Seasonality is an anachronism that is derived from certain asset classes historical penchant for over or under performance during certain times of the year. While it doesn’t always hold true in every instance, there is typically a trend towards strength in the fourth quarter that acts as a tailwind for certain stocks.

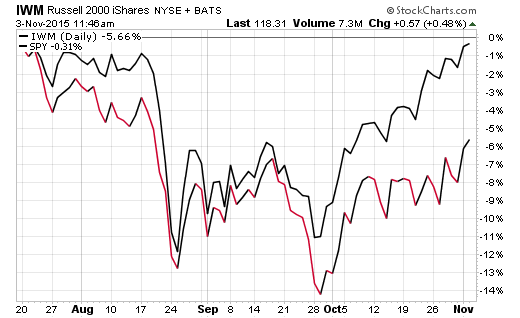

Examining a chart of the SPDR S&P 500 ETF (N:SPY) versus the iShares Russell 2000 ETF (N:IWM) since the July 2015 high, it’s obvious that small cap stocks have underperformed during this recovery. SPY is knocking at the door of its previous all-time high, while IWM is still languishing 6% below its prior peak.

With this short-term lookback, it’s easy to fall prey to the notion that now is the time to be bullish on large cap stocks and avoid the flagging small cap arena. However, I think that a counterintuitive approach will likely serve you much better.

If you are looking to position your portfolio for a further extension of this rally, then small or mid-cap stocks may offer more attractive upside than a large-cap benchmark such as SPY. The seasonal data points towards small caps being a greater beneficiary from any type of “Santa Claus” rally effect over the next several months. In addition, portfolio managers that are underinvested from the summer correction may start to realize that small caps have greater technical potential from a relative price standpoint.

Choosing a Small Cap ETF

Most ETF investors default to IWM as their preferred small cap vehicle. After all, it is the biggest fund in this space with over $20 billion in assets, and the Russell 2000 Index is considered the most popular benchmark to track. However, I would point out that the broad-based iShares Core S&P Small Cap ETF (N:IJR) has actually had much better relative performance than IWM coming out of the hole in October.

In addition, I am a fan of the Vanguard Small Cap ETF (N:VB), which I own for my opportunistic growth clients. This fund has an ultra-low expense ratio of 0.09% and like IJR, a more refined portfolio of stocks than the 2000 companies that make up IWM.

The Bottom Line

Those that are looking to put money to work in the stock market for further upside should have at least some small cap exposure to maintain diversification and enhance your growth potential. This asset class is known to have greater volatility than its large-cap peer group, however that same risk works on the upside as well and leads to periods of strong momentum.

Disclosure: FMD Capital Management, its executives, and/or its clients may hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.