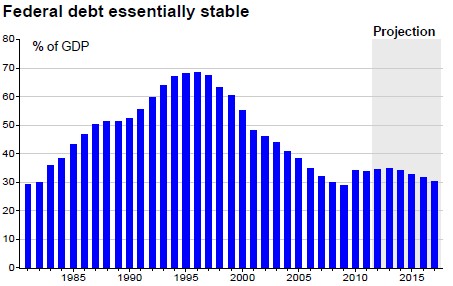

Nonetheless, actions taken back then did put Canada on a better footing to face the recent global financial crisis by providing more room on the fiscal side to support economic growth. Canada`s recession proved relatively mild and job losses were recovered rapidly when compared to the situation in many other advance economies. Despite, the slightly higher deficit pattern that resulted from the last recession and the softer economic environment expected over the medium term, yesterday’s Federal Update of Economic and Fiscal Projections still shows the federal debt to GDP ratio reaching 30.3% by 2016-17. Sound fiscal policies are contributing to Canada 30- year bonds trading below long Treasuries.

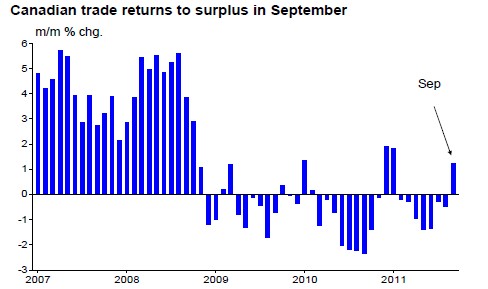

FACTS: Canada’s merchandise trade balance returned to a surplus for the first time since January, with a C$1.25 bn print for September (top chart), much better than consensus expectations for a deficit. The prior month was also revised upwards a bit. The return to black ink was helped by the surge in exports (+4.2%) and a drop in imports (-0.3%). Energy was the big driver of export gains with an 11.3% increase, but there were also decent gains for autos, forestry, agricultural products and industrial goods and materials, more than offsetting a drop in machinery and equipment. In real terms, exports increased 1.2% while imports fell 1.9%.

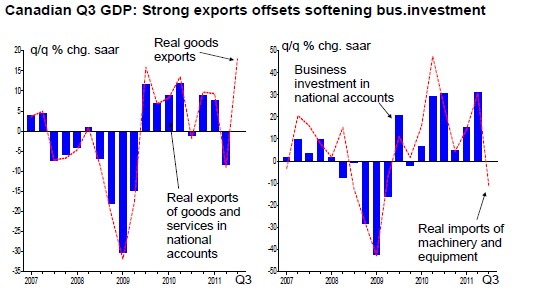

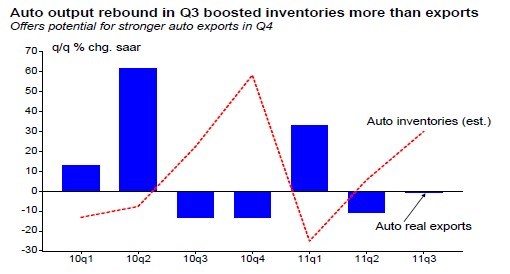

OPINION: Unlike in the prior quarter, trade is set to be a contributor to GDP in Q3 thanks to the 18% annualized increase in export volumes in the quarter (middle chart, left). The 11.5% drop in real imports of machinery and equipment point to a drop in business investment in Q3, not a surprising development given the prior quarter’s unsustainably hot pace (middle chart, right). Looking ahead to Q4, some sectors of the economy have potential for catch up. Production and real imports of autos have bounced back strongly in Q3, but those were put in inventories since exports stagnated in the quarter. So much so that inventories are tracking around 30% annualized growth in Q3 (bottom chart). With solid demand for autos in the final quarter of the year (if US October sales are any guide), expect those Canadian inventories to come back down and our auto exports to rise further. We saw a similar response in the first quarter of this year following inventory accumulation in the preceding quarter. Energy also has potential in the final quarter of the year, particularly given the partial rebound in Q3 (+11.4% versus the 22% drop in Q2). So, trade could provide some upside to the BoC’s Q4 GDP growth forecast (currently at only 0.8% annualized).

Economic Commentary:

Italy will begin selling 5 billion euros' worth of 1-year bonds today to test investors' appetite. The country will also begin selling 5-year bonds on monday. It should be noted that the yields, seen recently (7.25% on 10-year bonds), are the same level at which Greece, Portugal and Ireland requested aid from the EU and the IMF. However, at 1900 billion euros, Rome's debtt is too large for a wide scale bailout to be possible.

Equities once again ended the trading day in the red due to the critical situation in Italy. The U.S dollar consequently rose against most currencies, given its status as a safe haven. Further worsening of conditions in Italy will no doubt push the USD higher. We strongly recommend that USD sellers place orders at technical levels to take advantage of the potential turmoil.

Meanwhile in Greece, the new coalition government, Lucas Papademos, was named.He had previously worked at the European Central Bank as the Vice-President to Jean-Claude Trichet.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Growth Spearheaded by the U.S. and China

Published 11/14/2011, 09:54 AM

Updated 05/14/2017, 06:45 AM

Growth Spearheaded by the U.S. and China

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.