There’s an old saying.

“You can’t fight the dollar.”

And what this means is: because the world’s chained to the U.S. dollar (thanks to its reserve status) – everyone’s constantly affected by whichever way the dollar’s value goes.

If the dollar declines – then the foreign economies and currencies get a boost from an inflow of capital.

But if the dollar rises – then the opposite happens. Foreign economies and their currencies sink.

You can understand why, then, so many countries today are peeved with the Federal Reserve’s tightening. They’re all suffering the unintended consequences of a stronger dollar.

I’ve written about this problem before. . .

Foreign Central Banks from all over the world – such as Argentina, India, Vietnam, Indonesia, and many more – are all defending their own local currencies against a stronger dollar.

Those that borrowed trillions of dollars are exposed here. A rising dollar against their own falling local currencies creates a mismatch between liabilities (the rising U.S. dollar). And assets (their own weakening currencies).

Also keep in mind that as rates rise, the dollar-indebted foreign corporations and banks are all feeling the pain of increased borrowing costs.

For instance – I wrote last week that onshore bond defaults in China just hit a record high as liquidity gets tighter. . .

That’s why today – as U.S. interest rates rise (especially as of late hitting a seven-year high). And the dollar gets stronger – the global cost of capital keeps getting more expensive.

Thus – putting it simply – overseas investors and corporations are finding it increasingly difficult and costlier to get their hands on dollars.

And yet – so far – the market doesn’t realize just how costly and scarce U.S. dollars are becoming. . .

“The cost of borrowing dollars, especially offshore dollars, will continue to rise. Putting considerable pressure on global financing conditions.” Says Shweta Singh at TS Lombard. “The main threat to global financing is an offshore dollar squeeze.”

This – in my opinion – will kick off what’s set to be the next big global ‘liquidity crunch’.

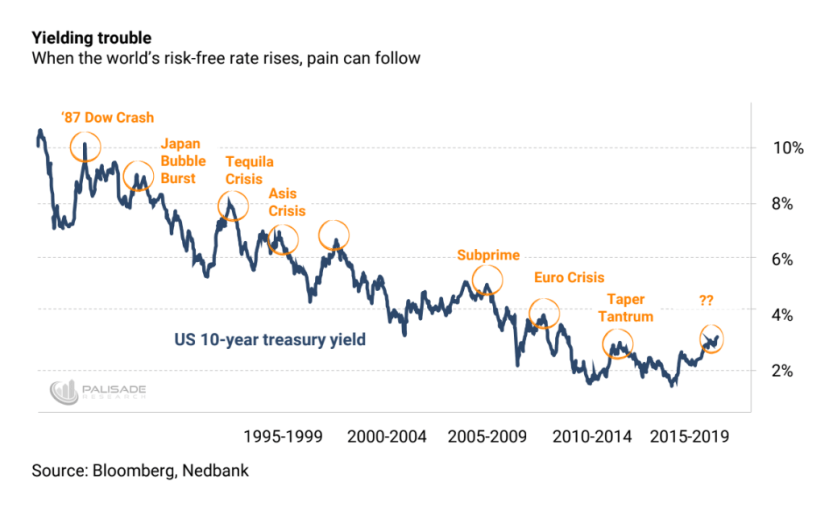

Just take a look at previous crises. . .

As you can see – one important feature that was present during past crises was a chronic shortage of dollars.

This eventually forced the Federal Reserve to pause their tightening. And instead began setting up ‘dollar liquidity swap lines’ with many foreign Central Banks to help ease this problem.

Putting this into context today – during 2007, the dollar credit to borrowers outside the U.S. (excluding banks) was 9% of global GDP.

Now it’s at 14%. . .

So with the world even more dependent on U.S. dollars and the Fed today – this coming liquidity crunch will be felt much worse than earlier times. And it’s already beginning to – we’ve already seen the Emerging Markets get slaughtered this year.

With U.S. yields and the U.S. dollar rising together – this will no doubt stress countries without the ability to print dollars.

Which is everyone besides the U.S.

And the remaining (but quickly shrinking) pool of available U.S. dollars is drying up faster and faster.

I’ve written about the reasons for a dollar shortage months ago in Anatomy of a Crisis: A Strong Dollar and Disappearing Liquidity (you can read here if you haven’t).

I wrote. . . “Putting it simply – the soaring U.S. deficit requires an even greater amount dollars from foreigners to fund the U.S. Treasury. But the Fed is shrinking their balance sheet… which means they’re sucking dollars out of the economy (the reverse of Quantitative Easing which was injecting dollars into the economy). This is creating a shortage of U.S. dollars – the world’s reserve currency – therefore affecting every–global economy… This is going to cause an evaporation of dollar liquidity – making the markets extremely fragile.”

And since then – the evaporation of dollars has only worsened.

The Treasury needs more dollars than ever as deficits continue soaring to levels not seen since 2008. . .

The Fed’s ramping up their Quantitative Tightening (sucking dollars out of the banking system). This is pulling out as much as $50 billion dollars a month (or $600 billion a year). . .

Also – because of the Trump Tax Cuts – we’ve seen corporations take their cash piles back home. This suddenly yanked dollars out of foreign banks that were once ‘Tax Havens’. . .

It gets very dim when we add everything up. . .

I can almost hear the noise of a sponge sucking up all this liquidity.

And as I wrote above – all this soaking up’s happening during a time when the world’s never been more dependent on U.S. dollars.

The worsening dollar shortage today will most likely be ‘ground zero’ for the next financial crisis.

This isn’t a pretty picture.

The charts in this article belong to our like-minded friends over in South Africa – Mr. Mehul Daya and Mr. Neels Heyneke of NEDBANK CIB.