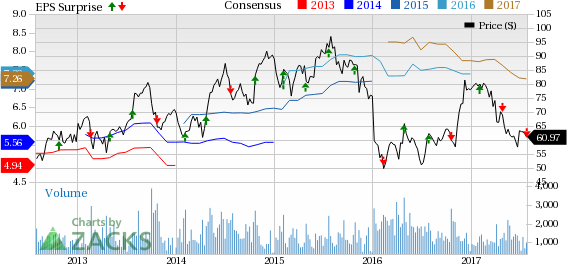

Group 1 Automotive Inc. (NYSE:GPI) reported adjusted earnings per share of $1.87 in second-quarter 2017, missing the Zacks Consensus Estimate of $1.99.

On a reported basis, Group 1 Automotive recorded net income of $39.1 million or $1.84 per share. In the prior-year quarter, the company registered net income of $46.6 million or $2.12 per share.

Revenues decreased 4% year over year to $2.67 billion and came almost in line with the Zacks Consensus Estimate.

Revenues from new vehicle retail sales declined 6% to $1.45 billion due to a 6.3% decrease in unit sales. Revenues from retailed used vehicles decreased 4.2% to $685.9 million on a 2.9% decline in unit sales. Revenues from used vehicle wholesale sales increased 3.2% to $99.4 million.

From the Parts and Service business, revenues improved 4.5% to $282.7 million. The company’s Finance and Insurance business witnessed a 1.7% fall in revenues to $94.6 million.

Gross profit decreased 1.3% year over year to $404.9 million. Operating income declined 5.3% to $92.2 million.

Segment Details

Revenues in the U.S. business fell 3.8% to $2.1 billion. The segment recorded a 4.9% decrease in new vehicle retail sales to $1.1 billion and a 5.4% decline in total used vehicles’ retail sales to $602.7 million. Parts and Service revenue increased 4.5%, while Finance and Insurance revenues declined 3.8%.

Revenues in the U.K. business declined 6.6% year over year to $437.1 million. Retail new vehicle sales dropped 11.7% to $231.4 million and total used vehicle sales grew 1.7% to $158.9 million. Parts and Service revenue decreased 7.3%, while Finance and Insurance revenues advanced 1.7%.

Revenues from the Brazil business rose 3.8% year over year to $111.4 million in the reported quarter. New vehicle retail sales declined 2.4% to $73.6 million, while total used vehicle sales increased 28.5% to $23.8 million. Parts and Service revenues increased 2.4%, while Finance and Insurance revenues grew 23%.

Financial Details

Group 1 Automotive’s cash and cash equivalents increased to $26.6 million as of Jun 30, 2017 from $21 million as of Dec 31, 2016.

Share Repurchases

During second-quarter 2017, Group 1 Automotive repurchased 629,298 or around 3% of the outstanding shares. As of Jun 30, 2017, the company had $50.7 million remaining under the share repurchase authorization.

Acquisitions

During second-quarter 2017, the company acquired its first Jaguar and Land Rover dealerships in the U.S., located in Albuquerque and Santa Fe, New Mexico.

In April, Group 1 Automotive opened Cedar Park Nissan in Austin, TX, which has expected annualized revenue of $30 million.

Also, in July 2017, the company acquired Beadles Group Ltd in the U.K., which expands the dealership footprint in the region to 43 stores. This is expected to fetch annual revenues of $330 million.

Zacks Rank & Key Picks

Group 1 Automotive currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked companies in the auto space are Allison Transmission Holdings (NYSE:ALSN) , Volkswagen (DE:VOWG_p) AG (OTC:VLKAY) and Daimler AG (OTC:DDAIF) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Allison Transmission has expected long-term growth rate of 11%.

Volkswagen has expected growth rate of around 17.3% in the long run.

Daimler has expected long-term growth rate of 2.8%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Group 1 Automotive, Inc. (GPI): Free Stock Analysis Report

Daimler AG (DDAIF): Free Stock Analysis Report

Volkswagen AG (VLKAY): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Original post