This week Federal Reserve Chair Janet Yellen made her semi-annual pilgrimage to the US Congress to report on monetary policy and the state of the economy. The Chair said the economic outlook was uncertain but "the recent pickup in household spending, together with underlying conditions that are favorable for growth, lead me to be optimistic that we will see further improvements in the labor market and the economy more broadly over the next few years. "

Follow up

????? - I must be living in a parallel universe as I see few signs that the economy will be noticeably improving (or decaying) within the near or long term. The Federal Reserve is only guessing what the long term future of the economy will look like.

Chair Yellen points to GDP and states:

Economic growth has been uneven over recent quarters. U.S. inflation-adjusted gross domestic product (GDP) is currently estimated to have increased at an annual rate of only 3/4 percent in the first quarter of this year. Subdued foreign growth and the appreciation of the dollar weighed on exports, while the energy sector was hard hit by the steep drop in oil prices since mid-2014; in addition, business investment outside of the energy sector was surprisingly weak. However, the available indicators point to a noticeable step-up in GDP growth in the second quarter. In particular, consumer spending has picked up smartly in recent months, supported by solid growth in real disposable income and the ongoing effects of the increases in household wealth. And housing has continued to recover gradually, aided by income gains and the very low level of mortgage rates.

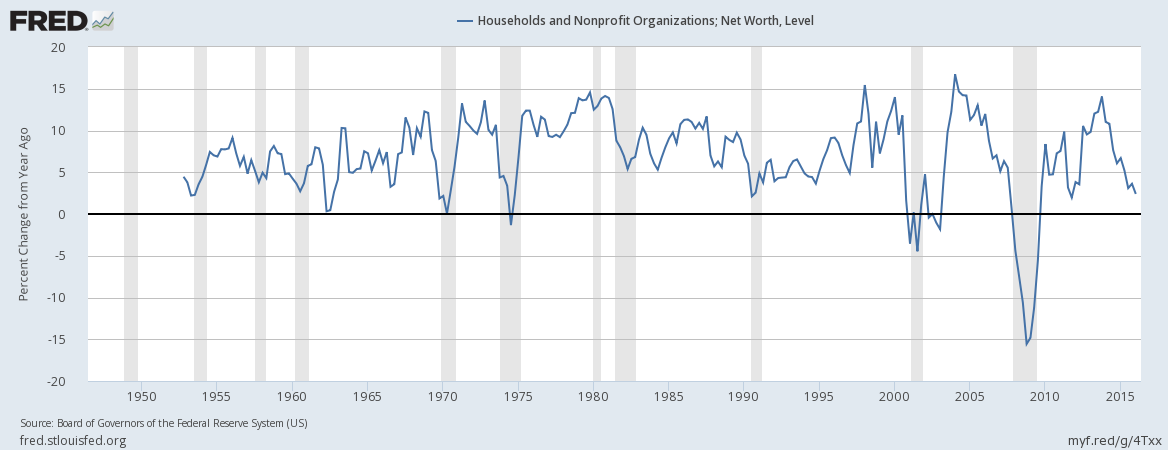

The rate of household net worth growth has been decelerating since the end of 2013. The ongoing household wealth accumulation is diminishing.

