Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Greggs' (LON:GRG) appeal lies in the combination of its relatively low-risk business model and its return to strong earnings growth in the past two years. It is in the middle of a strategic plan that has delivered impressive financial results and has the financial strength to complete that programme. We value Greggs at 1,158p per share.

Acquisition and contract progress

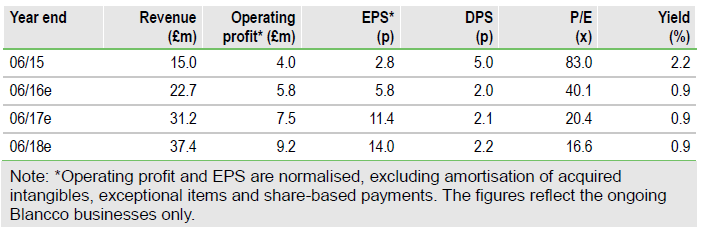

Blancco has announced the acquisition of, and a significant new contract win for, Xcaliber. Blancco already held 49% of the venture but has purchased the remainder for a consideration of $5.5m (£3.8m), $4.7m (£3.3m) of which is deferred and contingent upon certain revenue targets being met. We expected Blancco to acquire Xcaliber when it moved from early-stage loss making to profitable on a sustainable basis, but the contract win appears to have triggered Blancco to take control. The contract is multi-year for the roll-out of Xcaliber’s mobile phone diagnostics software across the 5,000+ North American retail base of a major mobile operator and is an extension of an existing 200 store trial. This news follows the announcements of the aftermarket services business disposal completion on 4 April, then the start of the £50m tender offer process on 6 April, which is based on a 215p to 250p range with a close on 4 May.