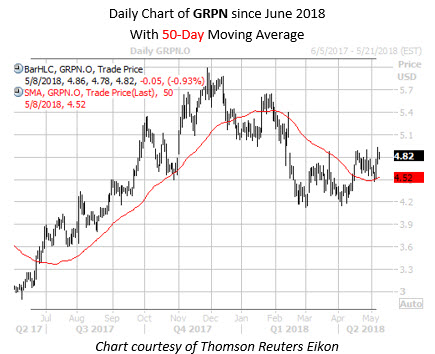

Online coupon concern Groupon Inc (NASDAQ:GRPN) is is slated to report its first-quarter results tomorrow morning as a busy week of earnings continues. On the charts, GRPN has pulled back about 17% from its late-November closing high to trade at $4.82, but appears to have recently reestablished support at its rising 50-day moving average.

GRPN has a history of volatile post-earnings reactions. The stock's price action the day after earnings has been positive only 50% of the time over the last eight quarters, including a 22.8% jump following its February 2017 report -- but GRPN's average post-earnings daily price move is a healthy 16.4%, regardless of direction.

This time around, the options market is pricing in a much higher-than-usual 23.2% next-day move, per at-the-money implied volatility data from Trade-Alert. From the equity's current price, a move of this magnitude to the upside would put the shares around $5.94 -- just below the stock's Nov. 28 four-year intraday high of $5.99. On the other hand, a drop of 23.2% would place GRPN at its lowest levels since June 2017.

Short sellers have been hitting the exits lately on GRPN, with short interest down 8.3% in the last two reporting periods. However, at 9.5% of the equity's float --or 7.1 times GRPN's average daily trading volume -- short interest is still high enough to contribute to another volatile post-earnings move in the shares.