Rising phoenix

Greka Drilling's, (GDL) drilling activity has been considerably weaker in 2013 than seemed likely at the beginning of the year. However, we believe this reflects a hiatus in 2013 related to GDL’s largest customer GDG. Drilling is set to rebound in 2014 through a resumption of activity levels at GDG, with LiFaBriC technology offering a point of differentiation versus peers. GDL remains an interesting play on its exposure to potentially booming unconventional hydrocarbons development activity in China.

Drilling: Activity down sharply in 2013

We estimate GDL’s drilling activity has fallen in FY13 due to a lack of site availability, extended pilot testing at new customers and a slowdown in drilling activity at GDG pending the resolution of title issues. With the latter now having been resolved a recovery in drilling activity and revenues is anticipated in 2014, led by drilling activity at GDG. New third-party contracts are expected to commence in 2014 from a relatively small base, building up to potentially larger contracts in 2015/16. FY13 meterage drilled is forecast to be less than half 2012 levels, although is set to rebound in 2014 as activity levels increase notably at GDG.

Contracts: Two-year backlog

GDL has built up a substantial backlog of business since late-2012, reflecting new contracts obtained from Petro-king/Sinopec and China Natural Petroleum Corporation (CNPC). GDL remains positive about the prospects for business development in India, where it recently won a contract with Essar Oil.

Financials: Weak FY13 on the cards

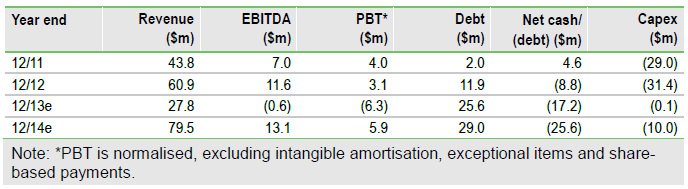

The decline in drilling activity in 2013 is pointing to depressed profitability in the period. Performance is expected to strengthen in 2014, driven by recovering drilling activity. However, our 2013 full-year EBITDA forecast of -$0.6m is down from $11.5m previously, due to considerably lower drilling activity.

Valuation: Between 8p and 19p/share

Our base case valuation is derived using an average peer group 2014 EV/EBITDA of 6x which, applying our forecast EBITDA of $13.1m, implies a market capitalisation of $53m, or 8.4p/share (based on 398m shares in issue and an FX rate of US$1.6/£). However, GDL is at a very much earlier stage of development and, with its China unconventionals focus should, in principle, be capable of substantially higher EBITDA growth over the two or three years post 2013. If we apply 6x EV/EBITDA to our EBITDA forecast of $26.1m in 2015e, this implies a value of 19p/share. The key catalyst for the stock will be drilling activity.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Greka Drilling: Weak FY13 On The Cards

Published 12/17/2013, 06:19 AM

Updated 07/09/2023, 06:31 AM

Greka Drilling: Weak FY13 On The Cards

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.