SodaStream Inc. (SODA) is set to report FQ4 2013 earnings before the market opens on Wednesday, February 26th. SodaStream is an at-home carbonated beverage system company. In addition to selling the system for at home water carbonation SodaStream also sells a variety of flavors and syrups for customers to create their own customizable sodas.

Recently Green Mountain Coffee Roasters (GMCR) announced a partnership with Coca-Cola (KO) to bring Coke brand sodas to the Keurig at-home, single-serving, beverage system. Rumors immediately began to fly that Pepsico (PEP) may announce a deal with SodaStream to compete in branded make your own at home soda with Coke. So far there has been no official announcement on that potential partnership. Whether or not any sort of deal does come to fruition, expectations are high for SodaStream’s growth. Here’s what investors are expecting on Wednesday.

The information below is derived from data submitted to the Estimize.com platform by a set of Buy Side and Independent analyst contributors.

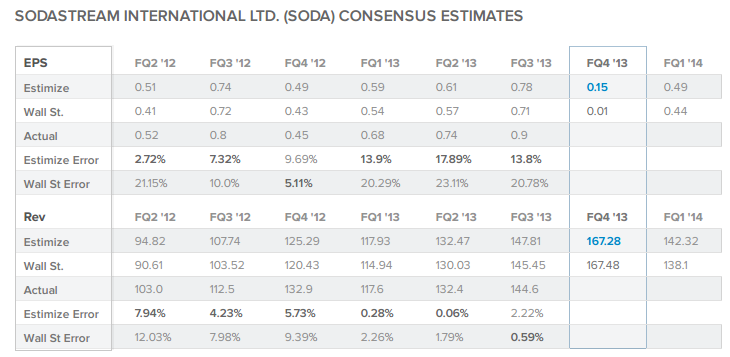

The current Wall Street consensus expectation is for SODA to report 1c EPS and $167.48M revenue while the current Estimize.com consensus from 16 Buy Side and Independent contributing analysts is 15c EPS and $167.28 revenue. While EPS is expected to be lower than FQ4 last year, sales should rise in the ballpark of 26%. This quarter the buy-side as represented by the Estimize.com community is expecting SodaStream to beat the Wall Street EPS consensus by a wide margin but come up slightly short of the mark on revenue.

Over the previous 6 quarters the consensus from Estimize.com has been more accurate than Wall Street in forecasting SODA’s EPS and revenue 5 times each. By tapping into a wider range of contributors including hedge-fund analysts, asset managers, independent research shops, students, and non professional investors, Estimize has created a data set that is up to 69.5% more accurate than Wall Street, but more importantly it does a better job of representing the market’s actual expectations. It has been confirmed by an independent academic study from Rice University that stock prices tend to react with a more strongly associated degree to the expectation benchmark from Estimize than from the Wall Street consensus.

The magnitude of the difference between the Wall Street and Estimize consensus numbers often identifies opportunities to take advantage of expectations that may not have been priced into the market. In this case we are seeing a large differential on EPS, but a small one for revenue.

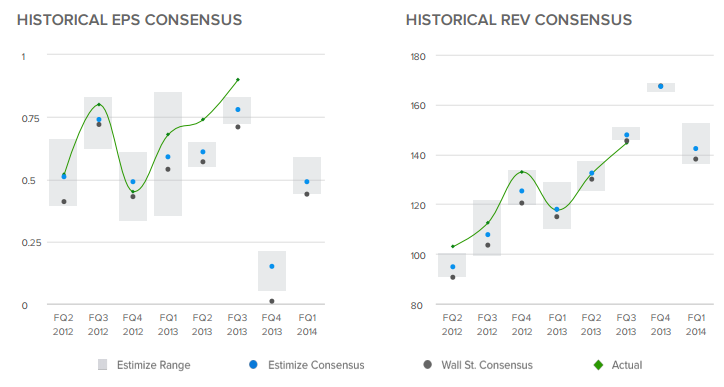

The distribution of estimates published by analysts on the Estimize.com platform range from 5c to 21c EPS and $165.00M to $168.64M in revenues. This quarter we’re seeing a smaller distribution of estimates for SodaStream.

The size of the distribution of estimates relative to previous quarters often signals whether or not the market is confident that it has priced in the expected earnings already. A narrower distribution of EPS estimates signaling more agreement in the market, which could mean less volatility post earnings.

