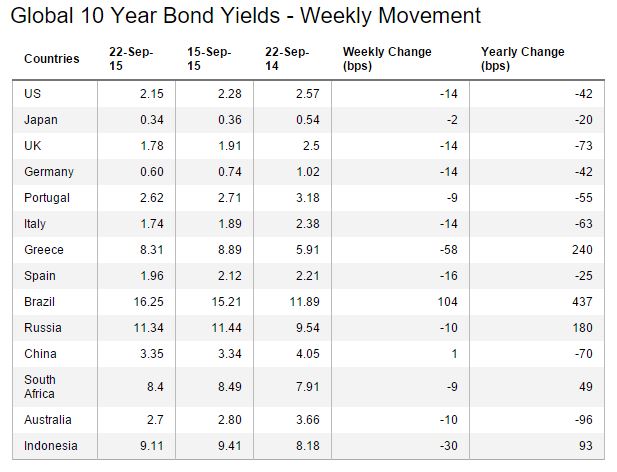

Benchmark bond yields of US, Eurozone Nations and Japan dropped sharply last week as bond markets factored in falling growth expectations and lack of inflation/deflation into asset prices.. ECB giving hints to the market on increasing its stimulus program added to the bullishness in bond markets.

U.S. 10-Year bond yield declined sharply by 14 bps in the last week and is at levels of 2.15%. Yields on the 10 year U.S. bond were highly volatile during the last week as yields went up sharply by 12 bps ahead of Fed meet, where the Fed decided to leave interest rates unchanged stating that recent global economic slowdown played a major part in the central bank’s decision. Post the meeting the 10 year yield dropped sharply on account of rising global growth worries.

Eurozone countries benchmark 10 year bonds yields dropped sharply after ECB hinted to the market that they might expand their stimulus program on rising worries over world economy. German bund yield dropped by 14 bps, Portugal yield dropped by 9 bps, Italy yield dropped by 14 bps, Greece yield dropped by 58 bps and Spain yield dropped by 16 bps.

Benchmark yields of emerging economies were mixed with Brazil 10-Year bond yield rising by 104 bps in the last week. Political crises in Brazil is leading to the yield going up sharply.

Russia’s benchmark 10-Yearbond yield dropped by 10 bps and China’s 10-Year bond yield rose by 1 bps. Australia's 10-Year bond yield dropped by 10 bps and Indonesia’s 10-Yearbond yield dropped by 30 bps last week.