Commodities that depend on economic growth to spur demand have been in a festive mood this December as signs of rising activity among some of the world's biggest consuming nations continue to improve. The recovery in the US in particular has received some attention with the spotlight turning to the US Federal Reserve meeting on December 18 with rising speculation that tapering of its asset purchase program may be introduced earlier than previously expected.

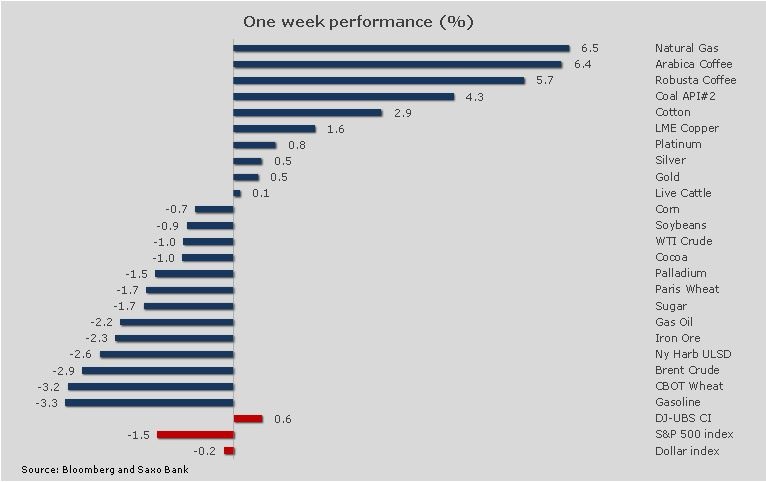

As a result, some of the best performing commodities so far this December can be located in the energy and industrial metal sectors, most noticeably natural gas and copper, while precious metals once again have seen selling pressure mount. The agricultural sector is generally lower due to ample supply apart from a few exceptions such as cocoa and coffee. Overall 2013 has been another difficult year for commodity investors as ample and even increased supply of most commodities combined with steady growth and very strong performances in other asset classes have reduced the need for diversification.

Coffee higher despite strong production

The rally seen over the past five weeks in Robusta coffee accelerated last week and helped drag Arabica coffee higher. Global production levels from the worlds's largest growers in Brazil, Colombia and Vietnam are expected to be very high so the support has been provided by farmers in Vietnam which have been holding back their supplies hoping for a higher price at which to offload.

Wheat pressurised by high global inventory levels

A report from the US Department of Agriculture raised the outlook for global wheat supplies and this left wheat traded in Chicago and Paris down among the biggest losers over the week. In Chicago, the March futures contract dropped to a contract low, while in Paris, the price of high protein milling wheat fell to a three-week low as a stronger euro helped off-set continued strong export demand. Near-term momentum on milling wheat has turned negative for the first time since October but any further downside much below EUR 200/tons seems limited.

Copper receives boost from short covering as stocks dwindles

Copper has put in a strong performance lately rallying seven out of the last eight trading days. The move higher has been supported by falling stockpiles, especially those monitored by the London Metal Exchange. Recently the stockpiles available for withdrawal has slumped to the lowest level in five years and this has forced speculative traders to cover their short positions and drive the price to the highest level since early November. With most of the short-covering now out of the way, further upside seems limited as we approach resistance around the USD 3.35/pound area.

Erratic trading in gold, silver ahead of FOMC

Gold and silver continue to find the road to recovery littered with sellers waiting for any uptick to sell into. This was indeed what happened this past week after both metals managed to climb as high as USD 1268/oz and USD 20.51/oz respectively before news about a potential US budget deal and renewed taper talk sent it back down. The rally was primarily driven by short covering after hedge funds found themselves to negatively positioned ahead of what normally becomes a very low liquidity time of year.

The major focus now before traders turn of their screens and get into the festive mood will be the FOMC meeting on December 18. An expected agreement by US lawmakers on a new two-year budget will remove another hurdle from the Fed's perspective in terms of when to begin tapering its monthly asset purchase program. After a string of better than expected US economic data since the last meeting speculation has been rising that tapering could already be announced at the next meeting.

Near term, I do not expect the current range between USD 1200 and USD 1260/oz to be broken but as we now move into the time of year were liquidity dries up and movements become more sporadic and volatile some caution is warranted. The option market is still mostly worried about the risk of further losses as reflected in the cost of buying downside protection which is considerable higher than the equivalent upside strategy.

Crude oil lower on Libya

Brent crude oil was lower on the renewed hope that export terminals in eastern Libya could soon reopen after several months of disruption. As a result, Brent's premium over WTI crude contracted back towards USD 10/barrel after almost reaching 20 dollars a couple of weeks ago. WTI crude also saw some light profit-taking after the recent run higher but improved pipeline infrastructure in the US, which will carry more WTI crude to the Gulf coast refineries, should lend support and help prevent Brent's premium from widening to much. This despite the continued increase in US production from non-conventional methods, which is now approaching eight million barrels per day, the highest level since 1989.

As we await the FOMC meeting and traders settle down for the break, both oil markets are expected to be rangebound with a potential confirmation from Libya adding some additional pressure down towards support at USD 95.50/barrel on WTI and USD 106/barrel on Brent.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Growth-Dependent Commodities Revel In Pre-Christmas Spurt

Published 12/15/2013, 03:00 AM

Updated 03/19/2019, 04:00 AM

Growth-Dependent Commodities Revel In Pre-Christmas Spurt

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.