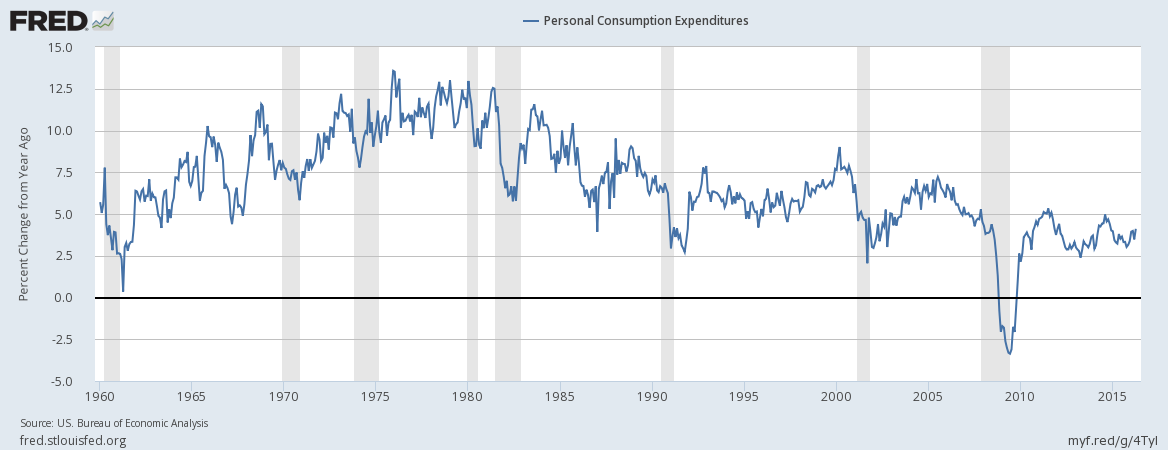

And the current rate of consumer spending growth is near average of the year-over-year growth rates seen since the Great Recession. So a smart pick up of consumer spending is not evident.

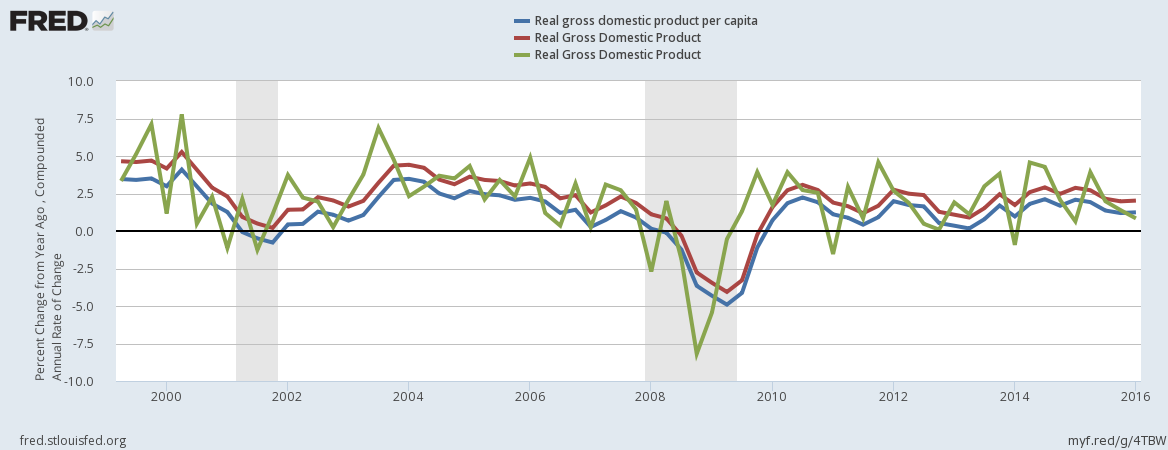

Not only do I reject GDP as a measure of economic well-being for the majority of Americans, but the annualization of quarterly GDP Growth distorts this data series. As an example, the chart below shows per capita year-over-year real GDP growth (blue line), year-over-year real GDP growth (red line), and the headline real GDP growth rate.

Logical takeaways from the above graphic:

- Headline real GDP is like riding a roller coaster, with significant changes between quarters. Has anyone out there felt these huge variations? Headline GDP tells you little about the economic state. So Chair Yellen implying next quarter will be better is based on a almost meaningless metric - headline GDP.

- In the period around 2000, the difference between per capita rate of year-over-year growth (blue line) and real GDP year-over-year rate of growth (red line) was 1.2%. In other words, population growth was adding 1.2% to GDP. In the period around 2016, population growth was only adding 0.8% to GDP.

- In 1Q2015 the headline GDP was a measly 0.6 %, yet the year-over-year growth was at a cycle peak of 2.9%. In 1Q2016, the headline GDP was another measly 0.8% and the year-over-year growth was 2.0%. The point here is that the economy is trending down, and it is unlikely that 2Q2016 will exceed the year-over-year growth seen in the first quarter no matter the headline number.