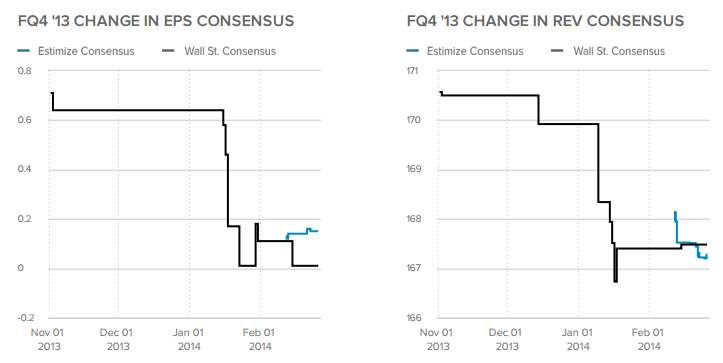

Over the past 4 months Wall Street reduced its EPS consensus from 71c to 1c while the Estimize community raised its expectations from 13c to 15c. Over the same period of time the Wall Street revenue consensus dropped from $170.57M to $167.48M while the Estimize consensus dipped from $167.95M to $167.28M. Timeliness is correlated with accuracy and downward analyst revisions going into a report are often a bearish indicator.

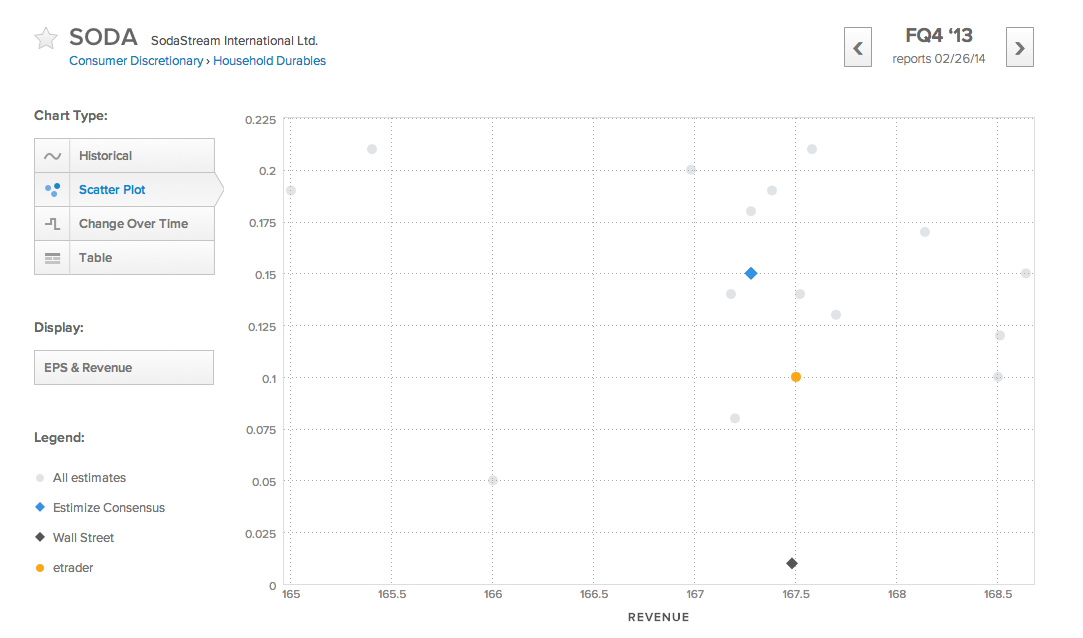

The analyst with the highest estimate confidence rating this quarter is etrader who projects 10c EPS and $167.50M in revenue. In the Winter 2014 season etrader is rated as the 100th best analyst and is ranked 95th overall among over 3,900 contributing analysts. Estimate confidence ratings are calculated through algorithms developed by deep quantitative research which looks at correlations between analyst track records and tendencies as they relate to future accuracy. In this case etrader is expecting SodaStream to beat the Estimize community consensus on revenue, but come up short on EPS.

While any sort of deal between Pepsico and SodaStream in the near future could be a game changer, this quarter look for SODA to continue to grow its sales and progress on a collision course with the Green Mountain Coffee Coca-Cola partnership. Transforming the way soda is distributed to an at home process could result in significant savings on the cost of transporting water and aluminum cans compared to simply taking water from the home and utilizing more efficient flavor concentrates and syrups. Although at home soda production has been attempted in the past, SodaStream has some momentum now and contributing analysts on the Estimize.com platform are looking for roughly 26% yoy growth in revenue and for SodaStream to beat Wall Street profit expectations by a significant margin.