And concerning inflation, Chair Yellen stated:

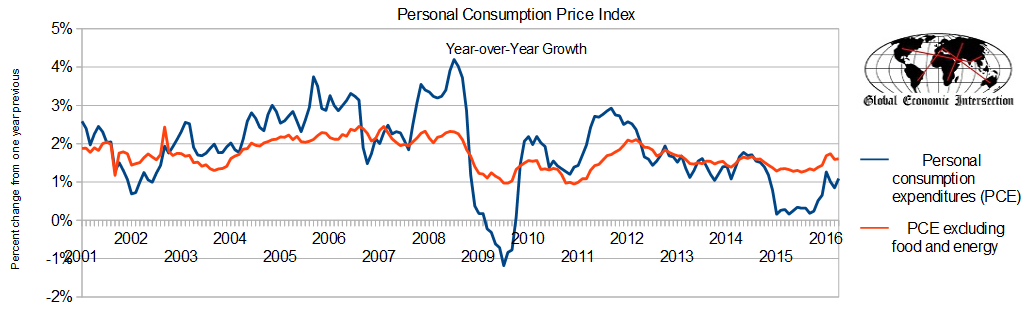

Turning to inflation, overall consumer prices, as measured by the price index for personal consumption expenditures, increased just 1 percent over the 12 months ending in April, up noticeably from its pace through much of last year but still well short of the Committee's 2 percent objective. Much of this shortfall continues to reflect earlier declines in energy prices and lower prices for imports. Core inflation, which excludes energy and food prices, has been running close to 1-1/2 percent. As the transitory influences holding down inflation fade and the labor market strengthens further, the Committee expects inflation to rise to 2 percent over the medium term. Nonetheless, in considering future policy decisions, we will continue to carefully monitor actual and expected progress toward our inflation goal.

Please look at the graph below and tell me when (if ever) core inflation will rise to 2%. Core inflation has seldom exceeded 2% in the 21st century.

There is little logic to support many of the state of the economy statements in Chair Yellen's report. However, I do agree with part of the Chair's conclusion of the state of the economy:

Of course, considerable uncertainty about the economic outlook remains. The latest readings on the labor market and the weak pace of investment illustrate one downside risk--that domestic demand might falter. In addition, although I am optimistic about the longer-run prospects for the U.S. economy, we cannot rule out the possibility expressed by some prominent economists that the slow productivity growth seen in recent years will continue into the future. Vulnerabilities in the global economy also remain. Although concerns about slowing growth in China and falling commodity prices appear to have eased from earlier this year, China continues to face considerable challenges as it rebalances its economy toward domestic demand and consumption and away from export-led growth. More generally, in the current environment of sluggish growth, low inflation, and already very accommodative monetary policy in many advanced economies, investor perceptions of and appetite for risk can change abruptly.

Yes, there is a lot of uncertainty on the economic outlook, even more so if one wears rose-colored glasses - and ignores what the data is saying.

Other Economic News this Week:

The Econintersect Economic Index for June 2016 marginally dropped into contraction. The index is at the lowest value since the end of the Great Recession. Note that an industrial output, non-monetary data set used to build the index has been swapped as the previous set became too volatile for accurate trending. Reflecting on the potential that a recession is underway (or soon to be underway) - I find the prospect unlikely (but not impossible). It is more likely the economic dynamics have slowed from "muddling along" to a "snails pace". The only group forecasting better economic growth is the self serving forecasts of the Federal Reserve - as well as the components of GDP, which do not translate to a better world for those on Main Street. For the near future, one may need a microscope and a micrometer to measure any improvement, but further deterioration is needed to raise our assessment to probable that a recession has or soon will start.

Bankruptcies this Week: Privately-held BFN Operations (f/k/a Zelenka Farms), Rio de Janeiro, Brazil-based Oi S.A. (Chapter 15)

Weekly Economic Release Scorecard: